[ad_1]

Printed on January 18th, 2023 by Samuel Smith

Compass Diversified (CODI) is a horny dividend inventory that’s at present providing a dividend yield of almost 5% alongside a horny valuation and powerful long-term development prospects.

It is among the high-yield shares in our database.

We have now created a spreadsheet of shares (and carefully associated REITs and MLPs, and many others.) with dividend yields of 5% or extra.

You’ll be able to obtain your free full checklist of all securities with 5%+ yields (together with essential monetary metrics corresponding to dividend yield and payout ratio) by clicking on the hyperlink under:

On this article, we’ll analyze the prospects of Compass Diversified.

Enterprise Overview

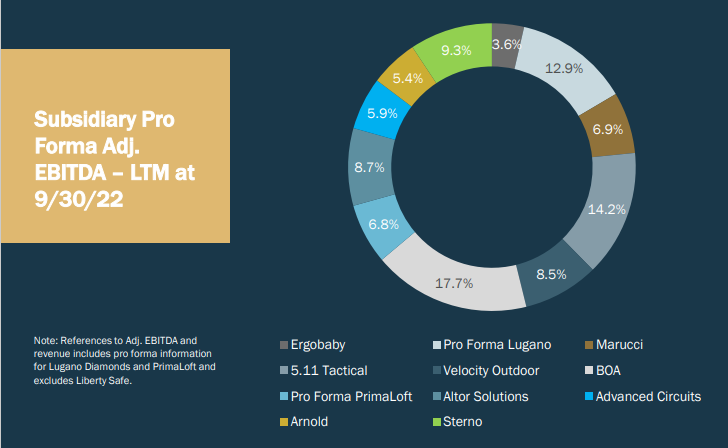

Compass Diversified Holdings is a personal fairness agency that makes a speciality of acquisition within the center market. The center market is loosely outlined as companies with proprietor earnings between $10 million and $500 million. Compass Diversified went public in 2006 and since that point, it has grown into an organization that generates about $2.2 billion in annual income. The corporate purchases controlling stakes in small corporations and holds them indefinitely. Compass Diversified Holdings has about ten completely different subsidiaries at most instances, however there are common modifications within the portfolio.

Supply: Investor Presentation

Compass Diversified Holdings reported its most up-to-date quarterly earnings leads to November. The corporate introduced that its revenues totaled $600 million throughout the quarter, which was 22% greater than the revenues that Compass Diversified generated throughout the earlier yr’s quarter. The corporate beat the highest line estimate simply, by $50 million.

Compass Diversified was capable of generate adjusted EBITDA of $98 million throughout the quarter, up 27% yr over yr. Compass Diversified Holdings’ non-GAAP earnings-per-share had been $0.67, however income are oftentimes not reflective of the corporate’s potential to generate money flows. Compass Diversified normally generates money flows which might be larger than its reported internet income, which generally are even damaging.

For 2022, Compass Diversified has elevated its EBITDA steering vary to $460 million – $470 million, which is nicely above the $330 million of EBITDA generated in 2021. Within the aftermath of reworking its firm from a partnership to a C-Company for tax functions (it now points a 1099 tax type as a substitute of a Okay-1 tax type), Compass Diversified lower its dividend by 31% this yr, bringing the payout to $0.25 per quarter, or $1 per yr.

