[ad_1]

- As 2024 approaches, the inventory market’s course hangs within the steadiness, formed by components equivalent to rates of interest, inflation, and earnings.

- Making appropriate predictions is sort of inconceivable, as demonstrated by the fallacious predictions made for 2023.

- Even then, being ready for dangers is part of sound monetary planning. So let’s check out just a few dangers markets may face subsequent yr.

- Trying to beat the market in 2024? Let our AI-powered ProPicks do the leg be just right for you, and by no means miss one other bull market once more. Study Extra »

The query on everybody’s thoughts proper now could be: What does 2024 have in retailer for markets?

Whereas it would seem mundane, the trajectory of the inventory market within the upcoming yr is something however sure.

It may persist in its upward development or pivot downward, contingent on components like rates of interest, , financial progress in main areas, company earnings, investor sentiment, or any unexpected occasions.

Up up to now, essentially the most substantial danger could be presuming a predetermined course for the market.

I am not suggesting that forecasting is unwarranted; it is essential for future monetary planning. Nonetheless, we must be ready for unexpected developments and issue them into our plans.

In essence, absolute certainty typically carries the danger of being confirmed fallacious—a phenomenon not unusual in our day by day lives.

Do not imagine predictions; they’re typically fallacious

Final yr, similtaneously we’re at this time, the Monetary Instances revealed a survey that greater than 80% of economists have been sure, thus predicting with certainty, a recession in 2023.

Do you continue to suppose a recession is coming? Individuals, on the whole, are sometimes sure to be fallacious, and as I stated earlier than, it’s applicable to count on something.

I feel, as with 2023, we should attempt to trip the market somewhat than outperform it, and if predicting the long run is troublesome maybe it could be wiser to start out with what we all know.

