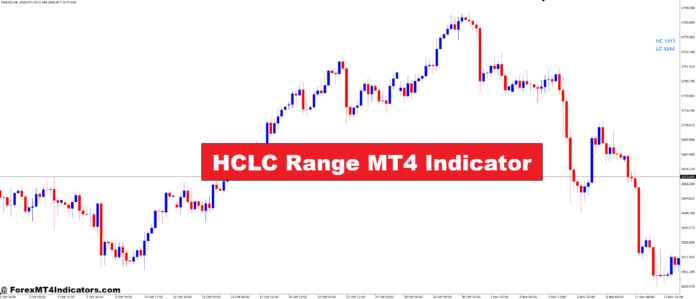

The HCLC Vary MT4 Indicator is a technical evaluation instrument utilized in MetaTrader 4, a preferred platform for foreign exchange and inventory merchants. It primarily focuses on the vary between the very best and lowest costs over a sure interval, serving to merchants assess market volatility. This indicator shows key value information on the chart, making it simpler to identify potential entry and exit factors. Whether or not you’re a novice or an skilled dealer, the HCLC Vary Indicator simplifies complicated market evaluation, permitting you to concentrate on making strategic trades moderately than getting slowed down by an excessive amount of data.

How Does It Work

The HCLC Vary MT4 Indicator works by calculating the distinction between the very best and lowest costs inside a selected vary of time. Merchants use this information to establish developments, volatility, and attainable breakouts. When the vary expands, it alerts larger volatility, which may point out potential alternatives for worthwhile trades. Conversely, a narrowing vary usually suggests consolidation, with costs anticipated to stay inside a smaller vary. By monitoring these patterns, merchants can plan their methods with extra confidence and readability, making it a helpful instrument in any dealer’s toolkit.

Advantages of Utilizing the HCLC Vary MT4 Indicator

One of many largest benefits of utilizing the HCLC Vary Indicator is its means to simplify the decision-making course of. By eradicating the noise from the market, it provides merchants clear alerts about value motion. This indicator helps establish intervals of excessive volatility, permitting merchants to enter or exit trades on the most opportune occasions. Moreover, it could additionally help in setting stop-loss and take-profit ranges, optimizing danger administration. With its user-friendly interface and actionable information, the HCLC Vary MT4 Indicator is an indispensable instrument for anybody seeking to enhance their buying and selling efficiency.

Maximizing Your Buying and selling Technique with the HCLC Vary MT4 Indicator

To get essentially the most out of the HCLC Vary MT4 Indicator, merchants ought to combine it into their current methods. By combining it with different technical instruments, like transferring averages or RSI, they’ll additional refine their method and enhance the probabilities of success. Moreover, backtesting with historic information permits merchants to grasp how the indicator performs beneath completely different market circumstances. Whereas the HCLC Vary Indicator can definitely assist merchants make extra knowledgeable choices, it’s essential to make use of it alongside sound danger administration strategies to maximise profitability and reduce losses.

The way to Commerce with HCLC Vary MT4 Indicator

Purchase Entry

- Anticipate the Vary to Increase: Search for a major enhance within the HCLC vary. This means larger volatility and potential value motion.

- Affirm an Uptrend: Examine if the value is trending upwards. The indicator ought to present a widening vary in the course of the upward value motion.

- Search for a Breakout: If the value breaks above a latest resistance stage with elevated volatility (indicated by a widening vary), think about getting into a purchase commerce.

- Help Affirmation: Guarantee that there’s assist close by to guard the commerce. The indicator mustn’t present a narrowing vary, which may sign a reversal.

- Set Cease-Loss: Place your stop-loss just under the latest low or assist stage to restrict potential losses.

Promote Entry

- Anticipate the Vary to Increase: Search for a widening vary that signifies excessive volatility and potential value motion within the downward path.

- Affirm a Downtrend: Examine if the value is trending downwards. The indicator ought to present a rising vary in the course of the value decline.

- Search for a Breakdown: If the value breaks beneath a latest assist stage with a widening vary, think about getting into a promote commerce.

- Resistance Affirmation: Guarantee that there’s resistance close by to guard your commerce. A narrowing vary may sign a reversal, so keep away from promoting on this case.

- Set Cease-Loss: Place your stop-loss simply above the latest excessive or resistance stage to restrict potential losses.

Conclusion

The HCLC Vary MT4 Indicator affords merchants a dependable, easy-to-understand instrument for assessing market volatility and making smarter buying and selling choices. Whether or not you’re simply beginning or are a seasoned dealer, this indicator can assist you analyze value actions with higher readability. By understanding its options and incorporating it into your technique, you’ll be able to achieve a major edge within the fast-paced world of buying and selling.

Beneficial MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

- Unique 50% Money Rebates for all Trades!

>> Signal Up for XM Dealer Account right here with Unique 50% Money Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Associate Code: 𝟕𝐖𝟑𝐉𝐐