[ad_1]

Gold has been powering greater on steadiness for a pair months now, surging to main breakouts. That upside momentum is bettering sentiment, with merchants rising extra bullish on gold’s potential. That’s well-placed, as this upleg stays younger. Main gold uplegs are three-stage occasions, every having distinct drivers. The primary and smallest stage isn’t even completed but, which bodes very effectively for gold and its miners’ shares.

The yellow steel’s newest upleg was stealthily born at panic-grade lows in late September. Over the subsequent 2.8 months into this week, gold powered a formidable 12.1% greater! But that continues to be small and younger by recent-upleg requirements. Gold’s earlier 4 uplegs in the previous few years averaged way-bigger 28.8% positive factors over much-longer durations of seven.9 months. This present upleg is probably going solely getting began, with so much to show.

Main gold uplegs evolve via three phases of particular shopping for from explicit merchants. They’re born when gold-futures speculators purchase to cowl quick contracts, which is stage one. After gold falls to deep lows, some catalyst spooks these guys. So that they rush to shut out their dangerous hyper-leveraged draw back bets, which is legally required. That purchasing quickly turns into self-feeding, catapulting gold sharply greater.

That fuels sufficient gold upside momentum to more and more appeal to again stage-two gold-futures lengthy shopping for. Not like quick masking which is obligatory, lengthy shopping for is voluntary. Speculators seeing gold surging wish to pile on and chase its positive factors. Since their complete gold-futures lengthy contracts normally outnumber their quick contracts by 2x to 3x, gold uplegs’ second phases are proportionally bigger. Mounting positive factors ignite stage three.

That’s pushed by traders returning to gold with their huge swimming pools of capital dwarfing gold-futures specs’. That makes gold uplegs’ third phases their largest and longest by far, accounting for the lion’s share of their general positive factors. Stage-three funding shopping for can final effectively over a yr, in contrast to a few months for stage-one gold-futures quick masking and a half-year at finest for stage-two gold-futures lengthy shopping for!

Regardless of surging 12%+ in a number of months, in the present day’s younger gold upleg hasn’t even exhausted stage one but. Whereas this upleg is technically 2.8 months previous, gold carved a deep double backside in early November. So effectively over 19/20ths of its complete positive factors accrued in simply the 1.5 months since, not sufficient time for specs to expire of gold-futures shorts to cowl and shut. Stage-two and stage-three shopping for stay nearly nonexistent.

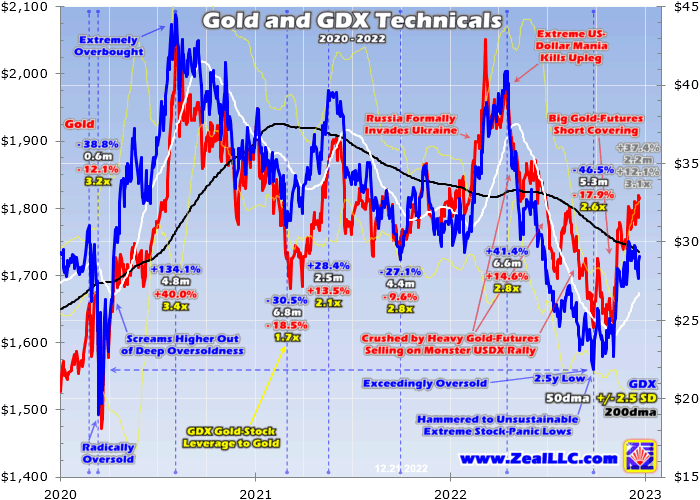

That every one however ensures this newest gold upleg has a protracted methods greater to run but. Speculators’ gold-futures positioning knowledge is printed weekly within the well-known Commitments of Merchants reviews. CoTs are present to Tuesday closes, however not launched till late Fridays. So the latest-available CoT knowledge for this essay was December thirteenth’s. This chart superimposes gold and its key technicals over specs’ complete lengthy and quick contracts.

The only cause gold blasted greater out of its current deep lows was frenzied gold-futures short-covering shopping for. Gold initially bottomed in late September, at ranges final seen after March 2020’s brutal pandemic-lockdown inventory panic. Gold’s 2.5-year low was pushed by complete spec quick contracts hovering to 185.3k, an excessive 3.8-year excessive! In early November close to gold’s second backside, they’d surged again as much as 180.1k.

