Revealed on March 29, 2022, by Felix Martinez

Worldwide Paper (IP) is an organization that you could be not hear of, however I’m positive you utilize its merchandise in a roundabout way in your on a regular basis life. The corporate pays a wholesome dividend yield with a confirmed dividend progress observe file.

We additionally cowl loads of different totally different high-yield shares in our database.

Now we have created a spreadsheet of shares (and intently associated REITs and MLPs, and many others.) with dividend yields of 5% or extra…

You’ll be able to obtain your free full listing of all securities with 5%+ yields (together with vital monetary metrics akin to dividend yield and payout ratio) by clicking on the hyperlink beneath:

Thus, we’ll overview Worldwide Paper for the next high-yield shares on this collection, with a present dividend yield of 4.0%.

Enterprise Overview

Worldwide Paper is a number one international producer of renewable fiber-based packaging, pulp, and paper merchandise. It has manufacturing operations in North America, Latin America, Europe, North Africa, Russia, and India, serving greater than 25,000 prospects in 150 international locations and trades with a market capitalization of $17.4 billion.

The corporate operates primarily in two segments. The primary phase, which accounts for 84% of the corporate’s complete income in 2021, is the Industrial Packaging phase. The opposite phase, World Cellulose Fibers, accounted for 14% of the corporate’s complete income in 2021.

For the commercial packaging phase, among the packaging objects that the corporate produces are for eCommerce, protein, fruit and vegetable, distribution of processed meals and beverage, and sturdy/non-durable items. As for the World Cellulose Fibers phase, Worldwide Paper produces absorbent hygiene merchandise, paper grade, and specialty merchandise.

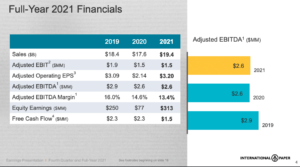

On January 27, 2022, the corporate reported fourth-quarter and full-year outcomes for Fiscal 12 months (FY)2021. Income for the quarter was up 14.5% in comparison with the fourth quarter of FY2020. On 1 / 4 to quarter foundation, income is up 3.5% in comparison with 3Q2021. The commercial packaging and the World Cellulose Fibers phase noticed income enhance of 12.8% and 19.7%, respectively.

Industrial Packaging’s working income had been $414 million in contrast with $414 million within the third quarter of 2021. In North America, earnings elevated, reflecting increased gross sales costs for corrugated packing containers and containerboard. Gross sales volumes had been steady for corrugated packing containers and improved for containerboard. Nevertheless, these had been offset partially by elevated distribution, wooden fiber, recovered fiber, and vitality prices.

Internet earnings for the quarter was $107 million in comparison with $153 million the corporate made in 4Q2020. It is a lower of 30.1% year-over-year. Nevertheless, for the 12 months, the corporate made a revenue of $1,752 million in comparison with a revenue of $482 million in FY2020. It is a 263% enchancment.

Complete income for the 12 months was up 10.2%, from $17,565 million in Fy2020 to $19,363 million final 12 months.

Supply: Investor Presentation

The corporate additionally made an effort to cut back its debt. It diminished its deficit by $1.4 billion, bringing all the 12 months to $2.5 billion.

Total, on an Incomes per-share foundation, the corporate made $3.20 for FY2021, which is a rise of 49.5% in comparison with the $2.14 per share the corporate made in 2020. We anticipate the corporate will earn $4.60 per share for FY2022. This can symbolize a rise of 43.7% versus FY2021.

Progress Prospects

The corporate’s progress prospects will come from adjustments that the corporate could make inside. For instance, Industrial Packaging advantages from a full 12 months of beforehand revealed worth will increase. This can assist develop income thus earnings. It additionally expects $200 to $225 million of gross advantages from constructing higher IP initiatives to assist enhance margin. One other progress driver will come from optimization. The corporate mill and field system has been optimized from prior-year disruptions.

Additionally, containerboard gross sales have boosted because of elevated gross sales in grocery channels and e-commerce. Nevertheless, it’s fascinating that the corporate’s earnings decreased from 2019 – to 2020 throughout the COVID-19 pandemic since everybody was residence ordering on-line. However, the corporate inventory worth elevated over 102% from March 2020 lows to June excessive 2021. Buyers who thought the corporate would develop its earnings considerably due to the pandemic drove the inventory worth increased.