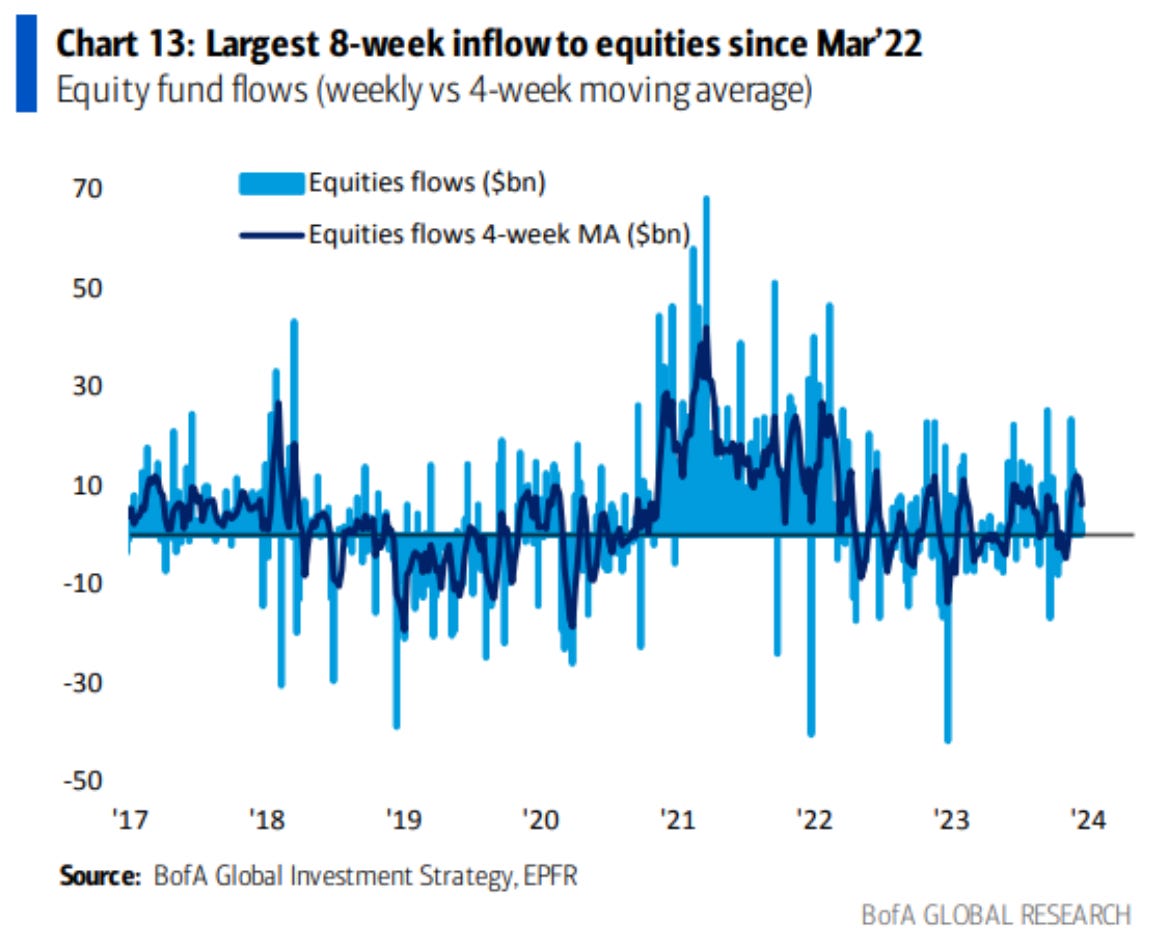

For a lot of 2023, we noticed buyers’ cash stream into Treasuries, then we noticed the biggest outflow from Treasuries since June 2020 into equities.

Flows into fairness funds have seen the biggest inflows in 2 months since March 2022, and an increasing number of individuals are chasing the rally.

Equities, to this point, have merely adopted their seasonal traits. There may be nothing to fret about (in the intervening time).

It’s when markets ignore their seasonal traits that we have to concentrate; the onset of weak point throughout a seasonally sturdy interval of the yr, equivalent to late December and January, could possibly be an indication that the development is worsening.

One information level value monitoring is the which have modified their development because the continues to rise.

This isn’t the everyday state of affairs; analyzing the information from 2000 onwards reveals a constant sample the place every decline within the information is reliably succeeded by the reversal of the S&P 500.

What’s really driving shares?

One vital issue is a weak . Apparently, when the greenback is powerful, inventory costs have a tendency to say no.

After the height in September 2022, the greenback went down whereas there was a reversal for the S&P 500, from there on, shares went upward.

We will say that so long as there’s a greenback with a bearish development, the inventory rally may proceed. That is supported by investor sentiment towards dangerous, non-defensive shares.

We’re seeing the precise reverse of what must be obvious within the case of a bearish market-there is not any rotation towards defensive shares with low volatility and on shopper items.

Ought to we proceed to suppose that issues shall be wonderful?

Based on a Bloomberg article, the S&P 500 has created the third wave of the “Elliott idea,” which is mostly essentially the most highly effective and intensive.

The index has approached all-time highs that could possibly be damaged within the coming days with the potential for touching 4900 within the coming weeks.

As soon as the power of the third wave is over, nonetheless, the index will are likely to create the fourth, which as you nicely know represents a correction.

The previous wave 2 of correction, began in January 2022 and lasted about 10 months with a drop of 20-25%.

Will the rally final for much longer? we will see.

Till then, comfortable holidays!

***

In 2024, let laborious selections turn out to be simple with our AI-powered stock-picking instrument.

Have you ever ever discovered your self confronted with the query: which inventory ought to I purchase subsequent?

Fortunately, this sense is lengthy gone for ProPicks customers. Utilizing state-of-the-art AI know-how, ProPicks gives six market-beating stock-picking methods, together with the flagship “Tech Titans,” which outperformed the market by 670% during the last decade.

Be a part of now for as much as 50% off on our Professional and Professional+ subscription plans and by no means miss one other bull market by not understanding which shares to purchase!

Declare Your Low cost Right now!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, provide, recommendation, counseling or advice to speculate as such it isn’t meant to incentivize the acquisition of property in any manner. As a reminder, any kind of asset, is evaluated from a number of views and is very dangerous, and subsequently, any funding determination and the related danger stays with the investor.

[ad_2]

Source link