Dwelling costs have began to right as rates of interest rose sharply in 2022. Nonetheless, the true downside for residence costs remains to be coming in 2023 because the standoff between sellers and patrons involves a head. Nonetheless, earlier than we get there, let’s evaluate how we acquired right here.

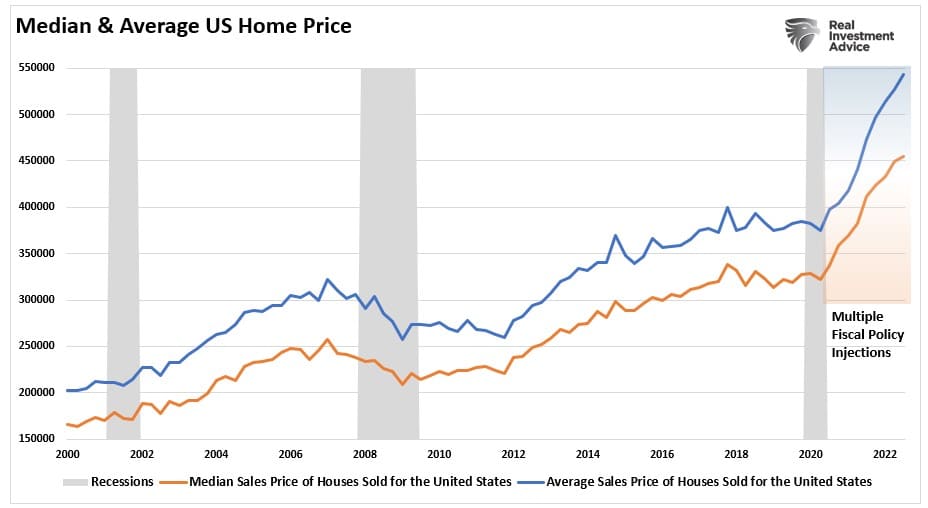

For the reason that flip of the century, there have been two housing bubbles, with residence costs reaching ranges of unaffordability not beforehand seen in the USA.

Such was, in fact, as a consequence of lax lending insurance policies and artificially low-interest charges luring financially unstable people into shopping for houses they may not afford.

Such is well seen within the chart beneath, which exhibits residence fairness versus mortgage debt. (Dwelling fairness is the distinction between residence costs and the underlying debt.)

The present surge in residence costs makes the earlier bubble in 2008 look quaint by comparability.

At that earlier peak in 2007, the fairness in folks’s houses was round $15 trillion, whereas mortgage debt stood at $9 trillion. When the bubble popped, residence costs collapsed, flipping home-owner’s fairness from constructive to destructive.

Dwelling fairness is roughly $30 trillion, whereas mortgage money owed have elevated to roughly $12 trillion. That’s an unimaginable unfold, not like something seen beforehand.

Nonetheless, this time, the surge in residence costs wasn’t as a consequence of a surge in lax underwriting by mortgage firms however somewhat the infusion of capital on to households following the COVID-19 pandemic-driven shutdown.

In fact, many younger Millennials took that cash and jumped into the home-buying frenzy. In lots of instances, shopping for sight unseen or keen to pay method over the asking worth (thereby inflating residence costs.) To cite Insider Enterprise,

“Increasingly more millennials are sinking large sums of cash into houses they’ve by no means truly set foot in. Whereas the sharp enhance in sight-unseen shopping for in 2020 was definitely pushed by pandemic restrictions, the phenomenon seems to be right here to remain, as a result of tech-forward nature of millennials and the aggressive nature of the housing market.”

In fact, the frenzy to purchase a house, and overpaying for it, led to remorse.

“The number-one cause for purchaser’s regret: 30% of respondents mentioned they spent an excessive amount of cash. The second most typical remorse was dashing the home-buying course of, with 30% saying their buy determination was rushed and 26% indicating they purchased too shortly.” – CNBC

Sadly, there might be much less demand as the huge flood of cash into the housing market from Authorities stimulus reverses.

At The Margin

The issue with a lot of the mainstream evaluation is that it’s based mostly on the transactional facet of housing. Such solely represents what is occurring on the “margin.” Somewhat, the few folks actively attempting to purchase or promote a house impression the info introduced month-to-month.

To grasp “housing,” we should analyze the “housing market” as a complete somewhat than what is occurring on the fringes. For this evaluation, we are able to use the info revealed by the U.S. Census Bureau.

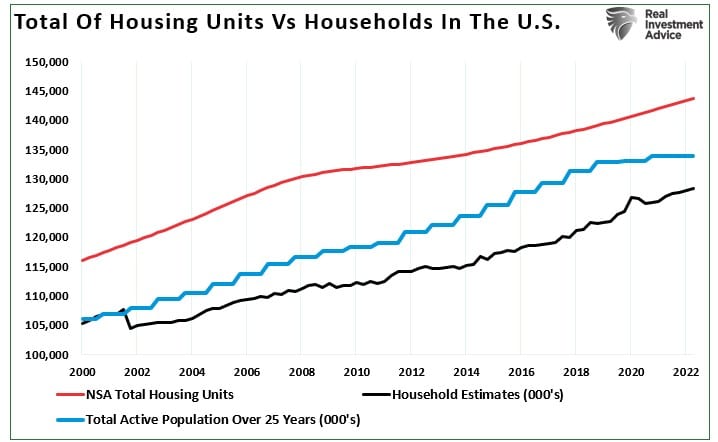

To current some context for the next evaluation, we should first have some foundation from which to work. Our baseline for this evaluation would be the variety of whole housing models, which, as of Q3-2021, was 143,613,000 models.

