[ad_1]

Revealed on April 14th, 2023 by Jonathan Weber

3M Firm (MMM) has elevated its dividend for greater than 60 years in a row, which makes for an distinctive dividend development monitor file. As we speak, 3M’s dividend yield is at a stage that’s approach larger than the historic norm, at round 5.7%.

The corporate’s shares have underperformed the broad market during the last 12 months and over a multi-year timeframe, primarily resulting from headwinds from lawsuits that 3M continues to battle.

3M Firm is among the high-yield shares in our database.

Additionally it is a part of our ‘Excessive Dividend 50’ sequence, the place we cowl the 50 highest yielding shares within the Positive Evaluation Analysis Database.

Now we have created a spreadsheet of shares (intently associated REITs and MLPs, and so on.) with 5% or extra dividend yields.

You may obtain your free full listing of all securities with 5%+ yields (together with vital monetary metrics corresponding to dividend yield and payout ratio) by clicking on the hyperlink under:

On this article, we are going to analyze the outlook for 3M Firm.

Enterprise Overview

3M Firm is a diversified industrial firm that sells a really wide selection of merchandise, from adhesives to non-public safety gear. Its product portfolio contains greater than 60,000 completely different merchandise, and the corporate is lively in additional than 200 international locations across the globe.

This diversification throughout completely different product strains and completely different geographic markets has allowed 3M Firm to be extra resilient in comparison with many different industrial corporations. 3M has greater than 90,000 staff, was based greater than 100 years in the past, in 1902, and is headquartered in St. Paul, Minnesota.

The corporate reported its most up-to-date quarterly outcomes on January 24. The corporate’s gross sales got here in at $8.1 billion for the quarter, which was down 6% in comparison with the earlier 12 months’s quarter, which was just about consistent with the Wall Avenue consensus estimate.

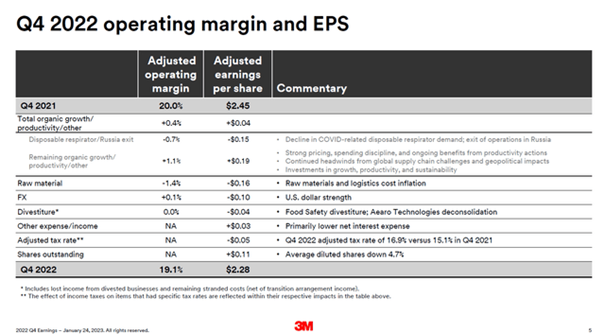

3M Firm’s earnings-per-share for the interval got here in at $2.28, which was barely lower than anticipated, and which was down from the earlier 12 months’s quarter. A large number of headwinds for financial development and industrial exercise, corresponding to excessive inflation, rising rates of interest, and an vitality disaster in Europe, are answerable for the destructive enterprise development that 3M has skilled in the course of the interval.

Supply: Investor Presentation

Increased uncooked materials costs had been the primary contributor to the margin decline 3M skilled in the course of the interval, whereas unfavorable foreign money charge actions additionally had a destructive affect. The US Greenback strengthened versus most currencies in 2022, which made 3M’s ex-US income value much less as soon as denominated in US {Dollars}.

Development Prospects

3M Firm has delivered stable earnings-per-share and enterprise development during the last decade. Between 2013 and 2022, its earnings-per-share rose from $6.72 to $10.10, which pencils out to an annual development charge of 5%. That’s not spectacular, however very stable for a dependable and established blue chip firm corresponding to 3M Firm.