Progress Prospects

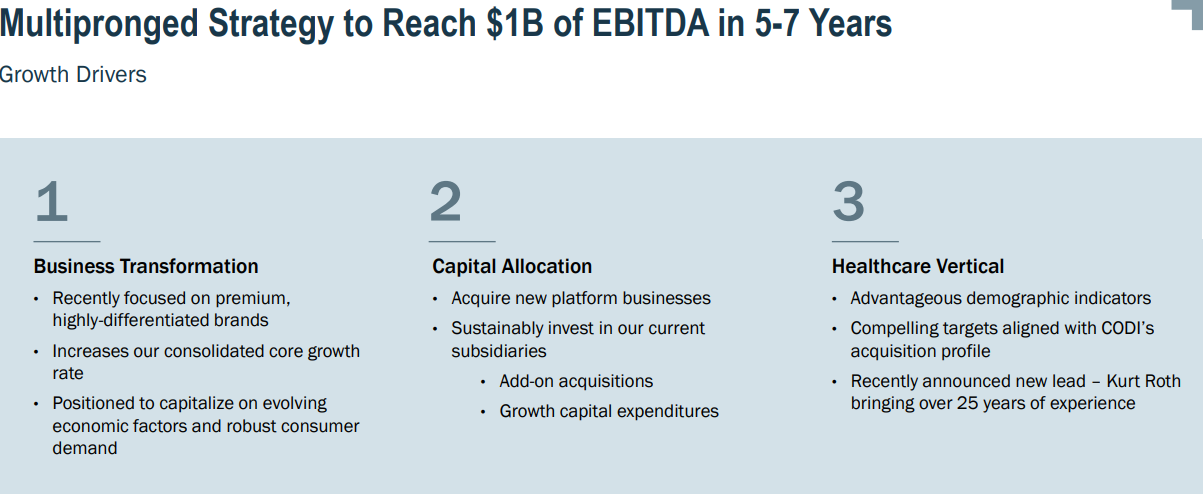

Compass Diversified’s development technique is targeted on producing $1 billion of EBITDA in 5-7 years from now. It has three main development drivers to attain that aim.

Supply: Investor Presentation

First, it plans to proceed remodeling and enhancing the companies inside its current portfolio to drive growing EBITDA organically. It goals to perform this by specializing in premium, extremely differentiated manufacturers, capitalizing on evolving financial elements and strong client demand, making strategic add-on acquisitions and excessive returning development capital expenditures.

Second, it plans to proceed buying new companies that match inside its present platforms, with a continued concentrate on premium, extremely differentiated manufacturers the place administration sees alternative for continued value-adding investments and the prospect to drive substantial additional EBITDA development.

Lastly, it’s taking the start steps in direction of launching a extra defensive healthcare vertical which it believes will present it with a extra balanced money circulate profile all through the enterprise cycle. Compass Diversified is especially bullish on healthcare on condition that it enjoys advantageous demographic indicators, and the corporate already believes it has some compelling targets which might be aligned with Compass Diversified’s acquisition profile. Within the meantime, it has employed Kurt Roth to be its healthcare vertical lead. He brings 25 years of expertise from the sector and is predicted to supply the required experience to drive sturdy worth on this new vertical.

Aggressive Benefits

Compass Diversified’s underlying subsidiaries primarily profit from superior entry to and price of capital than most of their friends by means of their proprietor, Compass Diversified. In the meantime, Compass Diversified advantages from its entry to everlasting capital that permits it to take a really long-term strategy to its investments. This allows it to deploy capital patiently, stand up to short-term market distortions, and act swiftly when a few of its opponents are sidelined.

Moreover, its portfolio of various and uncorrelated belongings and appreciable scale provides it a decrease total value of capital and elevated risk-adjusted whole returns. Lastly, by aligning itself carefully with shareholders, it has each incentive to ship superior long-term whole returns. Specifically, administration funds acquisitions on the father or mother firm stage and ties its incentive charges to the corporate’s returns on its investments. Because of this, Compass Diversified bears the chance and the rewards alongside shareholders.

Dividend Evaluation

Compass Diversified lately strengthened its dividend security by saying the sale of its Superior Circuits enterprise and used the proceeds from the sale to pay down debt on its revolving credit score facility. This improves its leverage and liquidity profiles, positioning it to climate any financial downturn that will happen this yr.

Moreover, its dividend is well-covered by money flows. Compass Diversified is predicted to report $2.40 in money circulate per share in fiscal 2022, overlaying its $1.00 per share dividend by 2.4 instances. When mixed with the sturdy development momentum in lots of its underlying companies and its anticipated enlargement into the healthcare vertical, Compass Diversified ought to be capable to pay out its dividend for a few years to return supplied that it doesn’t overleverage itself for acquisitions.

That mentioned, buyers ought to needless to say Compass Diversified may be very unlikely to develop its dividend shifting ahead on condition that it likes to make use of its retained money circulate to spend money on new development tasks and acquisitions.

Ultimate Ideas

Compass Diversified is a compelling excessive yield dividend inventory given its enticing portfolio of companies, sturdy monitor report of producing enticing returns on funding, and its promising development profile by way of a mix of natural development and strategic acquisitions.

Because of this, buyers mustn’t view it as a dividend development inventory, somewhat a dividend inventory that additionally gives sturdy long-term money circulate and intrinsic worth development.

General, we view Compass Diversified as providing a horny risk-reward profile that’s seemingly to supply profitable earnings and whole returns to buyers for a few years to return.

If you’re fascinated about discovering extra high-quality dividend development shares appropriate for long-term funding, the next Positive Dividend databases will probably be helpful:

The foremost home inventory market indices are one other stable useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them commonly:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link