GOLD PRICE FORECAST:

For Newbie Merchants, Obtain Your Free Foreign exchange Information Beneath

Advisable by Zain Vawda

Foreign exchange for Inexperienced persons

MOST READ: USD/ZAR Forecast: Rand (ZAR) Slides Regardless of BRICS Growth Plans, A Momentary Blip?

Gold costs could have fallen again barely from a 2-week excessive however stays up round 1.31% on the time of writing and on the right track to snap a 4-week dropping streak. Gold has been a shock this week given the early rise in US yields in addition to power within the Greenback Index (DXY) for almost all of the week.

US DATA, DOLLAR INDEX AND JACKSON HOLE

As Gold seems to be to snap its latest run of losses this week the US Greenback has remained supported on fears that the US Federal Reserve might want to hold charges larger for longer. This comes as US knowledge except for the PMIs this week stays robust. Sturdy labor knowledge and US Sturdy Items numbers yesterday additional strengthening the concept of upper charges whereas hawkish Fed feedback tied into the narrative.

Market individuals are keenly awaiting the feedback by Jerome Powell on the Jackson Gap Symposium later right now. Given the power on show by the Greenback Index (DXY) this week, it might seem that almost all of the hawkishness is priced in and will go away the Greenback with a contact activity of advancing additional. Ought to Powell convey an analogous message as we have now heard of late, I’m not certain how way more bullishness does the Greenback Index have left within the tank. With out something new from the Fed Chair there’s a very actual risk of some Greenback weak spot right now heading into the weekend.

Greenback Index (DXY) Each day Chart – August 25, 2023

Supply: TradingView, Chart Ready by Zain Vawda

Trying on the DXY chart above and we have now lastly had a day by day candle shut above the descending channel yesterday working into resistance on the 104.28 mark this morning. As talked about above ought to Chair Powell follow the narrative later right now, we may very nicely be in for a pullback towards the 103.50 deal with.

A continued advance for the Greenback Index right now faces a hurdle on the 105.00 psychological deal with earlier than resistance across the 105.60 mark which was the March swing excessive.

For Suggestions and Tips on Buying and selling Gold, Get Your Free Information Now

Advisable by Zain Vawda

How you can Commerce Gold

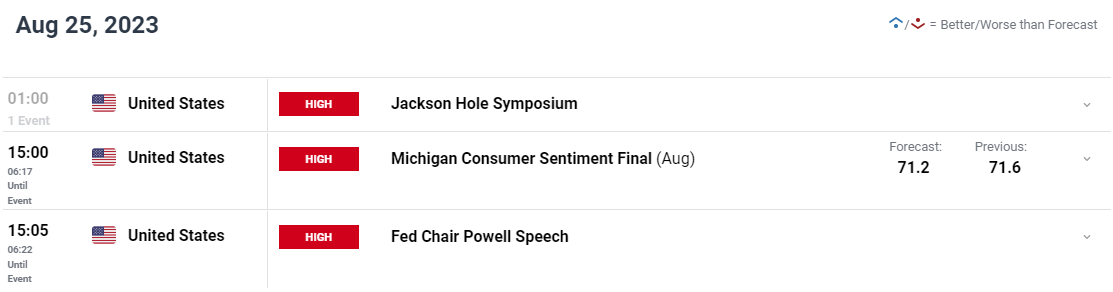

The Jackson Gap Financial Symposium in Wyoming is underway already with Fed Chair Jerome Powell talking right now. Given the dearth of excessive affect knowledge on the docket right now the primary driving pressure for markets is more likely to be feedback from a number of Central Financial institution policymakers scheduled to talk right now. As I’ve mentioned over the previous couple of days, I don’t count on fireworks by way of coverage modifications or feedback hinting at similar to we had eventually 12 months’s occasion given the market dynamics at current. Having mentioned that, Volatility across the occasion is almost definitely a assure.

