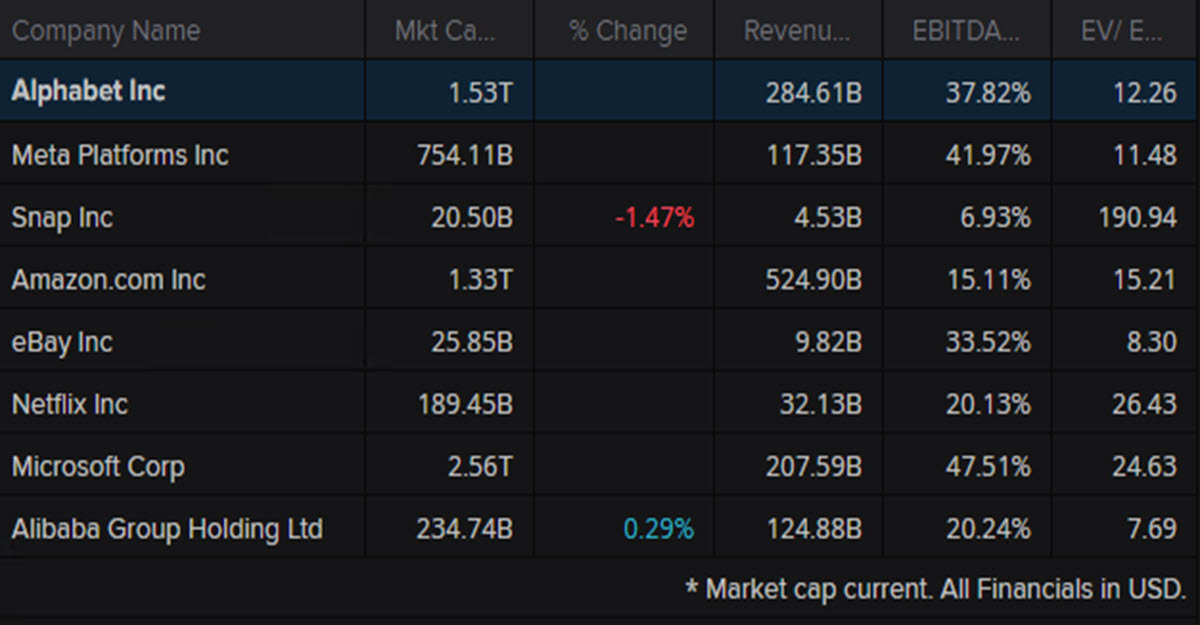

Regardless of mounting competitors in synthetic intelligence and web search, Google inventory has superior 40% this 12 months. That’s in step with the almost 39% rise within the Nasdaq composite, but it surely definitely doesn’t make it the most effective performing tech firms.

