GOLD PRICES FORECAST:

- Gold costs have been subdued on Friday, however losses have been restricted

- Merchants seem like avoiding giant directional bets forward of essential financial occasions within the coming days

- The Fed Might assembly’s financial coverage resolution and the U.S. labor market report will steal the limelight subsequent week

Advisable by Diego Colman

Get Your Free Gold Forecast

Most Learn: US Core and Headline PCE Diverge, Employment Prices Rise, US Greenback Nudges Greater

Gold costs (XAU/USD) retreated on Friday, weighed down by a stronger U.S. greenback, however the pullback was modest as falling U.S. Treasury yields capped the draw back. In late morning, bullion was down 0.05% to $1,999, with many merchants sitting on the sidelines and avoiding taking giant directional bets forward of main U.S. financial occasions within the coming days that would information markets within the close to time period.

There are a selection of highlights on the calendar for the week forward, however maybe crucial ones are the FOMC financial coverage resolution on Wednesday afternoon and the U.S. nonfarm payrolls report on Friday.

US ECONOMIC CALENDAR

Supply: DailyFX

Specializing in the Fed, policymakers are anticipated to boost borrowing prices by 25 foundation factors to five.00%-5.25%, however this might be the final hike of the cycle within the face of intensifying financial headwinds, together with the chance of recession later this yr. To achieve perception into the coverage outlook and higher put together for the longer term, merchants ought to look intently at ahead steerage and, extra importantly, Powell’s press convention.

In any case, if the central financial institution formally confirms that the tightening marketing campaign is over, yields are more likely to begin falling quickly throughout the curve as markets attempt to front-run the pivot to an easing stance. In principle, this could favor rate-sensitive valuable metals, boosting gold costs heading into the summer season.

| Change in | Longs | Shorts | OI |

| Day by day | -3% | 4% | -1% |

| Weekly | 3% | -2% | 1% |

On Friday, nonfarm payrolls (NFP) outcomes will undoubtedly steal the limelight. The March information, which confirmed that employers added 236,000 staff, in all probability overstated energy by not reflecting the total impression of the U.S. banking sector disaster, however the April report ought to higher seize these developments.

For the rationale talked about earlier than, it will not be stunning if hiring slowed considerably and the financial system created fewer jobs than the 178,000 projected. A adverse shock could reinforce the view that the nation is headed for a downturn, creating a good backdrop for safe-haven belongings. This situation ought to be supportive of gold costs.

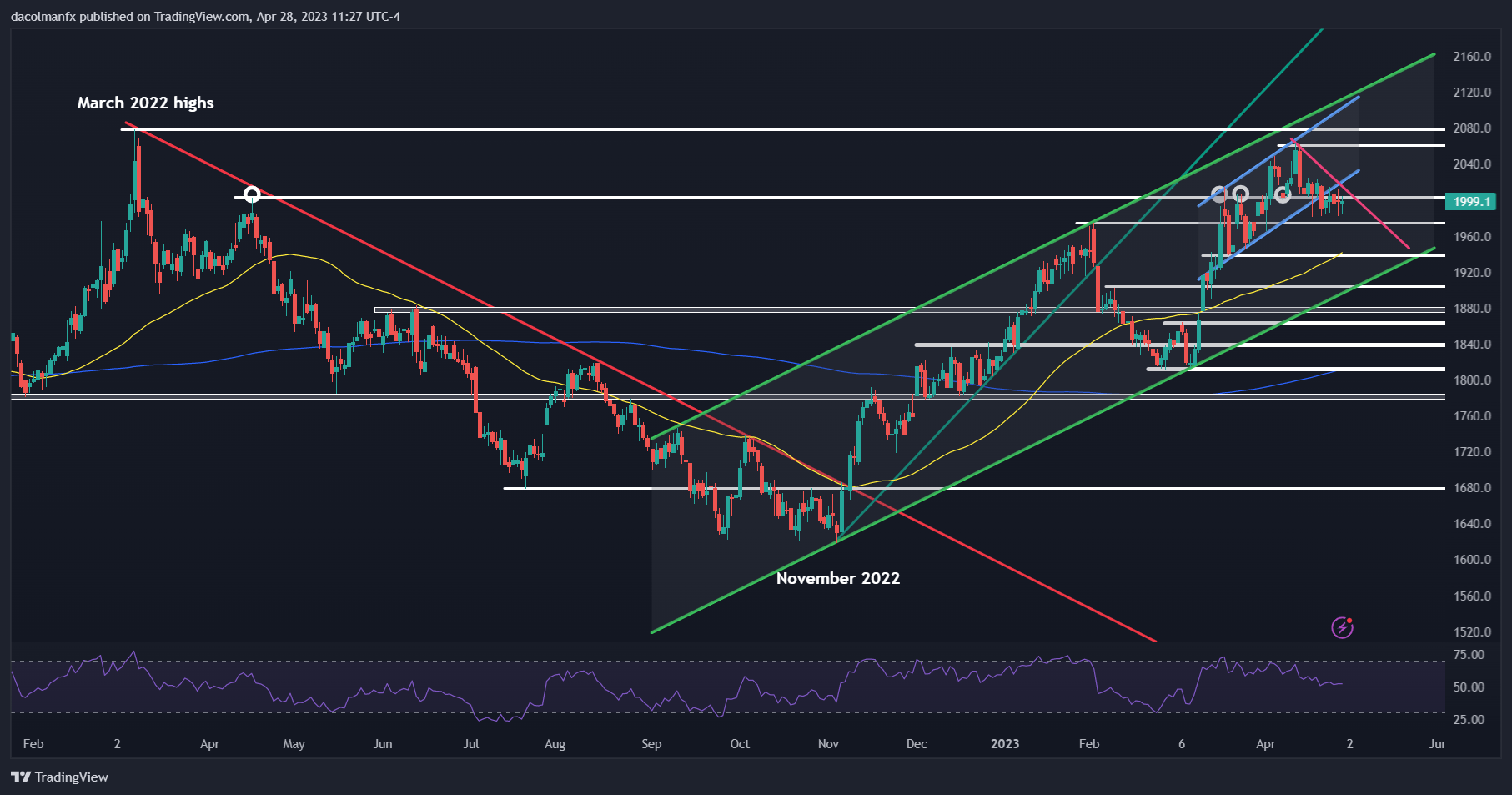

Turning to technical evaluation, gold seems to have entered a consolidation part after breaking under a short-term ascending channel, with costs at the moment hovering above help at $1,975. If this ground holds, XAU/USD may rebound and problem resistance at $2,000 quickly. If this barrier is taken out, the metallic may have fewer obstacles to retesting its 2023 highs.

On the flip facet, if promoting strain accelerates and costs breach help at $1,975, we may see a drop towards the 50-day easy shifting common briefly order. On additional weak point, consideration shifts to $1,905, the decrease certain of a medium-term rising channel.

Advisable by Diego Colman

The right way to Commerce Gold

GOLD PRICES TECHNICAL CHART

Gold Futures Technical Chart Ready Utilizing Buying and selling View