For all market-moving financial releases and occasions, see the DailyFX Calendar

TECHNICAL OUTLOOK AND FINAL THOUGHTS

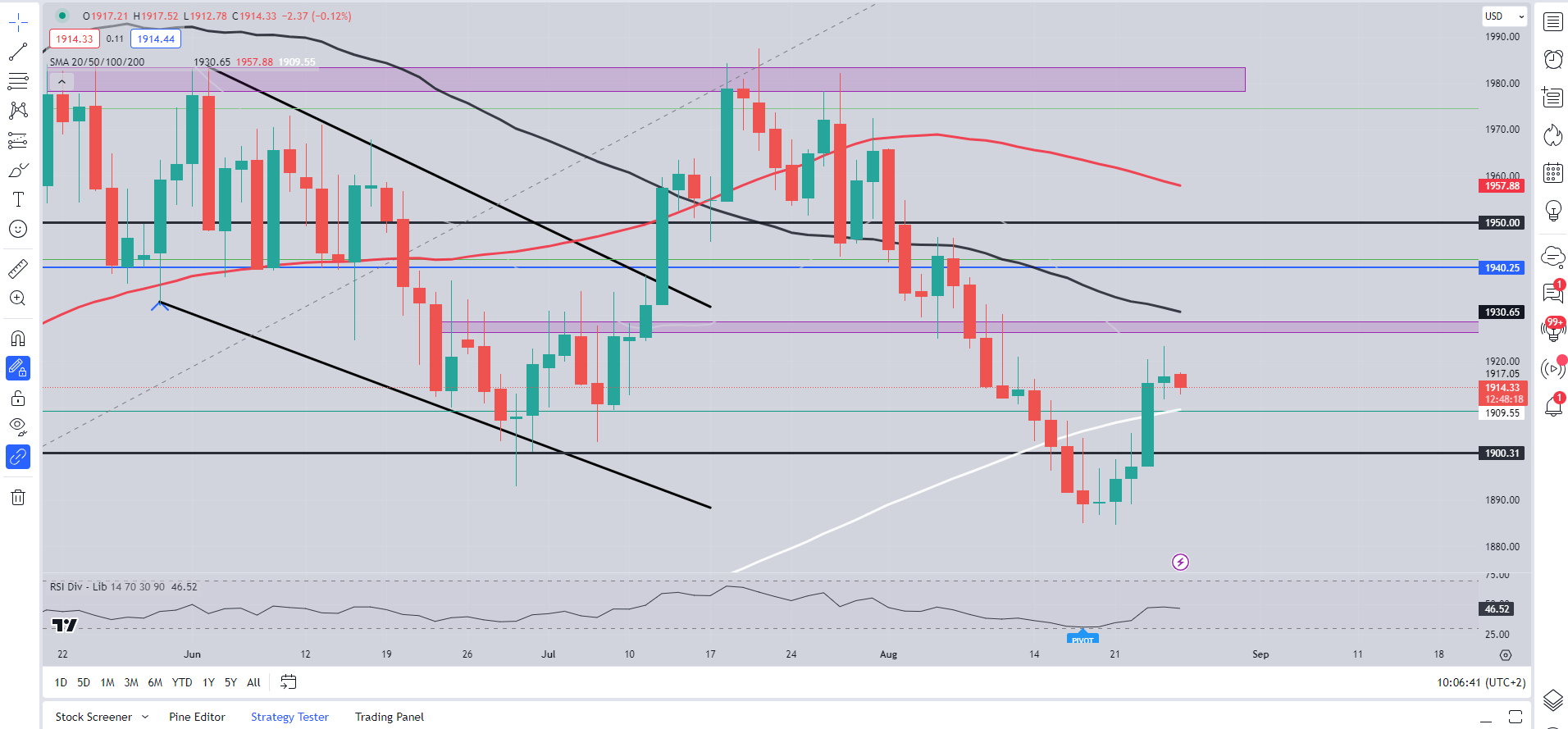

Kind a technical perspective, Gold costs have closed under the 200-day MA on a day by day timeframe for the primary time since December 2022 this week however rapidly recovered to commerce again above. This shocked me as I had anticipated the 200-day MA to place up extra resistance coupled with the stronger US Greenback we have now seen this week as nicely.

Having rallied from the weekly low across the $1884 mark to round $1923 earlier than a slight pullback yesterday, Golds stays in a fragile place forward of the handle by Jerome Powell at Jackson Gap. Fast help s offered by the 200-day MA across the $1909 deal with earlier than a retest of $1900 opens the door towards help on the $1893 deal with.

Alternatively, a transfer larger from right here faces a troublesome activity of breaking above the resistance space between the $1926-$1929 deal with (pink space on the chart). A break and day by day candle shut above right here would sign to that the bulls are firmly in management. Till then I nonetheless see draw back potential and an additional selloff in Gold as a severe risk.

Markets do look like largely pushed by the elemental and macro footage in the intervening time and thus my preliminary ideas are that any transfer will seemingly be depending on the message by Fed Chair Powell. The market response of late to knowledge releases and policymaker feedback have been blended and typically downright complicated. As seen with the rising Greenback and Gold costs this week an indication of some disconnect at current and perhaps price remembering because the day progresses.

Gold (XAU/USD) Each day Chart – August 25, 2023

Supply: TradingView, Chart Ready by Zain Vawda

Taking a fast have a look at the IG Consumer Sentiment, retail dealer knowledge exhibits 77% of merchants are net-long on Gold regardless of the rally up to now this week.

For a extra in-depth have a look at GOLD shopper sentiment and modifications in lengthy and brief positioning obtain the free information under.

| Change in | Longs | Shorts | OI |

| Each day | -3% | -8% | -4% |

| Weekly | -6% | 15% | -2% |

Written by: Zain Vawda, Markets Author for DailyFX.com

Contact and comply with Zain on Twitter: @zvawda