[ad_1]

Gold (XAU/USD) Evaluation

- Fed officers communicated that they’re in no rush to start out the slicing cycle amid a powerful US financial system, emboldened client and potential Purple Sea escalation

- Gold costs have edged decrease in the direction of the top of the week as Fed officers spur on USD

- The evaluation on this article makes use of chart patterns and key assist and resistance ranges. For extra info go to our complete training library

Advisable by Richard Snow

Learn how to Commerce Gold

Fed Officers Pleased to Delay Chopping Cycle, In search of Additional Progress on Inflation

Various distinguished Fed officers voiced their opinions of the US financial system, inflation and the timing of the primary rate of interest lower in what could be the subsequent part of central financial institution financial coverage after holding charges above 5%.

The Fed’s Patrick Harker acknowledged the power of the US financial system alongside client spending and warned concerning the potential of slicing rates of interest too early. He, like many others on the Federal Reserve, favor to undertake the ‘wait and see’ strategy with the aim of achieving better confidence that inflation is underneath management.

The Vice Chair of the Federal Reserve Philip Jefferson sought to keep away from a cease begin strategy in relation to fee cuts later this yr and isn’t specializing in one specific knowledge level however as an alternative is a broader physique of proof that may level in the direction of a fee lower.

Total, the Fed minutes and up to date feedback from Fed officers have been perceived as barely hawkish, favouring the upper for longer narrative for now – lifting the US greenback and weighing on gold.

Weekly Positive aspects Underneath Menace as Fed Officers are in no Hurry to Lower

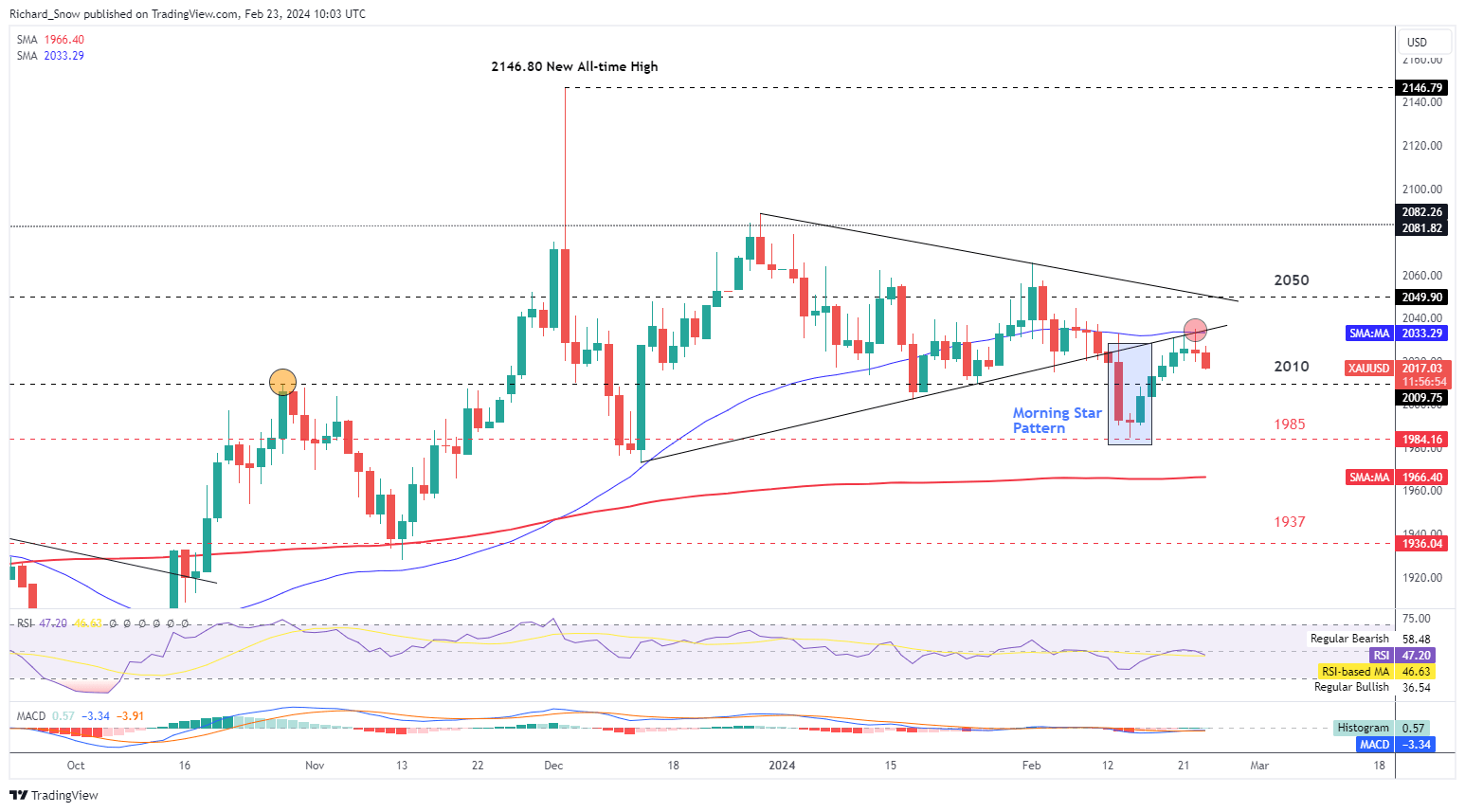

Trying on the weekly gold chart it is clear to see gold costs have pulled again from weekly excessive, wanting destined for one more take a look at of the zone of assist round $2010. For the reason that begin of the yr gold costs have been trending decrease however keep the potential for spikes to the upside as the valuable steel supplies a secure haven attraction amidst ongoing geopolitical tensions. Basically talking gold costs maintain onto plenty of tailwinds for 2024 with its secure haven attraction being one in all them but in addition the prospect of rate of interest cuts, decrease US yields, and a doubtlessly weaker greenback all boding properly for treasured steel.

Gold (XAU/USD) Weekly Chart

Supply: TradingView, ready by Richard Snow

The day by day chart helps us concentrate on extra granular value motion particulars throughout per week that originally noticed an upside continuation which has now turned decrease after reaching resistance. The 50 day easy shifting common got here into play yesterday with costs tagging this stage and retreating thereafter. The 50 SMA additionally coincides with the prior ascending trendline which now features as resistance.

When you’re puzzled by buying and selling losses, why not take a step in the suitable path? Obtain our information, “Traits of Profitable Merchants,” and acquire invaluable insights to avoid widespread pitfalls that may result in expensive errors.

Advisable by Richard Snow

Traits of Profitable Merchants

Gold costs have continued the place they left off yesterday, declining barely as we head into the weekend. Subsequent week US PCE knowledge will add to the inflation knowledge the Fed has been referring to and can issue into the decision-making course of going ahead. Inflation has confirmed comparatively sticky during the last two months and the committee might be in search of additional progress. $2010 emerges as assist with $1985 thereafter.

Gold (XAU/USD) Each day Chart

Supply: TradingView, ready by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and observe Richard on Twitter: @RichardSnowFX

[ad_2]

Source link