Revealed on March 26, 2022, by Felix Martinez

You probably have a furry buddy in your loved ones, there’s a excessive possible hood that you just introduced some form of medicine from PetMed Categorical, Inc. (PETS) for the pet.

PetMed Categorical, Inc. (PETS) is a high-yield dividend inventory with no debt on its stability sheet.

We additionally cowl a number of different totally different high-yield shares in our database.

We have now created a spreadsheet of shares (and intently associated REITs and MLPs, and many others.) with dividend yields of 5% or extra…

You’ll be able to obtain your free full record of all securities with 5%+ yields (together with necessary monetary metrics akin to dividend yield and payout ratio) by clicking on the hyperlink under:

Thus, for the next high-yield shares on this sequence, we are going to evaluation PetMed Categorical, Inc. (PETS), with a dividend yield of 4.4%.

Enterprise Overview

PetMed Categorical was based in 1996 by Marc Puleo. PETS initially grew via phrase of mouth, tv commercials, and catalogs. The corporate is America’s most trusted pet pharmacy, delivering prescription and nonprescription pet drugs and different well being merchandise for canines, cats, and horses at aggressive costs direct to the buyer via its toll-free quantity and on the Web via its web site.

The corporate headquarters is in Delray Seaside, Florida. PetMed Categorical, Inc. trades arms within the Nasdaq utilizing the ticker image PETS. PETS has been rising its dividend for over 13 years and made $309 million in gross sales for Fiscal 12 months (FY) 2021. At the moment, PetMed Categorical has a market cap of $555.7 million.

Supply: Investor Presentation

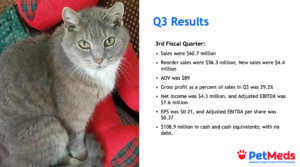

On January 24, 2022, PetMed Categorical reported third-quarter outcomes for the Fiscal 12 months 2022. The corporate fiscal yr ends on the final day of March yearly. Gross sales had been down 7.9% for the quarter in comparison with the third quarter of FY2021. For the quarter, the corporate generated gross sales of $60.7 million, decrease than the overall gross sales of $65.9 million in 3Q2021. Internet gross sales are down 12.7% for the primary 9 months of the fiscal yr, from $237.5 million in FY2020 to $207.4 million this fiscal yr. Internet revenue was $4.3 million, or $0.21 diluted per share, for the quarter, in comparison with web revenue of $7.6 million, or $0.38 diluted per share, for 3Q2020, a 44% lower year-over-year.

For the 9 months of the fiscal yr, web revenue is down 37% year-over-year. This was a novel quarter as a result of the corporate was coming off a strong quarter in the course of the pandemic. The third quarter of FY2021 was pushed by elevated on-line shopping for as a result of many shops and vets had been closed. We anticipate PetMed to make $1.17 per share for FY2022. This could characterize a lower of 23% in comparison with the complete fiscal yr of 2021.

Supply: Investor Presentation

Progress Prospects

Essentially the most vital development prospects for PedMed Categorical are via internet marketing and persevering with to develop to reorder gross sales because it did for FY2021. Ecommerce demand elevated resulting from COVID-19, so the administration group is hopeful that this may proceed to increase its reorder gross sales. We anticipate a 6% earnings development for the following 5 years as eCommerce grows and extra individuals have pets as members of the family. This development charge is barely decrease than its ten-year common of seven.4%.

Different development prospects could be that clients are more and more in search of pet wholesome locations. As an increasing number of individuals grow to be health-conscious, they’re additionally changing into extra health-conscious of their pets. This could assist to proceed to drive development for the corporate.

The corporate works with 70,000+ veterinarians and Vet Clinics across the nation. Working with these animal medical professionals ought to proceed to develop the corporate. It will enable these professionals to suggest and prescribe medical remedies that PetsMed sells.

As you see, the general pet market is a $107 billion trade, and we imagine that that is an trade that may proceed to develop.

Supply: Investor Presentation

Aggressive Benefits & Recession Efficiency

PetMed doesn’t have a considerable aggressive benefit immediately. We expect the corporate has a slim moat presently. The corporate is an internet enterprise that’s straightforward for opponents to get into. Nonetheless, The Firm does have a slight benefit because it has been in enterprise since 1996, and PetMed Categorical is a really well-known firm with pet lovers.

In the course of the Nice Recession of 2008-2009, the corporate continued to develop its earnings from $0.82 per share in FY2008 to $0.98 per share in FY2009. Popping out of the Nice Recession, PetMed made $1.14 per share in FY2010. Thus, the corporate appears to be like resilient in the course of the Nice Recession and the COVID-19 pandemic.

PETS’s earnings-per-share all through the Nice Recession:

- 2007 earnings-per-share of $0.60

- 2008 earnings-per-share of $0.82 (37% enhance)

- 2009 earnings-per-share of $0.98 (20% enhance)

- 2010 earnings-per-share of $1.14 (16% enhance)

As you see, the corporate did very properly in the course of the 2008-2009 Nice Recession. Virtually just like the recession was not even there. We have no idea how the dividend would have carried out as the corporate was not paying a dividend throughout that point. Nonetheless, it’s secure to imagine that the corporate would haven’t any points paying the dividend as earnings had been growing at double-digit charges within the interval

Supply: Investor Presentation

Dividend Evaluation

The corporate has a dividend development historical past of 13 years. In these 13 years, the corporate has a dividend development charge of 9.0% within the final ten years and a dividend development charge of 9.5% in the course of the earlier 5 years. Nonetheless, the dividend development charge has been slowing down lately. However, the latest enhance was 7.1%.

The next dividend announcement must be one other dividend enhance as the corporate has been paying the identical dividend charge of $0.30 per share per quarter during the last 4 quarters. Nonetheless, we predict it could be a a lot smaller enhance due to the elevated dividend payout ratio.

The corporate paid a complete dividend of $1.12 per share for FY2021. In 2021, the corporate Incomes-Per-Share (EPS) was $1.52. This gave a dividend payout ratio of 73.7%, which is excessive however not dangerously excessive. Nonetheless, we anticipate the corporate to make $1.02 EPS for FY2022. It will carry the dividend payout ratio above 100%.

Nonetheless, we predict the dividend might be secure as a result of the corporate has a fantastic Free Money Move (FCF) expectation for FY2022. We anticipate the corporate to make FCF per share of $1.81, overlaying the dividend with a payout ratio of 66.7%.

The corporate has an excellent stability sheet. The one debt PetMed has is $27.5 million. This offers the corporate an asset to liabilities ratio of 0.2. The dividend payout ratio is excessive however not regarding, contemplating the corporate doesn’t have debt.

Thus, we predict the dividend in all fairness secure.

Last Ideas

PetMed is a strong firm with many issues to love. The excellent stability sheet is top-rated. Additionally, the corporate has had Free Money Move development yr in and yr out. The one danger is that it has a slim moat and is accessible for a competitor to get into the pet medicine enterprise. Nonetheless, PetMed is a well known model that ought to assist the corporate proceed rising. The dividend in all fairness secure and the reliable dividend development for the foreseeable future.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].