[ad_1]

GOLD PRICE (XAU/USD) FORECAST

- Gold costs stall after encountering trendline resistance close to $1,950 forward of a high-impact occasion on Friday: the discharge of the most recent U.S. jobs report

- Complete nonfarm payrolls for August are forecast to have risen by 170,000, following July’s 187,000 enhance

- This text seems to be at XAU/USD’s key technical ranges to observe within the coming days

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX group

Subscribe to E-newsletter

Most Learn: US Greenback Setups – Key Value Ranges for USD/JPY, USD/CAD & USD/MXN Forward of US Jobs Knowledge

Gold costs (XAU/USD) lacked directional conviction on Thursday, transferring between small positive factors and losses across the $1,940 threshold, in a buying and selling session characterised by restricted volatility throughout many belongings forward of a high-impact occasion for monetary markets simply earlier than the weekend: the discharge of the most recent U.S. jobs report.

In the course of the Jackson Gap Symposium, Fed Chair Powell famous that inflation stays too excessive and referred to as for extra vigilance, however indicated that the FOMC will “proceed rigorously” in any additional strikes after having already delivered 525 foundation factors of tightening since 2022. This cautious stance means one factor: the establishment will lean closely on information.

The pivot towards a data-centric technique elevates the position of incoming financial data to a paramount standing. Because of this, the following employment survey will tackle added significance. Inside this context, a sturdy report has the potential to nudge policymakers in direction of one or two extra charge hikes, whereas lackluster figures might immediate them to embrace a extra dovish posture.

Specializing in Friday’s occasion, complete non-farm payrolls for August are forecast to have risen by 170,000, following the 187,000-gain recorded in July. In the meantime, nominal wages are seen growing 0.3% on a month-to-month foundation, ensuing within the yearly studying holding regular at 4.4%, a determine that’s nonetheless too excessive and might be incompatible with a sustained convergence of inflation in direction of 2%.

Unlock the secrets and techniques of profitable valuable metals buying and selling. Obtain the “The best way to Commerce Gold” information in the present day

Beneficial by Diego Colman

The best way to Commerce Gold

Associated: US Jobs Report Preview: Decoding How Gold, US Greenback and Yields May React

UPCOMING NFP REPORT

Supply: DailyFX Financial Calendar

When contemplating potential situations, the string of disappointing macro indicators in latest days, together with JOLTS, shopper confidence, and personal sector hiring, has heightened uncertainty in regards to the outlook. If the NFP figures validate the pattern of financial weak spot, rate of interest expectations might drift decrease, weighing on yields and on U.S. greenback. This might be fairly bullish for gold costs.

Within the occasion of better-than-expected outcomes, there could also be restricted room for a robust rally in yields and buck, barring a large upside shock within the numbers, as merchants could also be reluctant to completely embrace the narrative of persistent financial power as a result of conflicting alerts emitted by different indicators.

To know how positioning information could have an effect on market developments, obtain the sentiment information and empower your gold buying and selling

