Printed on March seventeenth, 2022, by Quinn Mohammed

Excessive-yield shares pay out dividends which can be considerably greater than market common dividends. For instance, the S&P 500’s present yield is only one.4%.

Excessive-yield shares could be very useful to shore up revenue after retirement. A $120,000 funding in shares with a median dividend yield of 5% creates a median of $500 a month in dividends.

We’ve created a spreadsheet of shares (and carefully associated REITs and MLPs, and many others.) with dividend yields of 5% or extra…

You possibly can obtain your free full listing of all securities with 5%+ yields (together with necessary monetary metrics comparable to dividend yield and payout ratio) by clicking on the hyperlink under:

Subsequent on our listing of high-yield shares to overview is New York Group Bancorp (NYCB).

NYCB final reduce its dividend by 32% in 2016, and it has maintained its $0.68 annual dividend since. Whereas the corporate’s dividend historical past is lower than stellar, the payout ratio is moderating as earnings have grown.

The long-term decline of the share value has induced NYCB to sport a excessive dividend yield of 6.2% at the moment, which can curiosity revenue buyers.

Enterprise Overview

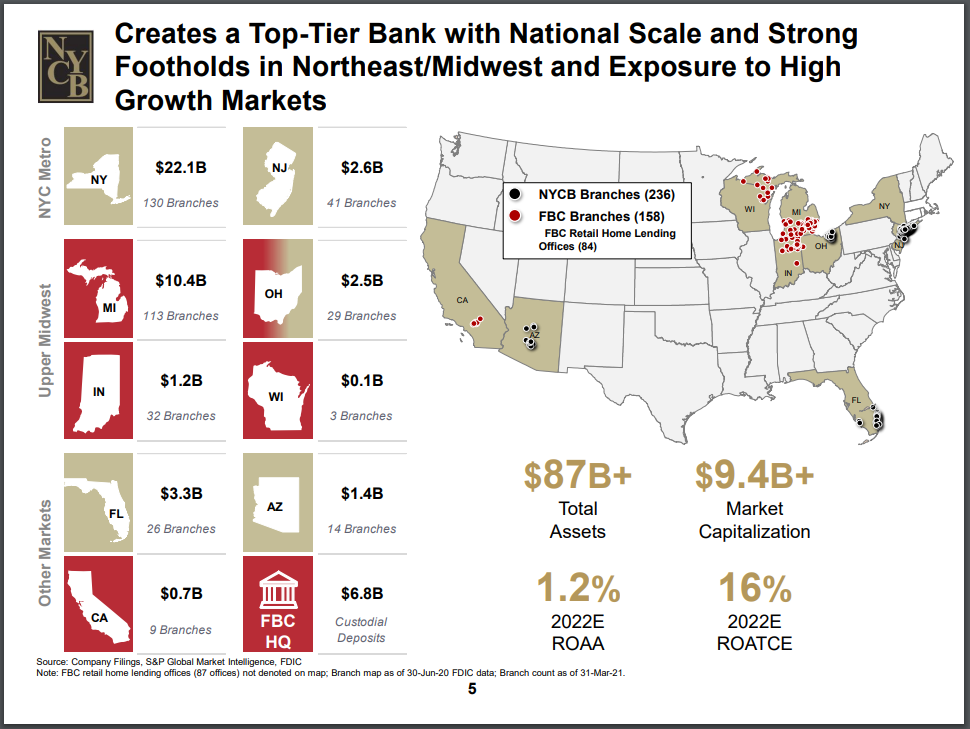

NYCB is a financial institution holding firm. The wholly owned subsidiary operates 236 branches in New York, New Jersey, Ohio, Florida, and Arizona. It operates two main entities, the New York Group Financial institution; a financial savings financial institution established in 1859, and the New York Industrial Financial institution, established in 2005.

NYCB operates a financial savings and loans enterprise mannequin. It has greater than $59 billion of complete belongings, $35.1 billion in deposits, and a $45.7 billion multi-family mortgage portfolio.

Supply: Investor Presentation

New York Group Bancorp reported This fall and FY 2021 outcomes on January twenty sixth, 2022. The financial institution achieved report quarterly mortgage development within the closing quarter of the 12 months, in addition to deposit development. Asset high quality additionally improved.

The corporate reported earnings-per-share of $0.31, up from $0.27 in the identical interval a 12 months in the past. Pre-provision internet income was $203 million, up 7% year-over-year. After adjusting for merger-related bills, that quantity was up 11% year-over-year.

The financial institution originated $4.6 billion in new loans and leases, up 18% year-over-year, and 55% increased than the third quarter. Multifamily originations have been up 62% quarter-over-quarter, whereas specialty finance originations have been up 52% from Q3.