The chart beneath exhibits the historic development of the variety of housing models in the USA in comparison with the overall variety of households and an estimate of the overall potential households of patrons over the age of 25.

For the estimate, we dividend the overall lively inhabitants over the age of 25 by 1.5 to account for single patrons and {couples}, who are inclined to make up the bulk.

Not surprisingly, there are at the moment extra homes than households to purchase. Such is as a result of a number of houses are vacant for various causes, second houses, trip houses, and many others. Such is why, as we wrote beforehand, there isn’t any such factor as a housing scarcity. To wit:

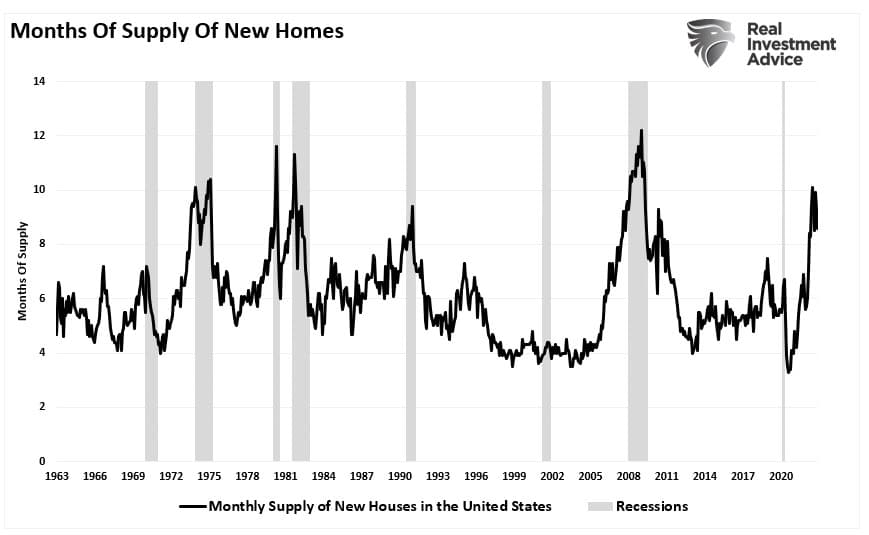

There are three main points that result in modifications within the provide of housing:

- Costs rise to the purpose that sellers come into the market.

- Rates of interest rise, pulling patrons out of the market.

- An financial recession removes patrons as a consequence of job loss.

When these happen, transactions decelerate, and stock rises sharply.

Not surprisingly, since that article was written in November 2020, simply 2-years later, the availability of houses has risen sharply. Such is commonly a number one indicator of recessionary onsets as nicely.

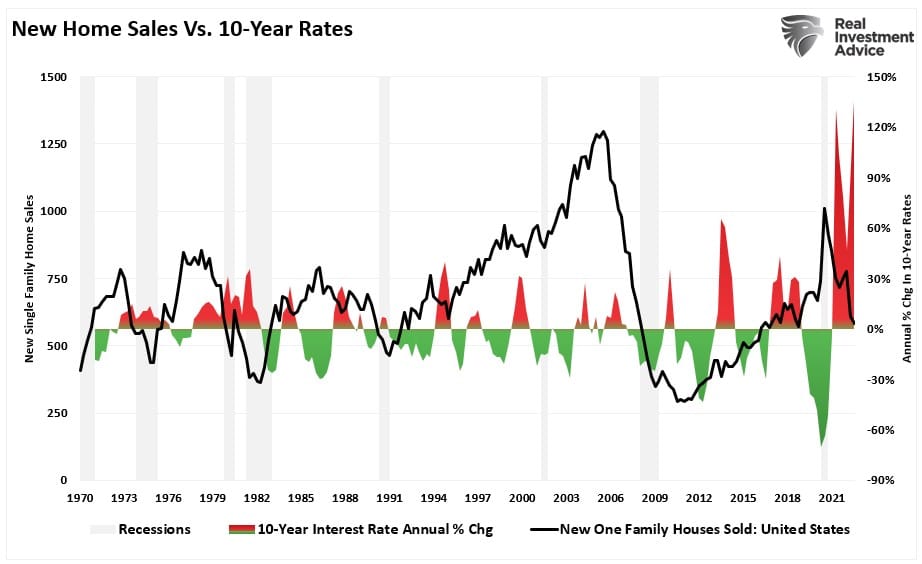

Additionally, sharply rising rates of interest pull patrons out of the market.

One other drag on costs within the new 12 months will proceed to be stock coming to market as present householders additionally attempt to promote their houses. Extra stock and few patrons will equate to an additional worth drop within the coming 12 months.