However by that latest-reported CoT week present to December thirteenth, they’d plunged to 123.2k contracts. So specs purchased to cowl a significant 62.2k contracts, the equal to 193 metric tons of gold! That’s lots of shopping for in such a brief span of time. That differs some from the 56.4k of short-covering shopping for in gold’s newest upleg famous on this chart. That’s merely as a result of mismatched low weekly decision of these CoT reviews.

Gold bottomed at $1,623 on Monday September twenty sixth. So technically the prior Tuesday’s CoT knowledge was nonetheless present that day. All of the gold-futures-contract modifications on this chart are taken from the exact days of gold bottoming and topping, even when they don’t precisely match CoT troughs and peaks. The subsequent CoT that was launched for Tuesday September twenty seventh higher displays specs’ gold-futures buying and selling hammering gold that low.

Regardless of that current gold-futures quick masking, this stage-one shopping for nonetheless seemingly isn’t completed. There are a pair methods to deduce that. Speculators’ hyper-leveraged gold-futures buying and selling normally proves the dominant major driver of gold’s short-term worth motion. So I analyze each CoT report in our weekly and month-to-month subscription newsletters for clues on gold’s possible near-term route. I developed some indicators to assist.

One recasts speculators’ complete gold-futures lengthy and quick contracts as percentages of their past-year buying and selling ranges. As of December thirteenth in that latest-reported CoT week, complete spec shorts had been nonetheless operating 34% up into their past-year vary. That implied spec short-covering shopping for was about 2/3rds completed with the final third remaining. Possible gold-futures quick masking isn’t exhausted till this indicator falls to zero.

That final occurred in late March 2022, forward of gold’s $1,977 mid-April excessive from which its depressing mid-2022 plunge erupted. Within the CoT main into that, complete spec shorts hit 105.4k contracts. Specs had so as to add 80.0k to assist pummel gold all the way down to late-September’s panic-grade low. Once more 62.2k of these have been lined to date, leaving nearly 1/4th left to go. So a fourth to a 3rd of seemingly stage-one quick masking stays.

However stage one is small, primarily appearing as a set off to usher in bigger stage-two gold-futures lengthy shopping for. That solely begins mounting after stage one pushes gold excessive sufficient for lengthy sufficient to gas ample upside momentum to draw again long-side speculators. They often management far more capital than the short-side guys, making stage two proportionally extra vital. That’s when gold uplegs actually speed up.

Over this previous yr, complete spec longs have outnumbered complete spec shorts by a mean of two.5x in these weekly CoT reviews. So this gold upleg’s coming second stage is more likely to get pleasure from two-and-a-half-times the capital inflows as stage one! And to date spec gold-futures lengthy shopping for has barely begun, these guys have solely began nibbling. That ought to speed up into early 2023, which is super-bullish for gold and gold shares.

Complete spec longs plunged to only 247.5k contracts in late September as gold bottomed. They’d clawed again just a little to 254.9k in early November, however then retreated all the way down to 243.1k on the finish of that month. That proved an excessive 3.6-year low! Speculators hadn’t been extra bearish on gold as evidenced by very low upside bets since early Could 2019. Then such lopsided positioning necessitated enormous mean-reversion shopping for.

That catapulted gold a blistering 22.3% greater over the following 4.1 months! Related positive factors are seemingly in the present day as stage two kicks in. Bear in mind in the present day’s 12.1% gold upleg is successfully simply 1.5 months previous, but to essentially transition from stage one to stage two. The shortage of spec gold-futures lengthy shopping for so far is clear in related metrics. Complete spec longs had been up simply 11% into their past-year buying and selling vary on December thirteenth.

Possible spec lengthy shopping for isn’t exhausted till that nears 100%, which final occurred in early March on Russia invading Ukraine. Big gold-futures lengthy shopping for fueled gold’s unsustainable geopolitical spike. So by that measure, over 8/9ths of seemingly stage-two spec lengthy shopping for continues to be but to return on this gold upleg! Alternatively complete spec longs had been operating 393.4k in mid-April earlier than gold rolled over onerous on massive futures promoting.