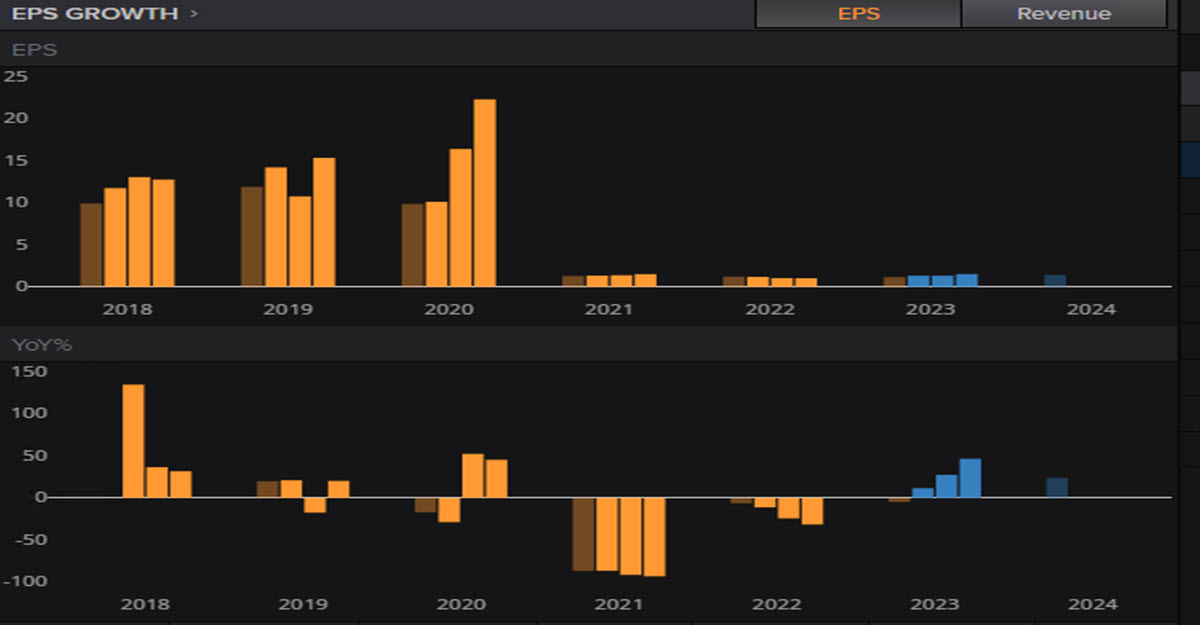

The Mountain View California-based firm is predicted to report a 4.5% improve in income to $72.799 billion from $69.69 billion a 12 months in the past, in response to the imply estimate from 32 analysts, primarily based on Refinitiv information. The identical analysts are in search of a $1.34 EPS. The present common score on the shares is “purchase” and the breakdown of suggestions is 41 “robust purchase” or “purchase,” 9 “maintain” and no “promote” or “robust promote.”

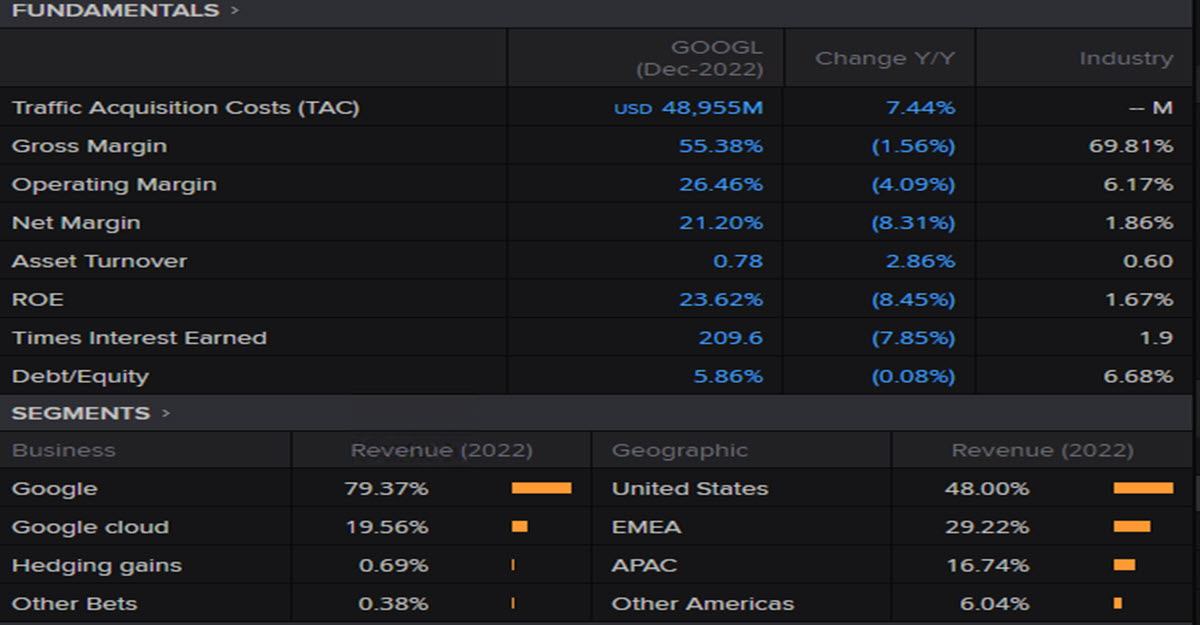

GOOGL Q2 2023 outcomes are more likely to replicate features from its strengthening cloud service choices that embody Google Cloud Platform and Google Workspace, which have been constantly gaining momentum. The section’s Revenues have been $7.45 in Q123 and accounted for 10.7% of complete revenues, exhibiting a y/y development of 28%: GOOGL’s efforts in integrating information lakes, information warehouses, information governance and superior machine studying right into a single platform are anticipated to have bolstered its prospects within the cloud market.

