Whereas the US debate over the CBDCs and their results, the remainder of the world are getting nearer to releasing their very own CBDCs.

The Financial institution of Worldwide Settlements (BIS) lately introduced their multi-CBDC pilot program Mission Dunbar. Led by the BIS Innovation Hub, this program would be the first-of-its-kind methodology to settle multi-currency worldwide funds extra securely and shortly. The announcement states:

“Mission Dunbar explores how a typical platform for a number of central financial institution digital currencies (multi-CBDCs) may allow cheaper, quicker and safer cross-border funds.”

The Reserve Financial institution of Australia, Financial institution Negara Malaysia, the Financial Authority of Singapore, and the South African Reserve Financial institution additionally introduced that they are going to be collaborating in Mission Dunbar to check if multi CBDCs are technically viable.

Anticipated advantages

Collaborating authorities count on to realize the under outcomes.

Decreased reliance on intermediaries. With the appliance of CBDCs, correspondent banks (banks that maintain international forex accounts) is not going to be wanted for settlements. This additionally eliminates the AML/CFT compliance steps of correspondent banks.

Simplification of the settlement course of. CBDCs gained’t require banks to carry international forex accounts. As a substitute, CBDCs will probably be transferred straight from the sender to the recipient financial institution. All transfers will probably be recorded on a single ledger momentarily and have full-time visibility to all members.

Effectivity features with frequent platform processes by eliminating the guide conciliation processes with plural AML/CFT necessities. A digital system will probably be pre-setting the sanctions and necessities of every nation and monitor the transactions’ conformity routinely.

Course of automation with sensible contracts. An environment friendly CBDC platform can even routinely apply enterprise guidelines and circumstances comparable to having adequate liquidity, technical validations and assembly enterprise necessities through sensible contracts

Most important Challenges

At its preliminary step, Mission Dunbar foresees three main challenges which have a subsequent impression on the multi-CBDC settlement platform.

Entry

The entry problem is especially about non-resident banks that don’t have a neighborhood presence and will not be approved to offer home monetary companies. Will these banks be trusted to entry and challenge funds with CBDCs?

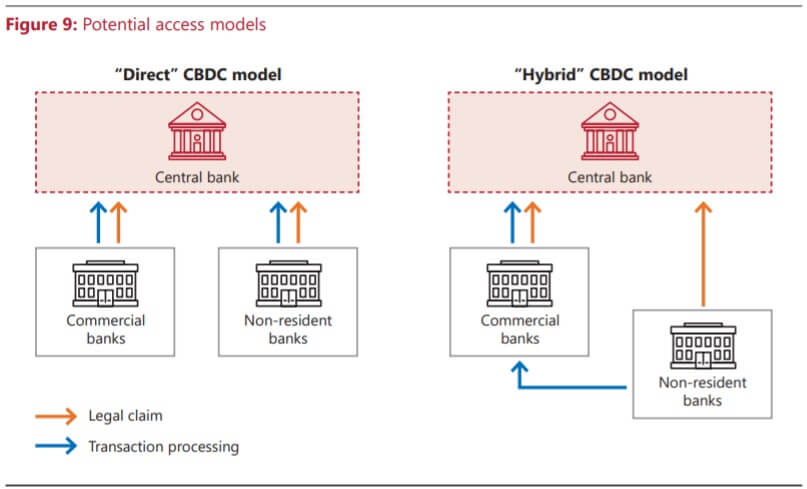

To fight this drawback, Mission Dunbar contains two entry frameworks as “direct” and “hybrid”.

The direct mannequin will belief non-resident banks and permit them to carry and transact straight with CBDCs. The hybrid mannequin, however, would require non-resident banks to acquire a sponsorship from a industrial financial institution to observe their KYC, AML, and CFT processes. If all are so as, the non-resident banks will be capable to entry the multi-CBDC platform by way of their sponsor banks.

Jurisdictional Boundaries

Simplifying the cross-border funds whereas respecting regulatory variations throughout jurisdictions presents one other main problem to Mission Dunbar. To resolve this complication, the mission took a design strategy that differentiate between cross-border settlements and different “non-settlement” processes.

Non-settlement processes like KYC necessities will probably be differentiated and dealt with off the platform, whereas laws relating to the worldwide switch settlements comparable to sanctions will probably be operated by way of sensible contracts.

Governance

Lastly, whereas the shared platform is meant to use universality, a sure degree of safety and privateness have to be maintained. Subsequently, the mission designed a good governance system the place various stakeholders are correctly represented and selections are made pretty. As well as, central banks are additionally granted autonomy throughout the boundaries and parameters of a common platform-level framework.

Regardless of challenges, members are hopeful that Mission Dunbar will probably be a helpful expertise, even when it fails. Chief FinTech Officer of Financial Authority of Singapore Sopnendu Mohanty expressed their pleasure and mentioned:

“Mission Dunbar marks a key milestone in advancing the effectivity of cross-border funds globally. The sturdy collaboration between collaborating central banks, industrial banks, and know-how answer suppliers has established the inspiration for growing future-ready fee rails. We stay up for collaborating in subsequent phases of this daring endeavor.”

Get your every day recap of Bitcoin, DeFi, NFT and Web3 information from CryptoSlate

Get an Edge on the Crypto Market 👇

Turn out to be a member of CryptoSlate Edge and entry our unique Discord group, extra unique content material and evaluation.

On-chain evaluation

Worth snapshots

Extra context

Be part of now for $19/month Discover all advantages