By late November specs had dumped 150.3k contracts, but to date solely 18.6k of these have been purchased again as of that latest-reported CoT. That’s lower than 1/eighth of the full possible stage-two shopping for! So someplace round 7/8ths to eight/9ths of that massive spec gold-futures lengthy shopping for stays excellent. And these leveraged merchants are more and more paying consideration, gold’s current positive factors are beginning to win them over.

In that latest-CoT-week knowledge as of December thirteenth, specs added 12.5k lengthy contracts. That proved their largest CoT week of lengthy shopping for by far since mid-April, again earlier than gold plunged when its psychology remained bullish! So there’s no cause to not anticipate the much-larger stage-two spec gold-futures lengthy shopping for to speed up within the subsequent few months. That can supercharge gold’s younger upleg, ramping its positive factors.

That ought to drive gold excessive sufficient for lengthy sufficient to begin attractive traders to return, unleashing their vastly bigger stage-three shopping for. Sadly international gold funding demand is simply printed quarterly by the World Gold Council in its excellent Gold Demand Traits reviews. That seriously-low-resolution knowledge is just too rare to research in-progress gold uplegs. Fortunately there’s a fantastic each day proxy mirroring it.

That’s the mixed holdings of the dominant GLD and IAU gold exchange-traded funds. As of the top of Q3’22, in line with the WGC these American behemoths commanded a whopping 40.0% of all of the gold bullion held by all of the world’s physically-backed gold ETFs! The traits of their collective holdings are inclined to intently observe general international gold funding demand. They usually present nearly no stage-three shopping for.

GLD+IAU holdings peaked close to 1,626 metric tons in mid-April 2022. Buyers more and more fled after as heavy gold-futures promoting slammed gold this previous summer season. Dumping GLD and IAU shares sooner than gold, that finally compelled their holdings to plunge a significant 16.7% or 271t by early December! That massive investor exodus from gold on draw back momentum left these holdings operating simply 1,355t a number of weeks in the past.

With no leverage to fret about, traders observe gold worth traits way more casually than these hyper-leveraged gold-futures guys. So peaks and troughs in gold funding usually lag these in gold itself by a pair weeks to months. Gold traders must see proof of main development modifications earlier than they may begin migrating capital out or again in. Whereas they lastly began to nibble, their stage-three shopping for is trivial.

These current GLD+IAU holdings lows proved the worst since March 2020 simply rising from that inventory panic, really excessive. But as of midweek, traders had solely completed sufficient differential GLD-and-IAU share shopping for to drive a trivial 0.7% or 8.9t construct. That’s nothing, solely about 1/thirtieth of needed capital inflows to revive GLD+IAU holdings to mid-April’s pre-gold-selloff ranges. Stage three hasn’t even began but!

Placing all this collectively, between late September to this week gold powered a pleasant 12.1% greater. That was fueled by stage-one gold-futures short-covering shopping for equal to 193t of gold. There’s seemingly at the very least one other 56t of stage-one shopping for left. Different specs have began nibbling on the lengthy facet, doing about 58t of gold-equivalent gold-futures lengthy shopping for. However that’s merely round 1/eighth of their seemingly complete.

That means one other 410t+ of spec gold-futures lengthy shopping for coming within the subsequent few months! After that drives gold excessive sufficient for lengthy sufficient to convey again traders, they need to have at the very least one other 262t of shopping for to do per that GLD+IAU-holdings proxy alone. This younger upleg’s final stage-three shopping for should show manner bigger although, as this raging inflation and mounting inventory bear are super-bullish for gold.

However sticking with these conservative numbers, this younger upleg’s complete stage-one, stage-two, and stage-three shopping for ought to shake out round 988t of gold. But to date solely about 260t have been purchased, simply over 1 / 4 of that estimated complete. Which means almost three-fourths of this upleg’s seemingly shopping for continues to be coming! That’s nearly sure to drive gold a lot greater in coming months, making for a fantastic gold new yr.

Speculator gold-futures mean-reversion shopping for will actually speed up on the lofty US Greenback Index’s sharp imply reversion decrease. The first cause gold plunged 17.9% on heavy futures promoting in the course of this yr is the USDX rocketed parabolic with an epic 14.3% achieve to an excessive 20.4-year excessive in that span! That was pushed by the most-extreme tightening the Fed has ever tried, led by monster charge hikes.