We anticipate the corporate to develop earnings by about 4% over the subsequent 5 years. This can give the corporate an incomes per share of $5.60 for 2027.

Aggressive Benefits & Recession Efficiency

We expect the corporate doesn’t essentially have an financial moat. Nevertheless, we consider that it does a aggressive benefit. The corporate advantages from scale and dependable manufacturers. The corporate can enhance costs and optimizes its manufacturing to reduce prices.

The corporate carried out terribly throughout the Nice Recession of 2008-2010. The inventory worth noticed a lower of over 68% from 2007 to the low in 2009, and earnings decreased in that very same interval.

IP’s earnings-per-share all through the Nice Recession:

- 2007 earnings-per-share of $2.10

- 2008 earnings-per-share of $1.90 (9% lower)

- 2009 earnings-per-share of $0.83 (56% lower)

- 2010 earnings-per-share of $1.94 (133% enhance)

As you see, the corporate didn’t do effectively throughout the 2008-2009 Nice Recession. Earnings and the inventory worth decreased in these years. Additionally, the corporate needed to lower its dividend from $0.93 per share 12 months to $0.30 per share for the 12 months. This was a dividend lower of 67.5%.

Dividend Evaluation

Because the Nice Recession, the corporate has needed to lower its dividend. Nevertheless, the corporate has been rising its dividend by a 16.6% compounded annual price since that point. It is a very spectacular dividend progress price over a ten-year interval. Nevertheless, on October 12, 2021, the corporate introduced a slight dividend lower of 9.8%. This dividend lower is that the corporate introduced a spin-off of its printing papers enterprise late final 12 months.

The corporate administration workforce is dedicated to a aggressive and sustainable dividend of 40% to 50% of free money movement. The dividend adjustment is in keeping with its dividend coverage and is effectively beneath the 15% to twenty% adjustment the administration workforce anticipated.

On this similar announcement, the corporate board approved a share repurchase program to accumulate as much as $2 billion of its inventory. The brand new authorization is along with $1.3 billion remaining as of Q3 finish from a earlier repurchase authorization.

Presently, the dividend payout ratio is 62.5% for FY2021. We anticipate the corporate to make $4.60 per share for FY2022, which supplied a dividend payout ratio of 40.2%. It is a very protected dividend payout ratio of an organization that pays out a excessive dividend yield.

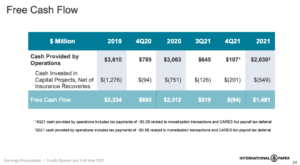

Supply: Investor Presentation

Free money flows additionally cowl the dividend very effectively. For 2021, the corporate reported a free money movement of $3.77 per share. This supplied a well-covered dividend payout ratio of fifty.9%. For FY2022, we anticipate the corporate to better a free money movement per share of $3.63, which can give us a dividend payout ratio of 51.3%.

Total, the dividend seems protected on an incomes foundation and a free money movement foundation.

Supply: Investor Presentation

The corporate additionally has a good steadiness sheet. The corporate has a 0.9 debt-to-equity ratio, which is first rate, and an curiosity protection ratio of three.3. Moreover, Worldwide Paper has an S&P Credit score Ranking of “BBB.” The “BBB” credit standing is an investment-grade ranking.

Thus, the steadiness sheet is in good situation and will assist the corporate face up to a recession and not using a dividend lower. In the course of the 2008-2009 Nice recessions, the corporate had a poorer steadiness sheet than its present situations. Subsequently, we predict the dividend could be very protected.

Remaining Ideas

Worldwide Paper is an organization that not many traders know, however we’re positive you might have used its merchandise earlier than with out figuring out it. That is the kind of firm that dividend progress traders search for and like to spend money on. The excessive dividend yield is fascinating and protected for the foreseeable future. The corporate has a good steadiness sheet that ought to assist it carry out a lot better than over the past recession. Total, we predict the dividend is protected proper now.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].