Inflation continues to exceed the Federal Reserve’s 2 % goal. The Private Consumption Expenditures Worth Index (PCEPI), which is the Federal Reserve’s most popular measure of inflation, grew at a repeatedly compounding annual charge of 6.1 % from February 2021 to February 2022, up from 5.9 % within the earlier month.

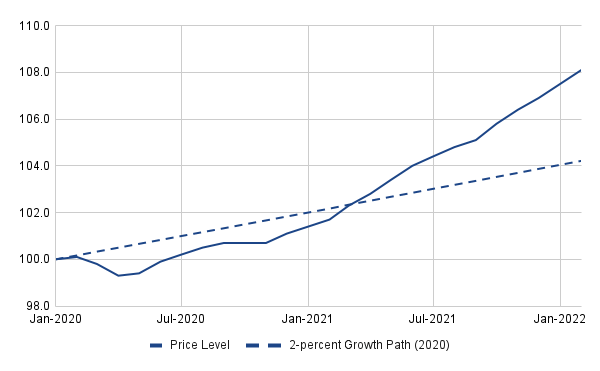

The value stage has grown 3.7 % on common since January 2020, simply previous to the pandemic. As Determine 1 reveals, the value stage was 3.9 proportion factors increased in February 2022 than it might have been had it merely grown at two % over the interval.

Fed officers are ostensibly dedicated to a median inflation goal. Beneath such a rule, a interval of above-target inflation could be offset by a interval of below-target inflation in order that inflation is the same as goal on common. The Federal Open Market Committee (FOMC) reaffirmed its Assertion on Longer-Run Objectives and Financial Coverage Technique, which describes the rule, in January 2022. However the course of coverage projected by FOMC members suggests it’s not actually dedicated to delivering 2 % inflation on common.

In March, FOMC members had been requested to challenge inflation beneath the idea that the Fed conducts financial coverage appropriately, as she or he sees it. The median, central tendency, and vary of FOMC member inflation projections are offered within the Abstract of Financial Projections and reproduced in Desk 1 beneath.

| Projection | 2022 | 2023 | 2024 | Longer run |

| Median | 4.3 | 2.7 | 2.3 | 2.0 |

| Central Tendency | 4.1–4.7 | 2.3–3.0 | 2.1–2.4 | 2.0 |

| Vary | 3.7–5.5 | 2.2–3.5 | 2.0–3.0 | 2.0 |

Two issues stand proud of Desk 1. First, most FOMC members assume inflation ought to stay above-target by means of 2024. The decrease sure of the central tendency, which excludes the three highest and three lowest projections, is 4.1 % in 2022, 2.3 % in 2023, and a pair of.1 % in 2024. Second, no FOMC member thinks inflation ought to fall beneath goal through the projection window. The decrease sure of the vary of projections is 3.7 % in 2022, 2.2 % in 2023, and a pair of.0 % in 2024. In different phrases, Fed officers don’t intend to offset the above-target inflation realized over the past yr with a interval of below-target inflation in order that inflation is the same as the Fed’s goal on common through the projection window.

Bond markets are equally predicting that inflation will stay above goal over the following few years and that the Fed is not going to offset above-target inflation with a interval of below-target inflation. On March 30, 2022, bond markets had been pricing in round 3.21 % PCEPI inflation per yr over the following 5 years and a pair of.66 % PCEPI inflation per yr over the following ten years.

Little doubt some will try and absolve the Fed for failing to attain 2 % inflation on common by pointing to provide disturbances. The COVID-19 pandemic and, extra just lately, Russia’s invasion of Ukraine have actually pushed costs up. And a median inflation-targeting central financial institution ought to let costs rise in response to destructive actual shocks. Even nonetheless, that’s not sufficient to let the Fed off the hook.

Though short-term provide disturbances push up costs, they achieve this quickly. As restrictions on exercise and the dangers of COVID-19 subside, provides rebound and costs fall. A lot the identical will be stated concerning the battle in Ukraine, which is able to ultimately finish. There isn’t a purpose to assume these provide disturbances will proceed to push costs up over the following three years. Certainly, most of the provide constraints related to the COVID-19 pandemic ought to have already reversed given the widespread use of vaccines, much less harmful variants in circulation, and the choices of policymakers to calm down restrictions imposed to cease the unfold.

There’s additionally no purpose to assume provide disturbances have pushed costs up thus far. If provide disturbances had been solely in charge, nominal spending would stay on development. In truth, nominal spending has grown far more quickly. From 2010 to 2020, nominal spending grew at a continuously-compounding annual charge of three.93 %. Within the time since, it has grown at a charge of 5.06 %. The excessive inflation noticed over the past yr isn’t merely a supply-side drawback. Inflation is excessive as a result of the Fed has failed to manage nominal spending.

Regardless of affirmations on the contrary, the Fed seems to have deserted its common inflation goal. Extreme nominal spending has pushed costs effectively above the extent per the Fed’s common inflation goal. Relatively than offsetting the above-target inflation with a interval of below-target inflation, as could be required by a median inflation-targeting central financial institution, the Fed has merely vowed to deliver inflation again all the way down to 2 %. If it does so, inflation will exceed 2 % on common.