The corporate’s deepening deal with generative AI can be one other main focus of consideration: there are two tasks occurring proper now, BARD and SGE (Search Generative Expertise) and the monetization plans for these instruments, the best way they are going to be built-in within the Search enterprise – that by means of promoting is the BIGGEST driver of GOOGL revenues – and the way demand for AI will assist pushing the expansion of the cloud enterprise can be carefully analysed by buyers.

The dependency on persevering with internet marketing development is without doubt one of the RISKS for the corporate and Microsoft’s present massive investments with Bing and the acquisition of OpenAI may sooner or later erode Alphabet’s at present undisputed dominance within the search market (in any case fostered by Android’s dominance within the cellular sector). Alphabet can also be allocating a whole lot of capital towards high-risk bets (helped by the regular money movement coming from adverts) and can most likely see an erosion of margins additionally attributable to aggressive hiring throughout 2022 (adopted by 16,000 redundancies at first of this 12 months). The steady scrutiny of regulators due to its market dominance and the billions in fines the corporate has been compelled to pay not too long ago are one other threat to take into consideration.

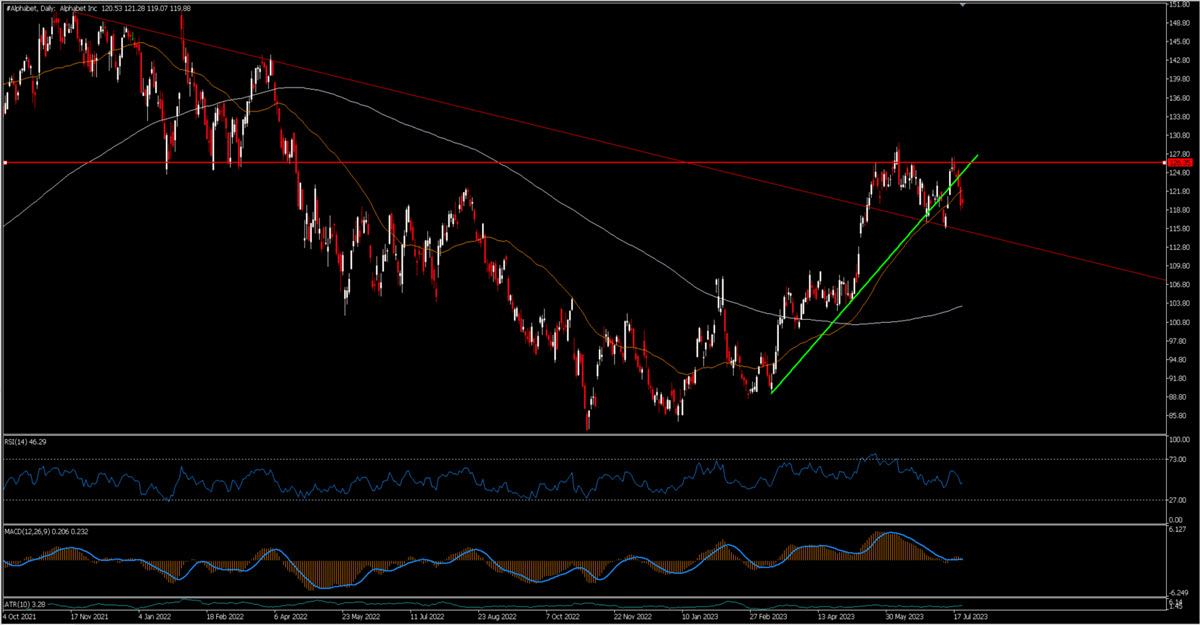

Technical Evaluation

GOOGL is much from its all-time highs however has not too long ago damaged the long-term bearish trendline below which it was buying and selling in Could 2023: having discovered a critical impediment within the $125 space, it’s nonetheless buying and selling above that trendline and $118/$120 is a stage to observe. As for the ascending construction inside which the inventory has been shifting this 12 months, at first look the expansion is slowing down (damaged darkish inexperienced dotted trendline), however it’s also true that – permitting for a little bit of ”rumor/noise” – plainly the worth continues to be framed inside an ascending channel. Analysts interviewed by Infinitiv/Reuters appear to be indicating that the consensus is for an upward transfer above the $126/$130 space and a possible medium-term goal round $139.

GOOGL, Every day

The largest threat might be a basic market correction which might additionally take GOOGL down with it, though it definitely hasn’t been among the many greatest performing mega-caps this 12 months.

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is offered as a basic advertising communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication incorporates, or must be thought of as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.