Internet curiosity margin was 2.44%, down three foundation factors year-over-year. Loans held for funding have been up $2.1 billion to $45.7 billion, up 19% from one 12 months in the past. Complete deposits have been up 5% to $35.1 billion.

Following wonderful 2021 outcomes, we estimate NYCB will generate $1.40 in earnings-per-share in 2022.

Progress Prospects

New York Group Bancorp has discovered development from 2016 by 2020, after the company reduce its dividend. Nevertheless, leads to 2021 have been nice, and we anticipate development to proceed into 2022.

New York Group Bancorp will profit from rising charges, with a number of will increase presently anticipated in 2022. Rising charges usually widen the revenue margins of banks. And earnings from loans are inclined to rise at a sooner tempo than curiosity paid on deposits.

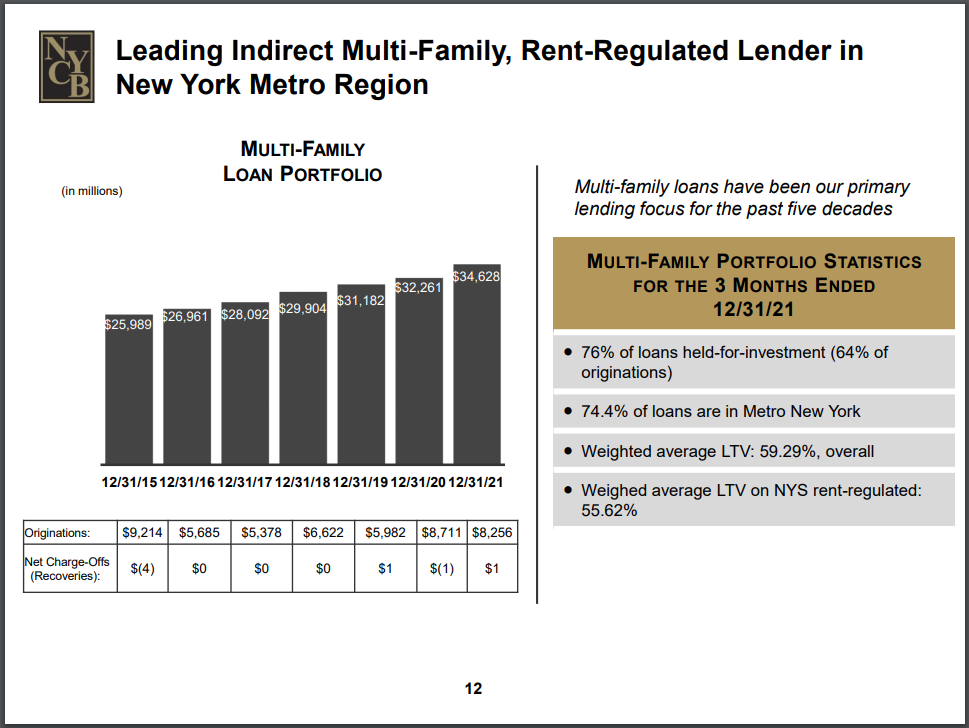

Additionally, the corporate will develop as its loans and deposits enhance. It has a prudent mortgage technique, which is to deal with multi-family loans. Multi-family loans are notably engaging, and the corporate is aiming for development particularly on this space.

Multi-family loans signify 76% of NYCB’s complete mortgage portfolio. Nevertheless, New York Metropolis handed stricter laws, making it more difficult for landlords to boost rents on rent-controlled models, which may negatively have an effect on the financial institution’s prospects, and by extension, their skill to service their loans.

Supply: Investor Presentation

Nearly all of multi-family models in New York have hire management options. Of NYCB’s multi-family loans in New York Metropolis, greater than 50% are collateralized by buildings with rent-regulated models.

Hire-regulated models sometimes have below-market rents. Based on NYCB, these buildings usually tend to retain their tenants in downward credit score cycles. Thus, they could be a dependable supply of revenue throughout gentle recessions.

This helps clarify NYCB’s extraordinarily low losses on multi-family loans.

Moreover, multi-family loans are cheaper to supply and repair than different forms of loans, which permits for NYCB to generate excessive ranges of effectivity.

NYCB’s effectivity ratio improved to 38.4% for 2021, in comparison with 44.0% in 2020. Moreover, the corporate’s effectivity ratio is way superior to that of its peer group, at over 50.0%.