However the Fed’s capacity to hawkishly shock has waned dramatically, as I argued again in early November when gold hovered simply above these panic-grade lows. Certainly the USDX has collapsed 9.2% since its lofty heights, with absolutely 9/10ths of that since early November! That ongoing greenback imply reversion decrease because the Fed runs out of room to maintain mountaineering will proceed to spark massive gold-futures shopping for, driving gold greater.

Its ensuing robust upside momentum alone can be sufficient to more and more appeal to again traders, who love chasing positive factors. However this raging inflation unleashed by the Fed’s excessive cash printing lately will supercharge gold funding demand. Over the last inflation super-spikes of the Nineteen Seventies, gold almost tripled through the first then greater than quadrupled through the second in monthly-average-price phrases!

Gold is heading a lot greater on remaining stage-one and still-coming stage-two gold-futures shopping for, which can be accelerated by the US greenback returning to earth after parabolic extremes. The ensuing robust gold upside momentum will entice again much-larger stage-three funding shopping for, itself amplified by raging inflation hammering inventory markets and eroding buying energy. But gold gained’t be the most important beneficiary.

That can show the gold miners’ shares, which leverage materials gold strikes. This subsequent chart overlays gold with its miners’ main benchmark, the GDX gold-stock ETF. It’s already outperforming its steel’s younger upleg, surging 37.4% at finest since late September. That has amplified gold’s positive factors by 3.1x, on the excessive facet of the key gold miners’ typical 2x-to-3x vary. The gold shares will fly as this gold upleg grows!

Bear in mind gold’s final 4 uplegs averaged 28.8% positive factors in 7.9 months. GDX’s final 4 averaged 70.2% positive factors in just about the identical timeframe, leveraging gold by 2.4x. And the final two uplegs of each gold and gold shares had been prematurely truncated by anomalous heavy gold-futures promoting on excessive Fed hawkishness. The prior two regular gold and GDX uplegs averaged large 41.4% and 105.4% positive factors!

Given in the present day’s backdrop of the primary inflation-super-spike because the Nineteen Seventies ravaging investments, gold might simply blast one other 40%+ greater earlier than this newest younger upleg offers up its ghost. A 40% achieve off its deep late-September low would catapult gold up close to $2,275! All the joy that generated would blast gold shares stratospheric with life-changing positive factors, particularly in smaller fundamentally-superior miners.

Researching and buying and selling the higher mid-tier and junior gold shares has been our specialty at Zeal for over 20 years now. We aggressively added new trades at fire-sale costs in current months surrounding gold’s bottoms, filling our e-newsletter buying and selling books. Their unrealized positive factors are already operating as excessive as +73.2% mid-week! All speculators and traders want gold-stock portfolio allocations given gold’s bullish outlook.

If you happen to commonly get pleasure from my essays, please assist our onerous work! For many years we’ve printed widespread weekly and month-to-month newsletters centered on contrarian hypothesis and funding. These essays wouldn’t exist with out that income. Our newsletters draw on my huge expertise, data, knowledge, and ongoing analysis to elucidate what’s happening within the markets, why, and the right way to commerce them with particular shares.

That holistic built-in contrarian method has confirmed very profitable, yielding large realized positive factors throughout gold uplegs like this underway subsequent main one. We extensively analysis gold and silver miners to seek out low-cost fundamentally-superior mid-tiers and juniors with outsized upside potential as gold powers greater. Our buying and selling books are stuffed with them already beginning to soar. Subscribe in the present day and get smarter and richer!

The underside line is gold’s upleg continues to be younger. Gold’s robust current positive factors had been largely pushed by stage-one gold-futures short-covering shopping for, which isn’t even completed but. The much-larger stage-two gold-futures lengthy shopping for and stage-three funding shopping for has barely began. Round three-fourths of the possible gold shopping for more likely to gas this upleg stays, all however guaranteeing the lion’s share of gold’s positive factors are nonetheless coming.

And that’s not even contemplating excessive market occasions that ought to supercharge gold demand. These embrace the lofty US greenback imply reverting a lot decrease and the primary inflation super-spike because the Nineteen Seventies raging. They may nearly definitely gas a lot bigger gold-futures shopping for and funding demand than regular. The ensuing highly effective main gold upleg will catapult battered gold shares far greater, an epic alternative.

Adam Hamilton, CPA

December 23, 2022

Copyright 2000 – 2022 Zeal LLC (www.ZealLLC.com)

[ad_2]

Source link