[ad_1]

Revealed on January thirteenth, 2023 by Josh Arnold

There are particular sectors of shares that are likely to lend themselves to being nice sources of earnings. Basically, low progress and low capex wants are usually traits of sturdy earnings shares, as a result of firms with these traits lack ample progress funding alternatives for his or her capital. That frees the administration workforce as much as as a substitute return capital to shareholders by way of dividends. Financials are an incredible supply of dividend shares, however there’s extra to finance than banks. Funding managers usually provide sizable dividend yields, reminiscent of the topic of this text.

That inventory is Artisan Companions Asset Administration Inc. (APAM), an organization with a market cap of lower than $3 billion, however a really excessive yield. In reality, the 6.5% present yield is nice sufficient to land Artisan on our checklist of high-yield shares.

This checklist accommodates about 200 shares with yields of not less than 5%, that means all of them yield not less than 3 times that of the S&P 500.

You may obtain your free full checklist of all securities with 5%+ yields (together with vital monetary metrics reminiscent of dividend yield and payout ratio) by clicking on the hyperlink under:

Beneath, we’ll analyze the prospects of Artisan as an funding alternative at present.

Enterprise Overview

Artisan is a publicly-owned funding supervisor. The corporate offers funding companies to pension and revenue sharing plans, trusts, endowments, charitable organizations, governments, non-public funds, mutual funds, and extra. It manages fairness and glued earnings portfolios which have investments from everywhere in the world. The corporate focuses on conventional elementary evaluation to seek out and choose funding alternatives for its funds.

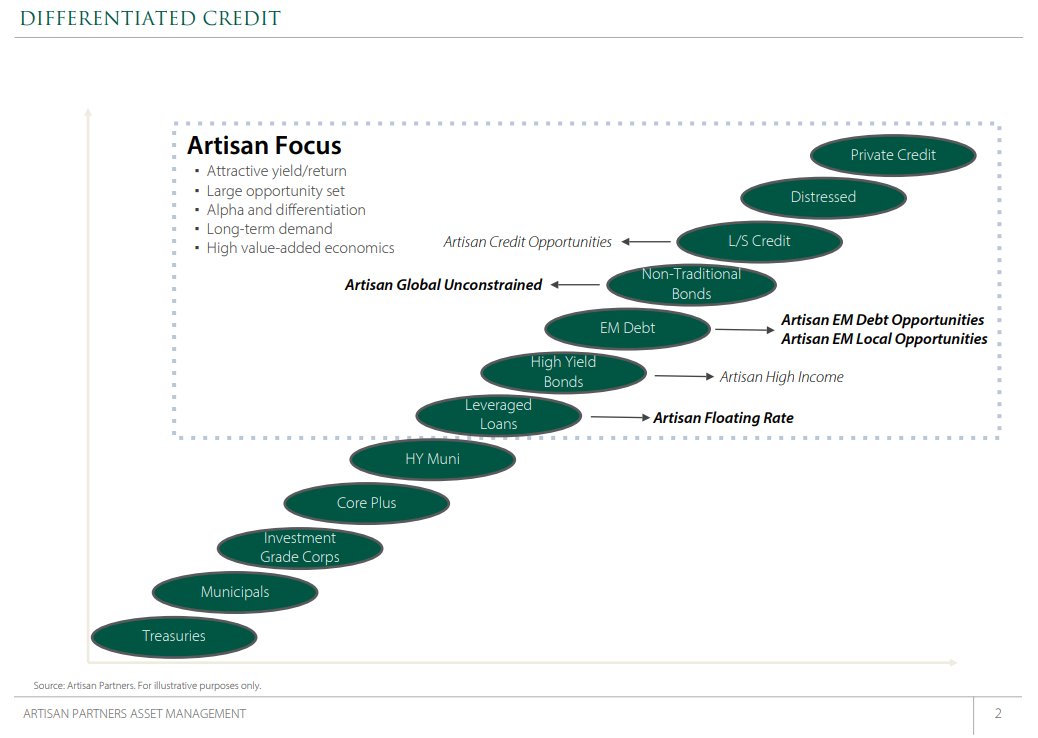

Supply: Investor presentation, web page 2

By way of Artisan’s credit score focus, it’s within the backside half of the credit score danger ladder, as seen above. This affords Artisan a lot increased yields than traders centered on authorities and high-grade company points, as an illustration, nevertheless it additionally carries with it elevated danger. Artisan seeks to handle that commerce off between danger and reward to generate returns for shareholders.

Artisan was based in 1994 and is predicated within the US. The corporate produces slightly below a billion {dollars} of annual income, and trades with a market cap of $2.7 billion.