Dwelling Costs To Fall Additional

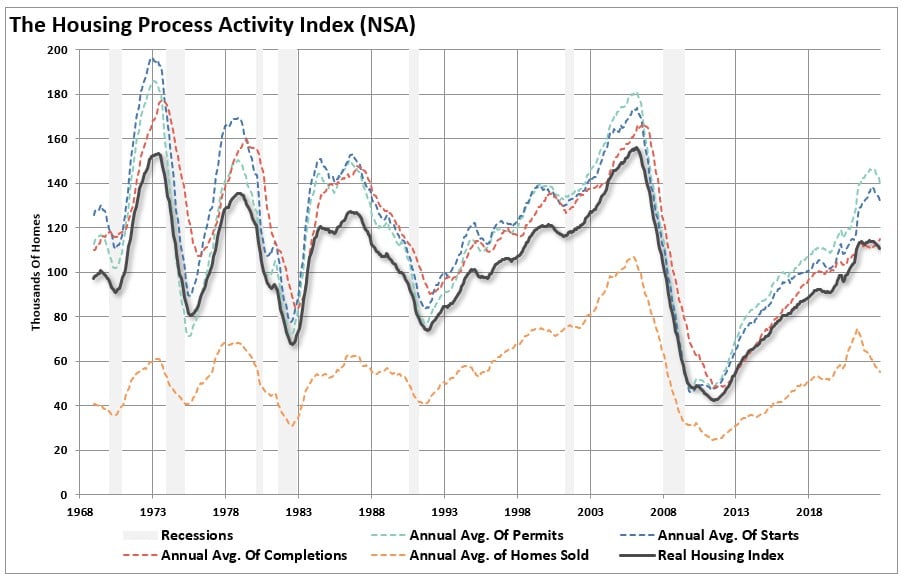

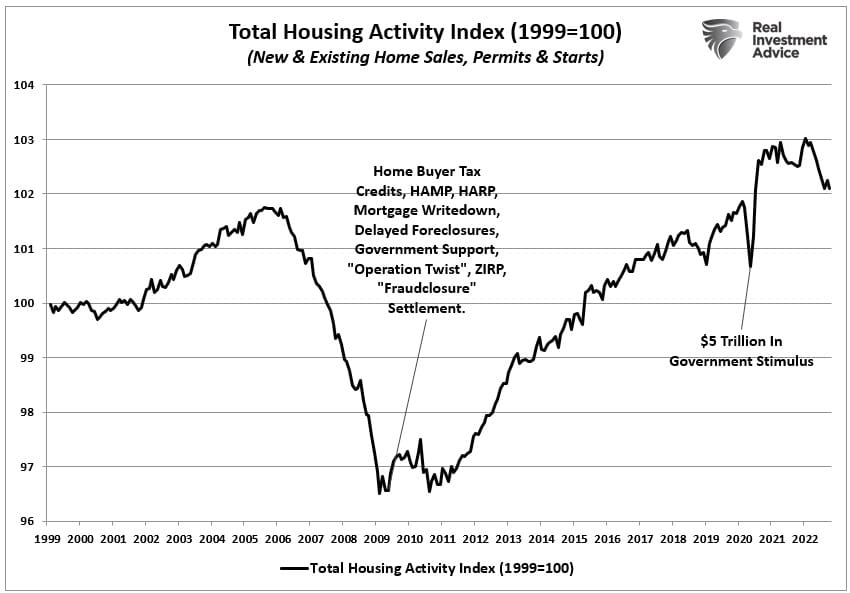

The chart beneath is essentially the most telling of why residence costs will fall additional within the coming 12 months. It’s a composite index of all the pieces concerned in housing exercise.

It compiles new and , , and . The index was rebased to 100 in 1999.

The runup within the exercise index into 2007 was a perform, as famous above, of lax lending insurance policies that led to the collapse in exercise in 2008.

Following the collapse in 2008, the Fed dropped charges to zero and launched a number of QE packages because the Authorities bailed out all the pieces that moved.

The rise in housing exercise over the subsequent decade was unsurprising, and repeated financial interventions boosted the wealth impact.

Nonetheless, the sharp bounce in housing exercise in 2020 resulted from the direct financial injections into households.

The reversion in residence costs that has begun will possible proceed as that extra liquidity continues to go away the financial system.

That drain of liquidity, coupled with larger rates of interest, and fewer financial lodging, will drag residence costs decrease.

As that happens, the “residence fairness” that many new patrons had of their houses will dissipate as homeownership prices proceed to rise as a consequence of larger charges and inflation.

As residence worth depreciation beneficial properties traction, extra householders might be dragged into promoting to retain what worth they’d.

For a lot of People, most of their web price is tied up within the homesteads. As the worth fades, the choice to promote turns into extra of a panic somewhat than a necessity.

Whereas there isn’t an unlimited wasteland of unhealthy mortgages sitting on the books, as seen in 2008, that doesn’t negate the danger of additional residence worth declines within the coming 12 months.

Not solely are additional residence worth declines attainable, however additionally it is possible they may very well be deeper than many at the moment count on.