[ad_1]

Revealed on January twelfth, 2023 by Nathan Parsh

Low cost retailer Large Tons, Inc. (BIG) has a comparatively quick historical past of paying a dividend having initiated it in 2014. The corporate hasn’t supplied a dividend improve since 2018, however that hasn’t stopped the inventory from reaching a really excessive yield after falling greater than 57% over the past yr.

In actual fact, the inventory’s yield of 6.4% is sort of 4 instances the common yield of the S&P 500, which is sweet sufficient to land Large Tons on our checklist of high-yield shares.

This checklist comprises almost 200 shares with yields of at the very least 5%, that means all of them yield at the very least 3 times that of the market index.

You may obtain your free full checklist of all securities with 5% yields (together with necessary monetary metrics similar to dividend yield and payout ratio) by clicking on the hyperlink under.

On this article, we’ll take a deep take a look at Large Tons’ prospects as an funding immediately.

Enterprise Overview

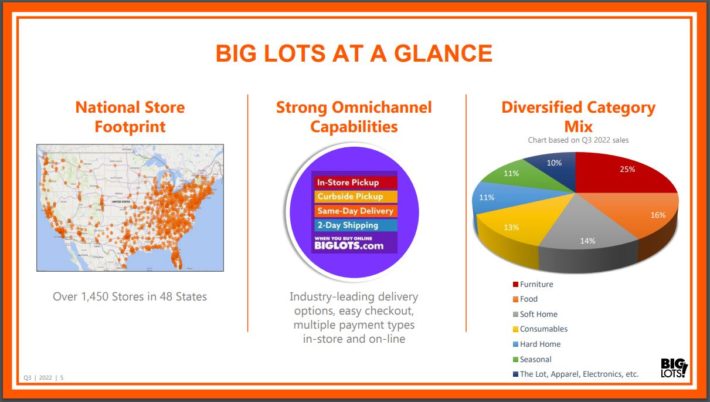

Large Tons is a house low cost retailer with a give attention to closeouts and providing clients low costs. The corporate’s merchandise classes embrace meals, consumables, residence, furnishings, attire, electronics, and seasonal. The corporate generates almost $6 billion in annual gross sales and has a market capitalization of simply $489 million.

Large Tons reported third quarter earnings outcomes on December 1st, 2022.

Supply: Investor Presentation

Income fell nearly 10% to $1.20 billion for the interval, which was $4.2 million lower than anticipated by the analyst neighborhood. The corporate reported an adjusted earnings-per-share lack of $2.99, which was a nickel worse than anticipated. The loss on the bottom-line in contrast unfavorably to a lack of simply $0.14 within the prior yr and a lack of $2.28 within the second quarter of 2022.

Comparable gross sales fell 11.7%, worse than the market had anticipated, however in-line with firm steerage. Declines have been felt in nearly each product class, however none was worse than the 26% decline in furnishings. Different areas, similar to delicate and arduous residence, have been down double-digits as nicely.

The one space of the shop that carried out nicely was seasonal, which improved 7% from the prior yr.

A lot of the decline in same-store gross sales is because of aggressive discounting of merchandise. Large Tons, like many different retailers, has been holding an excessive amount of stock following a replenish through the Covid-19 pandemic. Inflationary pressures have additionally prompted the price of stock acquisition to rise, which has meant dearer costs for patrons. Promotional exercise is getting used to trim stock, however this has not been a fast transformation.

On the finish of the quarter, Large Tons had $1.345 billion of stock, which is up 5.3% from the identical interval of 2021. The excellent news is that this year-over-year development in stock is down from 48.5.% within the first quarter and 22.8% within the second quarter. Sequentially, at the very least, Large Tons is seeing stock development come down considerably. The corporate expects stock to be flat or down within the fourth quarter.

The discounting of merchandise took a toll on gross margin, which contracted 510 foundation factors to 34.5%.

Following third quarter outcomes, Large Tons isn’t offering earnings-per-share steerage for the yr. The corporate does count on that comparable gross sales will probably be down low double-digits within the fourth quarter as Large Tons works to proper dimension its stock ranges. Gross margin is projected to stay within the mid-30% vary, however enhance on a sequential foundation.

Regardless of the weak spot and uncertainty concerning the corporate, we preserve our $5.00 per share estimate for 2022.

Progress Prospects

Large Tons has skilled a really uneven development historical past. The center of the final decade noticed earnings-per-share develop, however this was due principally fully to a decrease share rely. Income was largely unchanged from 2012 to 2019, whereas earnings and web revenue each fell over the interval.

The corporate did see substantial development in 2020 as earnings-per-share nearly tripled. Large Tons used its e-commerce enterprise to capitalize on the Covid-19 pandemic as shoppers turned to on-line buying to fulfill their wants. As a reduction retailer, the corporate provides shoppers good worth on the merchandise they want, one thing that turned out to be some extent in Large Tons’ favor throughout this time period.

E-commerce continues to be a energy for the corporate even because the worst of the Covid-19 pandemic seems to be over. Regardless of weak spot within the total enterprise, e-commerce grew 15% within the third quarter. Large Tons additionally provides a wide range of success choices as nicely, together with in-store and curbside pickup, same-day supply, and 2-day delivery for patrons shopping for merchandise on line.

That stated, we don’t count on earnings development over the following 5 years as Large Tons is already ranging from a excessive base.

Aggressive Benefits

With its enterprise centering on closeouts and low-price factors, Large Tons has a bonus throughout troublesome financial intervals. As shoppers tighten their wallets, they search for worth, one thing that Large Tons provides all through its shops. This is the reason the corporate has accomplished nicely throughout downturns, with the 2020 efficiency being a primary instance of this.

Large Tons additionally advantages from an in depth footprint.

Supply: Investor Presentation

The corporate has greater than 1,450 shops all through the continental U.S., with the vast majority of these positioned in additional density populated states east of the Mississippi River. This offers the corporate entry to a bigger buyer pool, although not as intensive as different low cost retailers. For instance, Greenback Basic Company (DG) has nearly 19,000 shops.

Large Tons has leveraged its e-commerce enterprise to nice lengths already. As a smaller participant within the low cost retail area, this will probably be a extremely necessary method for the corporate to take extra market share.

Dividend Evaluation

Large Tons has paid a dividend since 2014, with the following a number of years seeing intensive development. The quarterly dividend went from $0.17 in 2014 to $0.30 by the start of 2018. That’s the place the dividend development ended because the cost has remained fixed for 20 consecutive quarters.

The present yield of 6.4% is well-ahead of the inventory’s five-year common yield of two.9%, suggesting that shares could possibly be undervalued.

The dividend hasn’t been minimize even during times of uncertainty, which is a constructive signal. One other level within the firm’s favor is that the payout ratio has usually been low, usually within the mid-to-high 20% vary. That stated, we really feel that additional weak spot within the enterprise or a number of down years might finally result in a dividend minimize.

Closing Ideas

Large Tons does have some positives concerning the corporate. It’s enterprise mannequin tends to work nicely throughout financial downturns and the e-commerce enterprise has allowed the corporate entry to extra potential clients.

However, the corporate is small and is definitely dwarfed by different low cost retailers. Stock ranges stays elevated even because the year-over-year development has change into much less. The dividend yield, whereas beneficiant, might not be secure in a protracted downturn within the enterprise.

If you’re interested by discovering extra high-quality dividend development shares appropriate for long-term funding, the next Positive Dividend databases will probably be helpful:

The key home inventory market indices are one other strong useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them recurrently:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link