[ad_1]

Printed on January 4th, 2022, by Quinn Mohammed

Leggett & Platt is probably not a well known identify, however it’s possible that tens of millions of customers are available contact with the corporate’s merchandise day-after-day.

Regardless of being underneath the radar, Leggett has elevated its dividend for 51 years in a row, that means it’s a Dividend King. The corporate at the moment has a excessive yield of 5.4%, which is 180 foundation factors increased than its trailing decade common.

Not all high-yielding companies can sport payout ratios under 75% like Leggett is anticipated to for 2022, so deep evaluation needs to be accomplished to confirm the protection of high-yield shares.

We have now created a spreadsheet of excessive dividend shares with dividend yields of 5% or extra…

You may obtain your free full checklist of all securities with 5%+ yields (together with necessary monetary metrics similar to dividend yield and payout ratio) by clicking on the hyperlink under:

On this article, we’ll analyze a producing Dividend King, Leggett & Platt (LEG).

Enterprise Overview

Leggett & Platt is a diversified manufacturing firm. It was based in 1883 when an inventor named J.P. Leggett created a bedspring that was superior to the present merchandise at the moment.

As we speak, Leggett & Platt consists of three main segments.

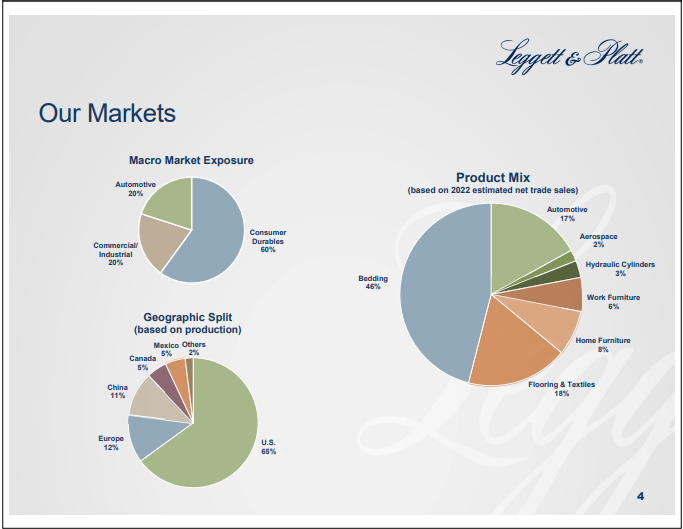

First, the bedding merchandise phase designs and manufactures bedding elements similar to bedding business equipment, metal wire, adjustable beds, and mattress springs. This phase represents 46% of 2022 anticipated internet commerce gross sales.

Second, the specialised merchandise phase revolves round automotive, aerospace, and hydraulic cylinder elements. Some product examples can be seat assist and lumbar programs, motors and cables, tubing, and hydraulic cylinders. This phase represents 22% of 2022 anticipated internet commerce gross sales.

And lastly, the furnishings, flooring and textile merchandise phase focuses on house furnishings, work furnishings and flood and textiles. This phase represents 32% of 2022 anticipated internet commerce gross sales.

Clearly, the corporate is working a diversified enterprise, with a different product combine and geographic cut up.

Supply: Investor Presentation

Leggett & Platt reported third quarter 2022 earnings outcomes on October 31st, 2022. Income for the quarter totaled $1.29 billion a 2% lower year-over-year. Adjusted earnings-per-share of $0.52 was down 27% from the identical prior yr interval.

Administration had additionally lowered its income steering for fiscal 2022. The corporate is forecasting revenues of $5.1 billion to $5.2 billion, implying roughly 1% progress versus the earlier yr.

And earnings-per-share is forecasted to be $2.30 to $2.45 for 2022. On the midpoint of $2.38, this means a 20% decline in comparison with the earnings-per-share that Leggett & Platt generated throughout 2021.

Development Prospects

Development at Leggett & Platt will depend on a multi-faceted strategy, together with common annual income progress (each natural, and thru acquisitions), new merchandise and applications, increasing addressable markets, and ensuring that acquisitions are strategic. Moreover, share repurchases, and value controls might additionally enhance the underside line.

Supply: Investor Presentation

Leggett & Platt has a constant coverage of buying smaller corporations to develop its market dominance in present classes, or to department out into new markets.

An instance of this technique was the $1.25 billion buy of Elite Consolation Options. Elite Consolation Options’ foam bedding operations complement Leggett & Platt’s present mattress capabilities and infrastructure. In 2021, LEG made three small acquisitions that expanded its capabilities in Worldwide Bedding, Aerospace, and Work Furnishings, respectively.

Supply: Investor Presentation

One other key part of Leggett & Platt’s earnings progress technique is price controls. The corporate constantly evaluates its portfolio to make sure it’s investing within the highest-growth alternatives, and it’s not afraid to divest low-margin companies with poor anticipated progress.

For low-growth or low-margin companies, it both improves efficiency, or exits the class. The corporate additionally drives price reductions throughout the enterprise, together with in promoting, common, and administrative bills, and distribution prices.

Leggett & Platt has been in a position to attain its long-term progress targets thanks largely to its important aggressive benefits within the core industries by which it operates.

Nonetheless, progress has ebbed and flowed at instances. From 2006 via 2013, the corporate had virtually no progress in earnings-per-share. Then from 2013 to 2016, earnings-per-share rose 70%. Nonetheless, income and EPS declined considerably in 2020 on account of the coronavirus pandemic.