| Change in | Longs | Shorts | OI |

| Day by day | 0% | 3% | 1% |

| Weekly | -15% | 46% | -1% |

GOLD PRICE TECHNICAL ANALYSIS

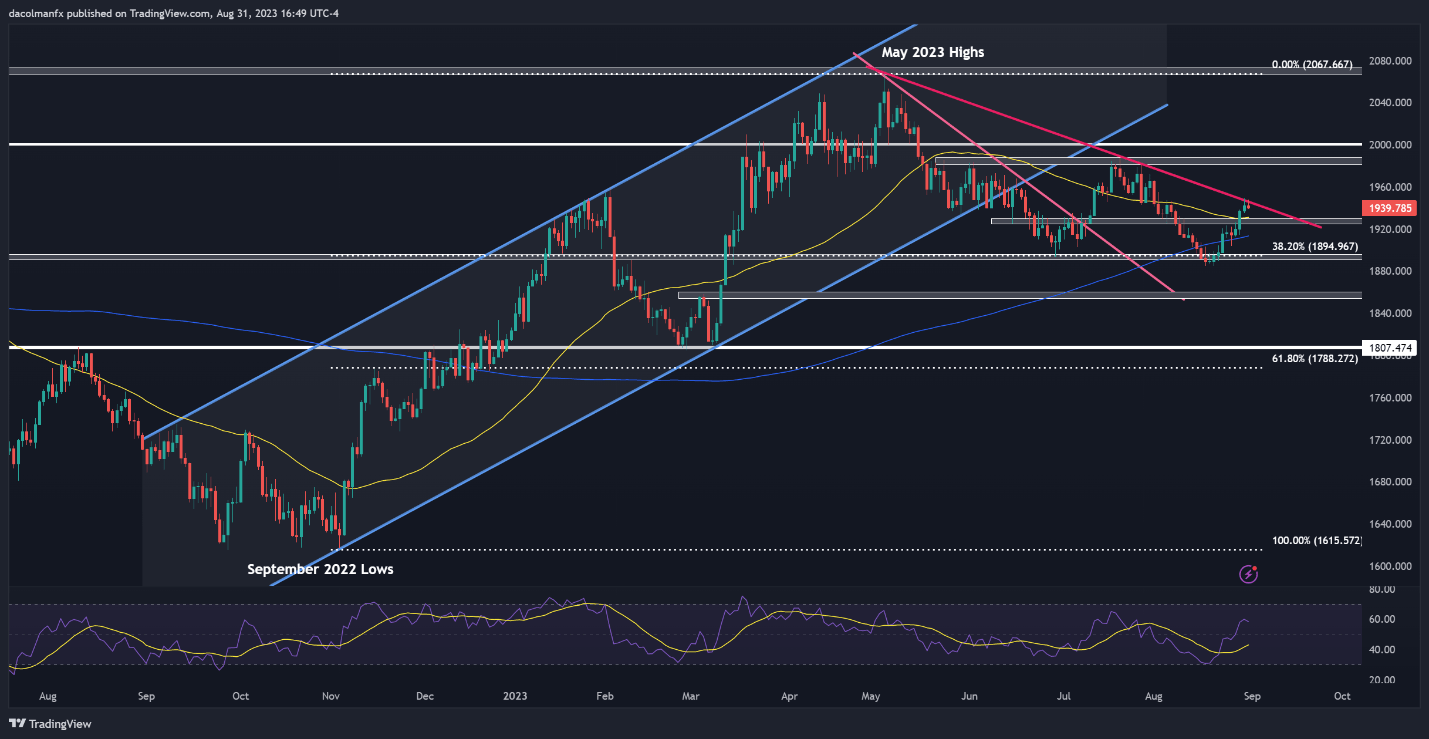

Gold rose within the latter a part of August, reclaiming each its 200-day and 50-day easy transferring averages. Nonetheless, XAU/USD’s upward momentum faltered earlier than the month concluded, coinciding with costs encountering short-term trendline resistance.

Whereas the continued rebound stays viable, a clear break above the $1,950 barrier is critical for renewed bullish confidence to infiltrate the valuable steel market. Ought to this situation play out, we might see a climb in direction of $1,985, adopted by development in direction of the psychological $2,000 mark.

On the flip aspect, if sellers regain the higher hand and repel costs from present ranges, preliminary assist seems at $1,930, and $1,912 thereafter, the 200-day SMA. Additional down the road, the following flooring to control is positioned round $1,895, which corresponds to the 38.2% Fibonacci retracement of the Sept 2022/Could 2023 rally.

Beneficial by Diego Colman

Get Your Free Prime Buying and selling Alternatives Forecast

GOLD PRICES TECHNICAL CHART

Gold Value Chart Ready Utilizing TradingView

[ad_2]

Source link