[ad_1]

Gold, XAU/USD, Federal Reserve, Technical Evaluation – Briefing:

- Gold costs rallied essentially the most in virtually 2 weeks after the Fed

- Markets proceed to wager in opposition to Powell’s fee outlook imaginative and prescient

- XAU/USD now turns to non-farm payrolls knowledge on Friday

Really useful by Daniel Dubrovsky

Get Your Free Gold Forecast

Gold costs gained 1.14 p.c on Wednesday, essentially the most in virtually 2 weeks. The yellow steel is on track for a seventh consecutive week of good points. That will be the longest successful streak because the summer time of 2020. All eyes have been on the Federal Reserve over the previous 24 hours, which delivered a 25 foundation level fee hike, as anticipated. That introduced benchmark lending charges to a spread of 4.50% – 4.75%.

As normal, the main focus was on what might come moderately than on what occurred. Because the finish of final 12 months, markets have been pricing in an more and more dovish outlook. Consequently, the US Greenback and Treasury yields fell because the S&P 500 gained. The Chicago Fed Nationwide Monetary Situations Index is at its lowest because the Fed began tightening final 12 months – an indication of easing liquidity in markets regardless of quantitative tightening.

What did Chair Jerome Powell say? He acknowledged that inflation has eased considerably however that ‘it stays elevated’. He confused that the central financial institution ‘might want to keep restrictive for a while’ and that if the economic system performs as anticipated, policymakers don’t see cuts this 12 months. How did the markets reply?

Regardless of Powell’s rhetoric, monetary markets continued to wager in opposition to the central financial institution. Fed Fund Futures level at 2 fee cuts in direction of the top of this 12 months. That is as merchants added in virtually half a cut to the 2-year horizon. On the intraday chart under, you possibly can see the US Greenback falling alongside front-end bond yields. Gold rallied, capitalizing because the ‘anti-fiat’ buying and selling instrument.

Powell was questioned concerning the latest easing in monetary situations, however his reply left extra to be desired. He mentioned that the main focus is “not on near-term strikes, however on sustained modifications”. All issues thought-about; this continues to go away markets susceptible to disappointment if a pivot turns into more and more unlikely. To that finish, the main focus stays on financial knowledge and non-farm payrolls on Friday.

Gold Surges Throughout the Federal Reserve Price Determination

Gold Technical Evaluation

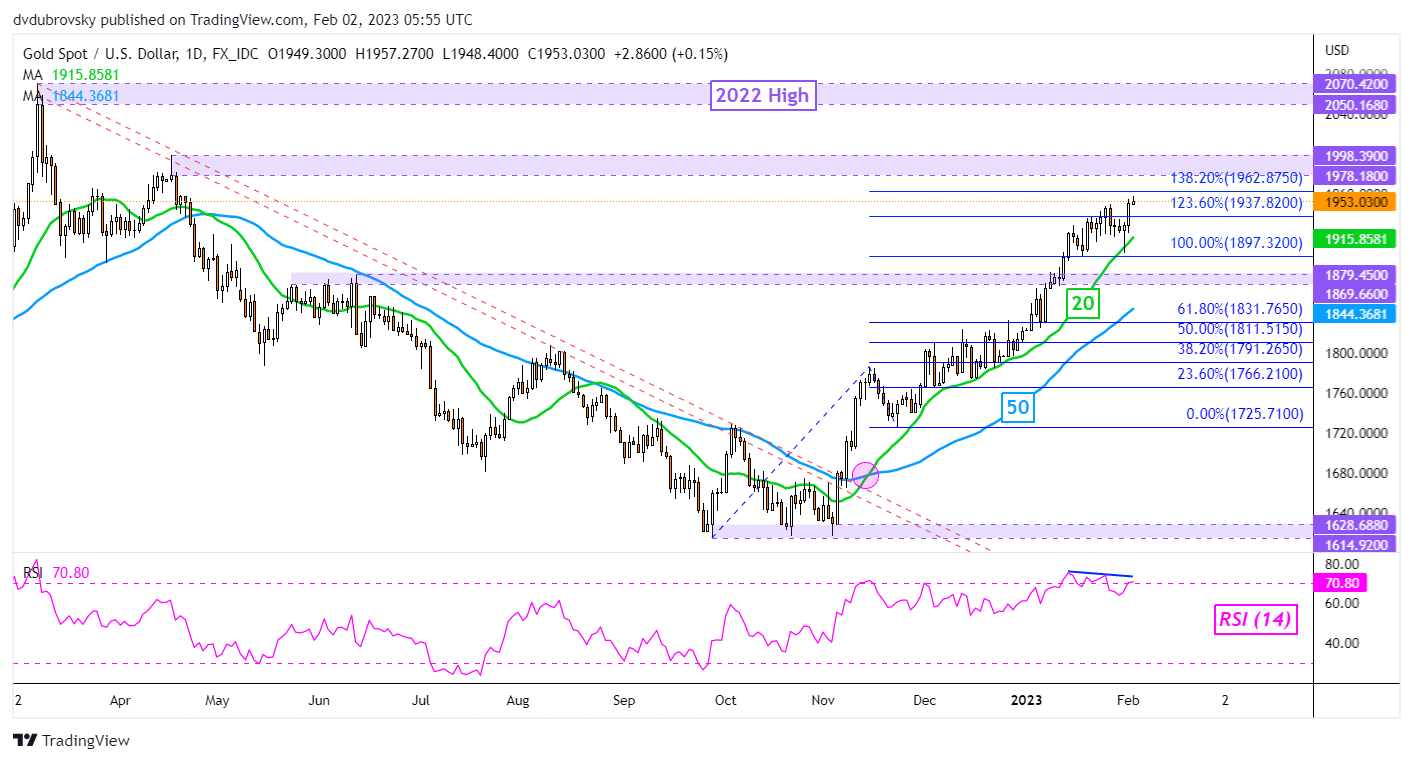

Gold closed at a brand new excessive this 12 months, taking out the January peak at 1949.16. That positioned XAU/USD nearer to the important thing 1978 – 1998 resistance zone. Destructive RSI divergence is current, displaying that upside momentum is fading. That may at instances precede a flip decrease. In such a case, the 20-day Easy Transferring Common (SMA) might preserve the upside focus.

Really useful by Daniel Dubrovsky

The best way to Commerce Gold

XAU/USD Each day Chart

Chart Created Utilizing TradingView

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

To contact Daniel, observe him on Twitter:@ddubrovskyFX

[ad_2]

Source link