Artisan posted third quarter earnings on November 1st, 2022, and outcomes got here in weaker than anticipated. Adjusted earnings-per-share got here to 70 cents, which plummeted from $1.33 in adjusted earnings-per-share within the year-ago interval. Likewise, income fell sharply, declining 26% year-over-year to $234 million.

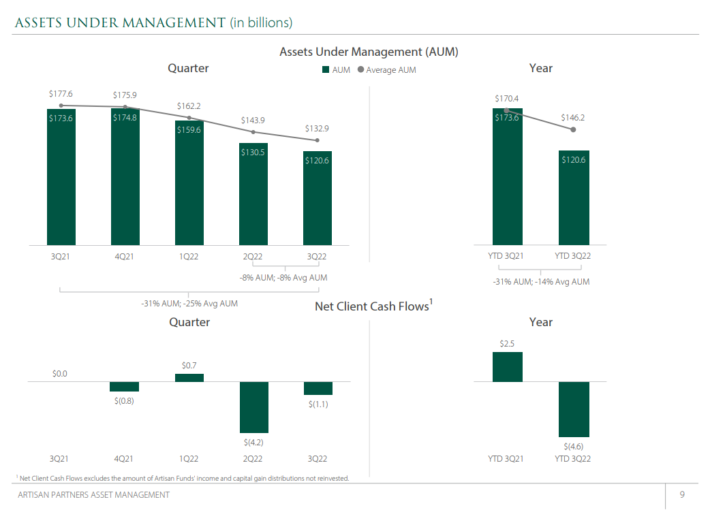

Property beneath administration, which is the first approach that Artisan generates charges, declined 31% year-over-year to $121 billion. That was attributable primarily to the decline in international inventory markets. As well as, Artisan noticed $5.4 billion in web shopper money outflows, in addition to $2.4 billion in capital beneficial properties distributions that purchasers selected to not reinvest.

Working bills got here to $156 million, down $18 million year-over-year, which was attributable to a decline in incentive compensation, in addition to third-party distribution bills. These have been offset barely by increased occupancy, expertise, mounted compensation, and journey prices.

Adjusted working margin fell sharply year-over-year from 45.2% of income to 32.9%. Asset managers are likely to have risky working margins as a result of the leverage they obtain on working bills with progress in property beneath administration is powerful. That works in each instructions, nevertheless, and the worldwide inventory market downturn of 2021 took a big toll on Artisan’s profitability.

With the fourth quarter but to be reported, we estimate full-year adjusted earnings-per-share of $3.05 for Artisan.

Development Prospects

Given the truth that Artisan is sort of wholly reliant upon rising property beneath administration to generate charges and earnings, its earnings progress historical past is predictably spotty. It’s regular for Artisan to see quite sizable beneficial properties and losses from 12 months to 12 months, however importantly, the corporate has remained solidly worthwhile all through the final decade. We be aware Artisan has seen web shopper outflows regularly prior to now a number of quarters, which hurts its skill to develop longer-term. As a substitute, the corporate may be very reliant upon the values of worldwide inventory and bond markets, each of which had terrible years in 2021.

Given these elements, we’re at the moment estimating -2% earnings contraction on common within the years to come back, as we see aggressive headwinds persisting, and as we discover the online shopper outflows to be considerably worrisome. On the plus facet, the corporate is controlling working bills, and the outflows have to this point been small and manageable. Nonetheless, we predict Artisan has a troublesome street forward when it comes to rising earnings from the ~$3 per share degree estimated for 2022.

Aggressive Benefits

Sadly for Artisan, we don’t see the place it has a lot of a aggressive benefit. There are numerous funding managers accessible to these trying to make investments their capital, and plenty of of them have huge scale and model recognition benefits over Artisan. The corporate notes its funds carry out comparatively properly, nevertheless it merely hasn’t resonated with prospects.

Supply: Investor presentation, web page 9

There’s maybe no higher illustration of this lack of benefit than the above information on outflows and property beneath administration. We imagine that if Artisan had a aggressive benefit, it will be attracting further investor capital, not shedding it. Whereas we imagine Artisan is a reliable funding supervisor, we can not look previous the truth that prospects are web sellers of the corporate’s funds.

Dividend Evaluation

Artisan has paid dividends to shareholders for 9 consecutive years, which is the period of time it has been publicly-traded. Nonetheless, it doesn’t have a dividend progress streak given the distinctive, variable nature of its dividend coverage. Administration goals to pay out 80% of the money the corporate generates for the 12 months, however given the risky nature of its earnings efficiency, 80% of money generated could be wildly totally different from 12 months to 12 months. It additionally implies that the corporate pays a daily quarterly dividend, after which sometimes pays a particular dividend on the finish of the 12 months.

