[ad_1]

Gold (XAU/USD) Evaluation and Chart

- US PPI is available in hotter-than-expected

- Retail gross sales missed market expectations and turned destructive in January.

- Gold is correcting greater after being technically oversold.

Really helpful by Nick Cawley

Learn how to Commerce Gold

Lately launched US producer worth inflation knowledge has pushed the value of gold again under $2,000/oz. and raised expectations that subsequent month’s US client worth inflation can also transfer greater. Month-on-month PPI in January rose by 0.3%, in comparison with forecasts of 0.1% and December’s studying of -0.1%.

US retail gross sales knowledge upset the market yesterday, turning destructive and lacking market forecasts by a margin. The January quantity 0f -0.8% was the bottom studying in almost a 12 months, whereas the earlier two months’ knowledge was additionally revised decrease. Retail gross sales fell by 0.8% in January, whereas December’s knowledge was revised to 0.4% from 0.6% and November gross sales had been revised to 0% from an preliminary studying of 0.3%.

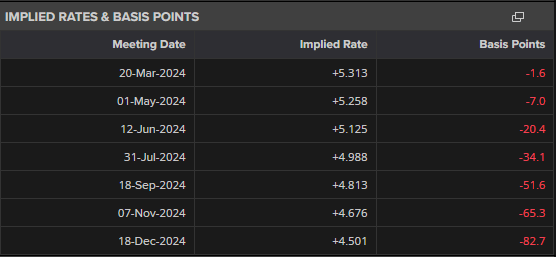

The drop off in client spending over the past three months despatched US Treasury yields, and the buck, decrease on Thursday however did little to alter market expectations that the Federal Reserve wouldn’t begin reducing rates of interest till the top of the primary half of the 12 months. The probabilities of an earlier fee minimize fell on Tuesday this week after knowledge confirmed that US inflation remained stickier than anticipated in January. Present market pricing suggests the primary 25 foundation level minimize will happen on the June twelfth FOMC assembly. The current pairing again of US fee minimize expectations has weighed on gold and despatched the value tumbling decrease over the previous two weeks.

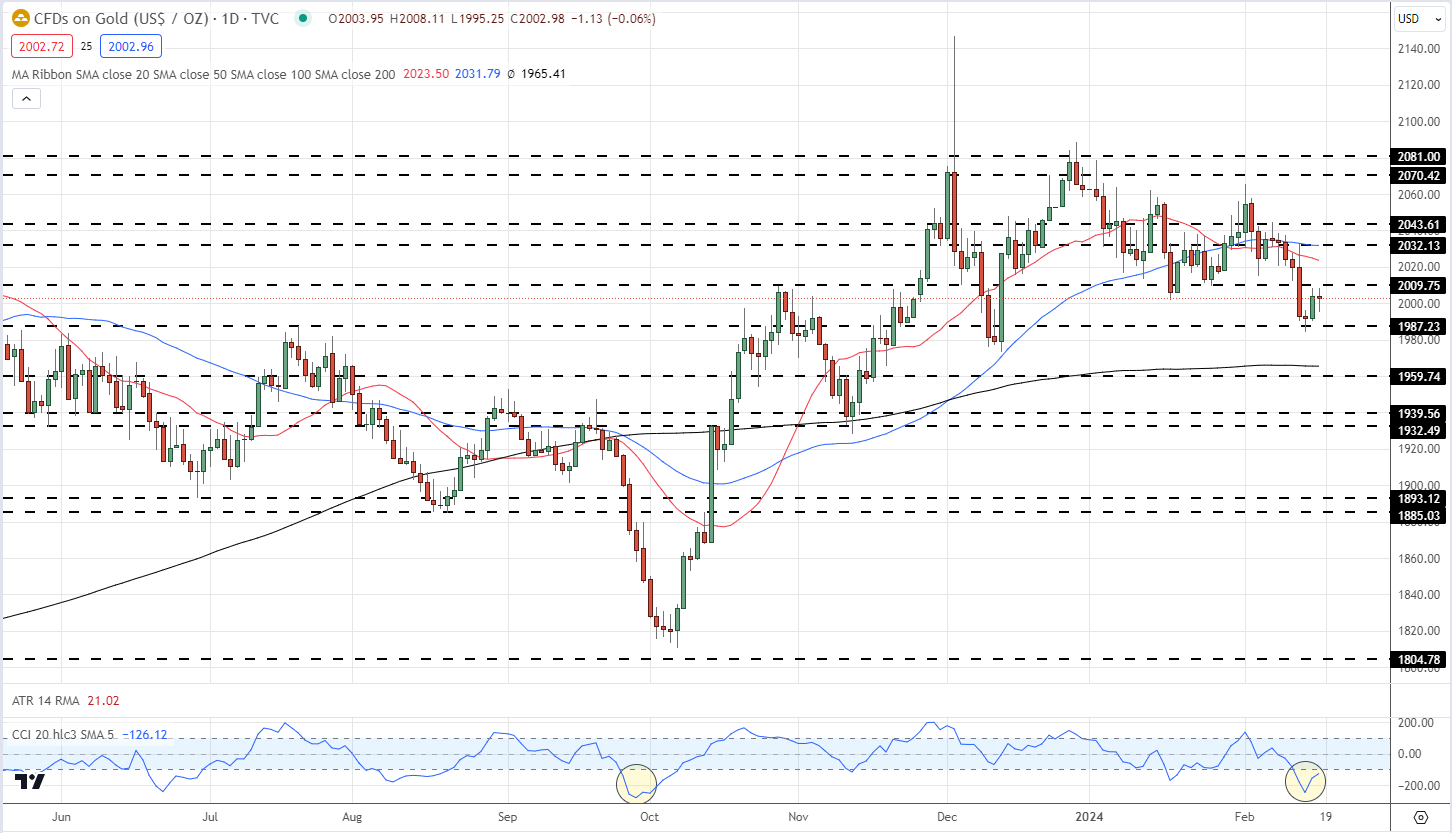

The dear metallic turned greater yesterday, partially on account of a technically oversold Commodity Channel Index (CCI) studying. The CCI indicator, akin to RSI, compares the distinction between the present and the historic worth over a set timeframe and reveals if a market is overbought, impartial, or oversold. On Wednesday the CCI indicator confirmed gold deep in oversold territory and again at ranges final seen in late September, simply earlier than the market rallied sharply. If the market continues to scrub out this oversold studying, gold may retest $2,009/oz. forward of the 20- and 50-day easy shifting averages at the moment sitting at $2,023/oz. and $2,031/oz. respectively.

Gold Day by day Worth Chart

Retail dealer knowledge reveals 68.74% of merchants are net-long with the ratio of merchants lengthy to brief at 2.20 to 1.The variety of merchants web lengthy is 8.85% decrease than yesterday and 21.69% greater than final week, whereas the variety of merchants web brief is 6.65% greater than yesterday and 15.93% decrease than final week.

| Change in | Longs | Shorts | OI |

| Day by day | -7% | -3% | -6% |

| Weekly | 10% | -7% | 4% |

What’s your view on Gold – bullish or bearish?? You may tell us through the shape on the finish of this piece or you may contact the creator through Twitter @nickcawley1.

[ad_2]

Source link