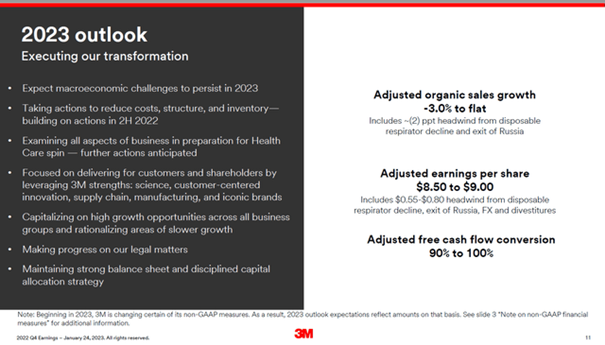

For the present 12 months, 3M expects an earnings-per-share decline, primarily resulting from a weakening macro-economic atmosphere and a possible recession:

Supply: Investor Presentation

Prior to now, earnings-per-share development rested on a number of contributing elements. The corporate was capable of develop its gross sales volumes over time, by getting into new markets and by introducing new merchandise. Worth will increase additionally contributed to income development, whereas 3M Firm has additionally had a historical past of shopping for again its personal shares.

These buybacks have decreased 3M’s share depend over time, by round 20% during the last decade. A declining share depend interprets into the next portion of the corporate’s general web revenue per every remaining share, thus buybacks add to 3M’s earnings-per-share development in the long term.

Usually, the identical development drivers ought to stay intact going ahead, which is why we imagine that 3M Firm will have the ability to develop its earnings-per-share at a mid-single digit tempo sooner or later, too. That being stated, the lawsuits and their unknown affect of them add some uncertainty about 3M’s future profitability.

Aggressive Benefits

3M’s aggressive benefits are principally centered round its product portfolio, patent portfolio, and profitable analysis and growth efforts.

The corporate’s product portfolio could be very large and diversified, which implies that 3M just isn’t very susceptible to weaknesses in single finish markets, as that may be balanced out by the outcomes from different product classes.

3M invests a mid-single digit share of its annual gross sales into R&D, which has traditionally paid off. Round 30% of 3M’s gross sales have been made with merchandise that didn’t exist 5 years in the past, which showcases 3M’s success in creating and commercializing new merchandise. There isn’t any assure that this can proceed sooner or later, however the R&D tradition appears to be sturdy at 3M, which ought to be advantageous.

3M has not been invulnerable throughout recessions, however it has proven stable resilience, particularly in comparison with many different industrial corporations. The corporate remained worthwhile in the course of the Nice Recession and in the course of the pandemic, when earnings-per-share declined by simply 4% within the 2019-2020 timeframe, earlier than hitting a brand new file excessive in 2021. The above-average resilience throughout opposed financial environments ought to be maintained sooner or later, too.

Dividend Evaluation

3M Firm has an impressive dividend development monitor file, having raised its dividend for 64 years in a row. Over the past decade, dividend development averaged 10% per 12 months, which is fairly sturdy.

Because of the truth that 3M’s dividend development charge was roughly twice as excessive as its earnings-per-share development charge during the last decade, 3M’s dividend payout ratio has risen significantly in that timeframe. Primarily based on present earnings-per-share estimates, the 2023 dividend payout ratio is 68%, which is on the higher finish of the historic vary.

It will seemingly not trigger a dividend lower, because the dividend remains to be lined simply, however 3M will seemingly not ship the same dividend development charge in comparison with the previous. As a substitute, it appears seemingly that 3M will attempt to convey down its dividend payout ratio over time, which is why dividend development within the coming years could possibly be subdued. Due to a excessive dividend yield of 5.7%, that won’t be a catastrophe, nevertheless.

Remaining Ideas

3M Firm has been a foul performer on a share value and complete return foundation during the last 12 months and the final 5 years. This was principally the results of a number of compression, nevertheless, and never the results of declining income or dividends.

Lawsuits associated to so-called “eternally chemical compounds” and (probably) defective listening to safety gear have launched uncertainties, which is why 3M has seen its valuation compress.

As we speak, 3M Firm trades at a transparent low cost in comparison with how the corporate was valued up to now, which supplies for some a number of enlargement potential going ahead.

We imagine that the corporate might ship double-digit annual returns over the subsequent 5 years, due to a mix of a excessive dividend yield, some earnings development potential, and a few a number of enlargement potential.

If you’re all for discovering high-quality dividend development shares and/or different high-yield securities and revenue securities, the next Positive Dividend assets will probably be helpful:

Excessive-Yield Particular person Safety Analysis

Different Positive Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link