The corporate’s earnings for 2021 have been terrific although. Nonetheless, earnings expectations for 2022 declined all year long and are actually anticipated to be 20% under 2021 earnings. From this level on, we forecast 4.0% annual EPS progress over the following 5 years.

Aggressive Benefits & Recession Efficiency

Leggett & Platt has established a large financial moat, that means it has a number of operational benefits, which holds again rivals. The corporate enjoys a management place in its business, which permits for scale.

Leggett & Platt additionally advantages from working in a fragmented business, which makes it simpler to determine a dominant place. In most of its product markets, there are few, or no, massive rivals. And when a smaller competitor does obtain important market share, Leggett & Platt can merely purchase them, prefer it did with Elite Consolation Options.

Leggett & Platt additionally has an intensive patent portfolio, which is essential in protecting competitors at bay. The corporate has extraordinary mental property, consisting of over one thousand patents issued and almost one thousand registered emblems.

Collectively, these aggressive benefits assist Leggett & Platt preserve wholesome margins and constant profitability. That mentioned, the corporate didn’t carry out properly through the Nice Recession.

Earnings-per-share through the interval are proven under:

- 2006 earnings-per-share of $1.57

- 2007 earnings-per-share of $0.28 (-82% decline)

- 2008 earnings-per-share of $0.73 (161% enhance)

- 2009 earnings-per-share of $0.74 (1% enhance)

- 2010 earnings-per-share of $1.15 (55% enhance)

This earnings volatility mustn’t come as a shock. As primarily a mattress and furnishings merchandise producer, it depends on a wholesome housing marketplace for progress. The housing market collapsed through the Nice Recession, which brought on a big decline in earnings-per-share in 2007.

Leggett & Platt is determined by shopper confidence, as roughly two-thirds of furnishings purchases in the US are replacements of present merchandise. When the economic system enters a downturn, shopper confidence sometimes declines.

It additionally took a number of years for Leggett & Platt to get well from the results of the Nice Recession. Earnings continued to rise after 2007, however earnings-per-share didn’t exceed 2006 ranges till 2012. The corporate noticed one other troublesome yr in 2020, because of the coronavirus pandemic. This demonstrates that Leggett & Platt just isn’t a recession-resistant enterprise.

Luckily, the corporate maintains a robust monetary place, which permits it to stay worthwhile and proceed rising dividends every year, even throughout recessions.

Dividend Evaluation

Leggett & Platt’s dividend per share in 2022 equaled $1.74. Utilizing the present ahead $1.76 dividend, Leggett has a excessive yield of 5.4%. This excessive yield is a whole 180 foundation factors increased than the corporate’s trailing decade common of three.6%.

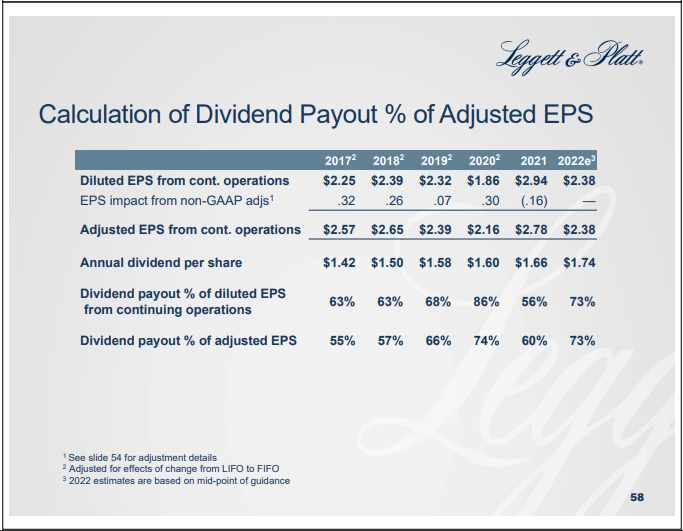

Supply: Investor Presentation

In response to Leggett & Platt’s 2022 outlook, we anticipate the corporate will earn $2.38 in adjusted EPS for the yr. Due to this fact, the corporate is forecasted to pay out 73% of adjusted EPS out in dividends. This payout ratio is unfavorable to the trailing decade common and is above the corporate’s 50% goal payout ratio.

Nonetheless, the corporate has demonstrated that they’re dedicated to the dividend, and to rising it. In any case, Leggett & Platt is a Dividend King with a 51-year dividend progress streak. We count on dividend will increase under the speed of earnings progress, which might see the payout ratio dip somewhat bit sooner or later.

Last Ideas

Leggett & Platt has a robust and safe yield, which is much more spectacular after contemplating that it has paid the next annual dividend per share for the final fifty years straight.

Whereas the payout ratio at present is above the corporate’s goal payout ratio, we count on the corporate will nonetheless develop the dividend. If the payout ratio begins to stretch, we anticipate the corporate would simply apply token dividend will increase. At instances the corporate’s outcomes have been very risky, and so this can be a extra prudent technique for the corporate.

Leggett & Platt affords enticing complete returns for each earnings and worth buyers at this value right here, with high-yield, earnings progress, and valuation growth expectations.

In case you are eager about discovering extra high-quality dividend progress shares appropriate for long-term funding, the next Certain Dividend databases might be helpful:

The main home inventory market indices are one other strong useful resource for locating funding concepts. Certain Dividend compiles the next inventory market databases and updates them often:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link