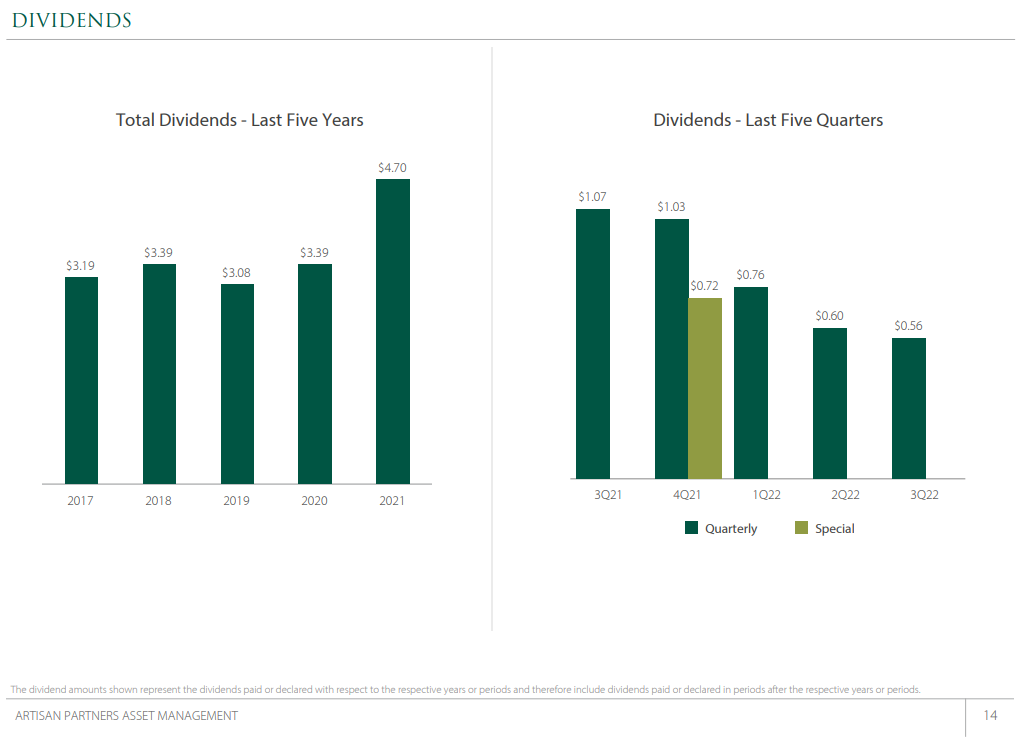

Supply: Investor presentation, web page 14

The quarterly dividends are variable in dimension, as are the particular dividends, so it’s almost unattainable to know from 12 months to 12 months what the entire payout could be. Nonetheless, to its credit score, Artisan’s whole dividends have been enormous for the previous 5 years, with the interval of 2017 to 2021 producing a complete of $17.75 in money distributions to shareholders. With the share value at $34 at present, that suggests shareholders obtained absolutely half of at present’s share value in dividends in simply 5 years.

Artisan’s payout has exceeded 100% of earnings at instances prior to now, however we see it beneath 90% for the foreseeable future. That’s very excessive, and it means the dividend is vulnerable to cuts. Nonetheless, Artisan’s coverage is to pay a variable dividend annually, so cuts are regular and must be anticipated on occasion.

The place Artisan excels is within the whole yield it offers traders, as the present quarterly dividend alone is price 6.5%, whereas any particular dividends add to that whole yield. That makes Artisan a really sturdy earnings inventory, offered traders aren’t on the lookout for dividend progress, and are okay with the payout being lower and raised consistently.

Last Ideas

Artisan Companions Asset Administration has confirmed itself to be a really sturdy earnings inventory in recent times, returning half of its present share value to shareholders in money dividends in simply the previous 5 years. Nonetheless, we see the earnings progress outlook as murky, and given the variable dividend coverage, meaning decrease dividends are fairly potential.

We like the present yield, significantly if the worldwide fairness markets flip increased in 2023, as that can elevate the corporate’s property beneath administration, and due to this fact, earnings. Nonetheless, for now, the payout seems to be considerably in danger, and we’re cautious on Artisan consequently, regardless of the massive yield.

If you’re serious about discovering extra high-quality dividend progress shares appropriate for long-term funding, the next Certain Dividend databases can be helpful:

The main home inventory market indices are one other strong useful resource for locating funding concepts. Certain Dividend compiles the next inventory market databases and updates them frequently:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link