[ad_1]

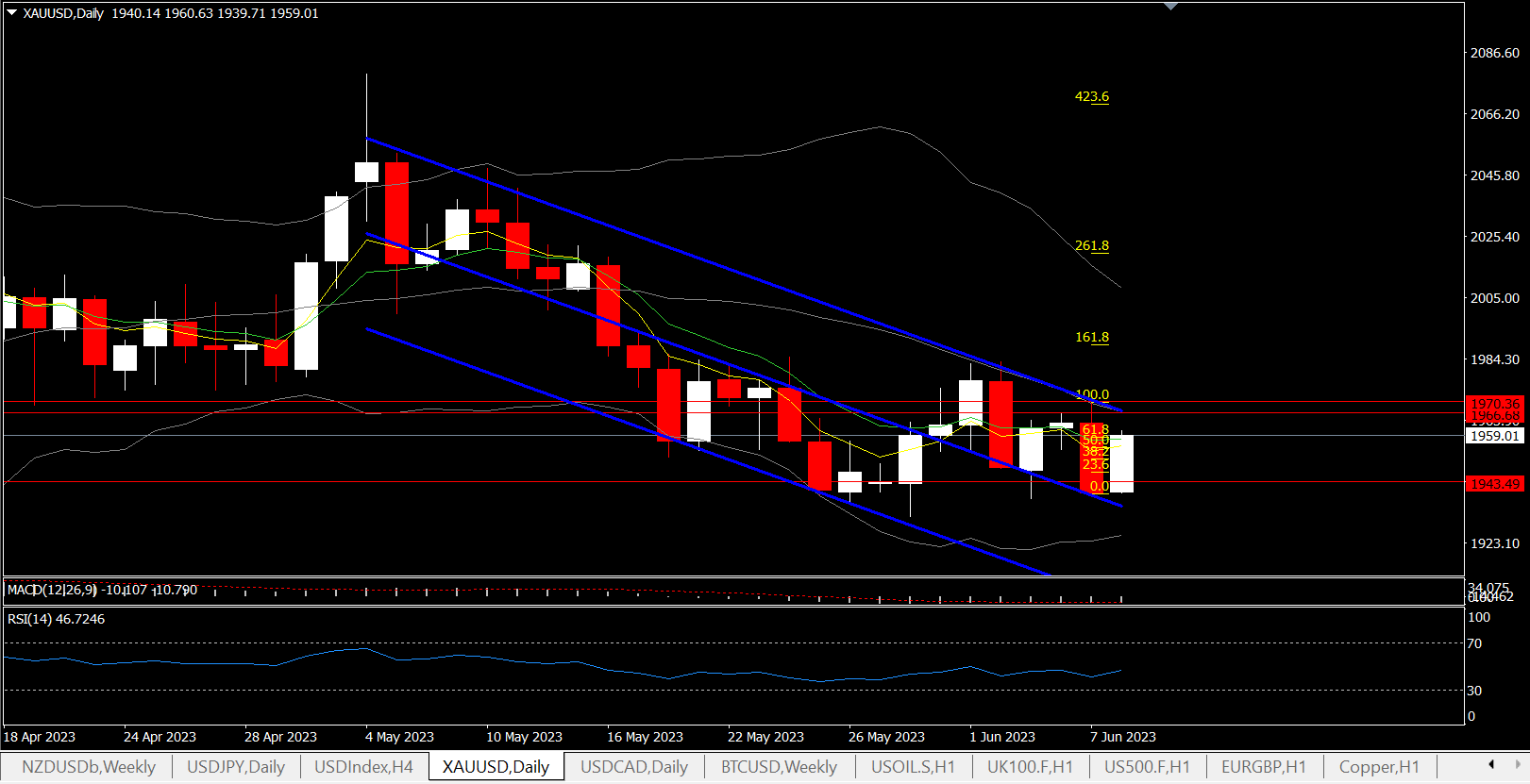

The Greenback extends decline on the climb of preliminary jobless claims retesting 20-day SMA, at 103.50, extending its hunch from an in a single day excessive. The pop larger in preliminary jobless claims helped decrease the temperature on Fed charge hike fears. Vital is the truth that Gold recovered greater than 60% of yesterday’s downleg, turning the eye to the important thing resistance space at 1966.75, which coincides with the 20-day SMA and prime trendline of 1-month channel. General, nonetheless, Gold holds inside a downchannel with momentum negatively configured, indicating than a transfer beneath $1930, might retest the essential $1900.

Treasury yields dove and erased earlier losses, with the 2-year yield slid 5 bps to 4.508% and the 10-year is down fractionally at 3.790%, versus respective in a single day highs of 4.60% and three.818%. Wall Road futures are blended and little modified with the US30 down -0.12%, whereas the US100 is up 0.21% and the US500 is fractionally firmer.

The 28k preliminary claims pop to a 2-year excessive of 261k firstly of June from 233k (was 232k) reversed the tightening in claims since April. Persevering with claims diverged sharply nonetheless, with a -37k plunge to a 3-month low of 1,757k on the finish of Might from 1,794k (was 1,795k), leaving that measure properly beneath the 17-month excessive of 1,861k in April.

Preliminary claims are coming into June above prior averages of 234k in Might and the 18-month excessive for the common of 239k in each March and April. For persevering with claims, we now anticipate an 11k rise between the Might and June BLS survey week readings, after a -54k drop in Might that marked the primary tightening since September, however prior positive factors of 26k in April, 99k in March, 60k in February, and 31k in January. It’s too early to inform if at this time’s huge claims divergences indicate something concerning the dangers for our 200k June nonfarm payroll estimate.

In the meantime implied Fed funds futures slipped after the claims information eased fears of Fed charge hike subsequent Wednesday. Nevertheless, it’s just one blip on the radar display screen amid a really noisy batch of numbers because the Might 2-3 FOMC. The June contract fell to five.147% from 5.157% yesterday, with July at 5.273% from 5.283%. December is at 4.991% from 5.029%.

The futures are suggesting a couple of 25% probability the FOMC will observe the BoC and RBA with 1 / 4 level tightening. July is reflecting a couple of 63% chance for a transfer up in charges by the tip of July. The markets will now await the CPI report on June 13, the primary day of the FOMC’s 2-day assembly the place we’re forecasting positive factors of 0.2% and 0.4% for the headline and core. Outcomes consistent with our forecasts would see the y/y charges gradual to 4.2% from 4.9% in April for the headline, and 5.2% from 5.5% for the core, though each clearly stay greater than double the two% purpose.

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is offered as a basic advertising communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication comprises, or needs to be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency will not be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link