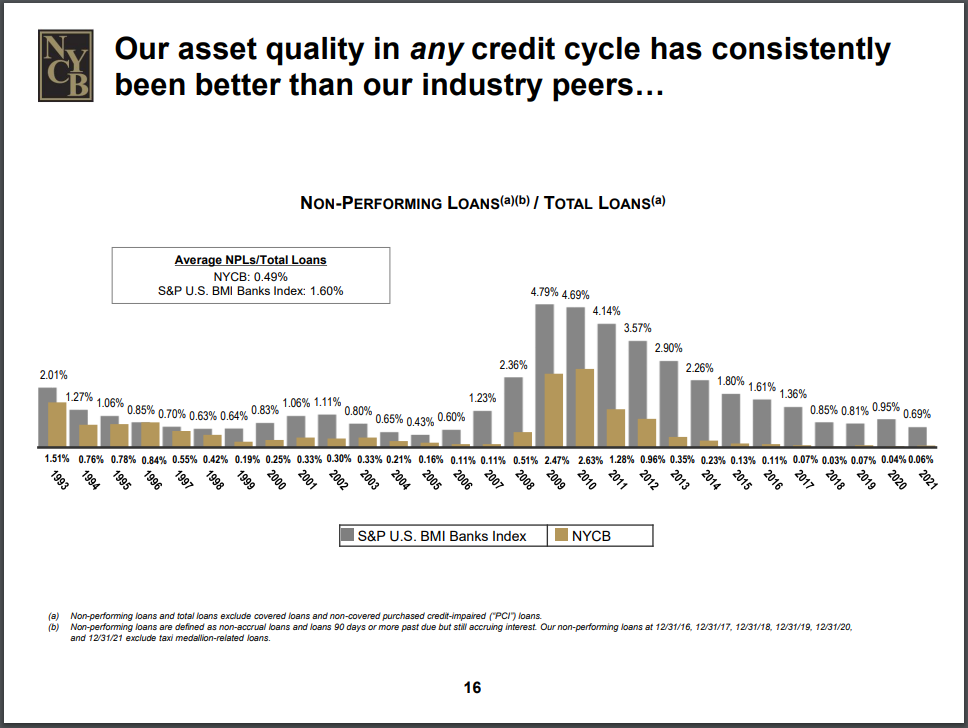

Aggressive Benefits & Recession Efficiency

NYCB’s high-quality belongings constantly outperformed its banking friends throughout numerous trade downturns, together with the Nice Recession and the COVID-19 pandemic. In 2021, non-performing belongings have been solely 0.07% of complete belongings.

Supply: Investor Presentation

New York Group Bancorp’s earnings-per-share all through the Nice Recession of 2007-2010 are listed under:

- 2007 earnings-per-share: $0.90

- 2008 earnings-per-share: $0.83

- 2009 earnings-per-share: $1.13

- 2010 earnings-per-share: $1.24

The corporate remained worthwhile by the complete stretch. Earnings dropped in 2008, however NYCB recovered and surpassed their 2007 outcomes instantly after. Its earnings reached a brand new excessive by 2010.

This sturdy and environment friendly efficiency allowed NYCB to keep up its dividend in the course of the recession, at $1.00 per share. On the identical time, many U.S. banks have been slicing their dividends and posting huge losses.

Regardless that the dividend held up in the course of the nice recession, it was nonetheless slashed later in 2016.

Dividend Evaluation

The company’s present annual dividend stays $0.68 per share. Shares of NYCB presently commerce at $10.97, thus yielding 6.2%. It is a excessive yield for NYCB, even when accounting for its trailing ten-year common of 6.0%.

With 2022 earnings-per-share expectations of $1.40, and the annual dividend of $0.68, the corporate is anticipated to pay out 49% of EPS in dividends. This payout ratio is kind of secure and sustainable for NYCB. In truth, the payout ratio at the moment is more healthy than it has been within the final decade.

With additional earnings development, the payout ratio ought to average even additional. We’re not anticipating the corporate to extend the dividend within the near-term, as they seem like investing in development.

Nevertheless, buyers could not view NYCB’s dividend favorably, given it doesn’t have a wonderful historical past. The corporate went by a dividend reduce in 2016. On the time, NYCB tried to amass Astoria Monetary, the same New York-based firm.

NY Group Bancorp reduce the dividend in anticipation of this acquisition, which was going to extend compliance and regulation prices. Ultimately, nevertheless, the merger settlement was terminated attributable to a low expectation for regulatory approval.

Closing Ideas

New York Group Bancorp has a excessive dividend yield of 6.2%, even compared to its historic common. The corporate doesn’t have a historical past of dividend will increase, and final reduce its dividend by 32% in 2016.

At this time its dividend is effectively coated by earnings. Moreover, the company ought to profit from rising rates of interest in 2022. This earnings development will additional average the payout ratio within the subsequent few years.

It’s doable, although not anticipated, that NYCB will elevate the dividend sooner or later. At present, they seem like extra targeted on earnings development and acquisitions.

NYCB’s 6.2% yield appears to be safe, and the inventory might be a stable financial institution decide for revenue buyers.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].