[ad_1]

USD/JPY, GOLD PRICE FORECAST

- Gold costs advance, however fail to push above cluster resistance

- USD/JPY lacks directional conviction, with the pair buying and selling barely under the 200-day easy shifting common

- This text explores the technical profile for gold and USD/JPY, specializing in essential worth thresholds that could possibly be related heading into the ultimate buying and selling periods of 2023

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX crew

Subscribe to E-newsletter

Most Learn: US Greenback in Dangerous Waters, Technical Setups on EUR/USD, GBP/USD, Gold

Gold costs (XAU/USD) trended larger on Tuesday in skinny buying and selling after the Christmas holidays, rising about 0.7% to $2,065, bolstered by the pullback within the U.S. greenback, which inched in the direction of its lowest level since late July.

Following Tuesday’s advance, XAU/USD has arrived on the doorsteps of an essential resistance area, spanning from $2,070 to $2,075. Earlier makes an attempt to interrupt by this ceiling on a sustained foundation have been unsuccessful, so historical past might repeat itself this time.

Within the occasion of a bearish rejection from present ranges, assist seems at $2,050, adopted by $2,010. Bulls should defend this ground tooth and nail – failure to take action might rekindle downward momentum, laying the groundwork for a drop towards $1,990. On additional weak point, the main focus turns to $1,975.

Then again, if patrons handle to push costs decisively above $2,070/$2075, upward impetus might collect tempo, creating the proper situations for the valuable steel to begin consolidating above $2100. Continued energy might pave the best way for a retest of the all-time excessive at $2,150.

Questioning how retail positioning can form gold costs? Our sentiment information supplies the solutions you might be in search of—do not miss out, get the information now!

| Change in | Longs | Shorts | OI |

| Day by day | 2% | 6% | 4% |

| Weekly | -5% | 11% | 1% |

GOLD PRICE TECHNICAL CHART

Gold Value Chart Created Utilizing TradingView

Discover unique insights and tailor-made methods for the Japanese yen by downloading our “How you can Commerce USD/JPY” information.

Really helpful by Diego Colman

How you can Commerce USD/JPY

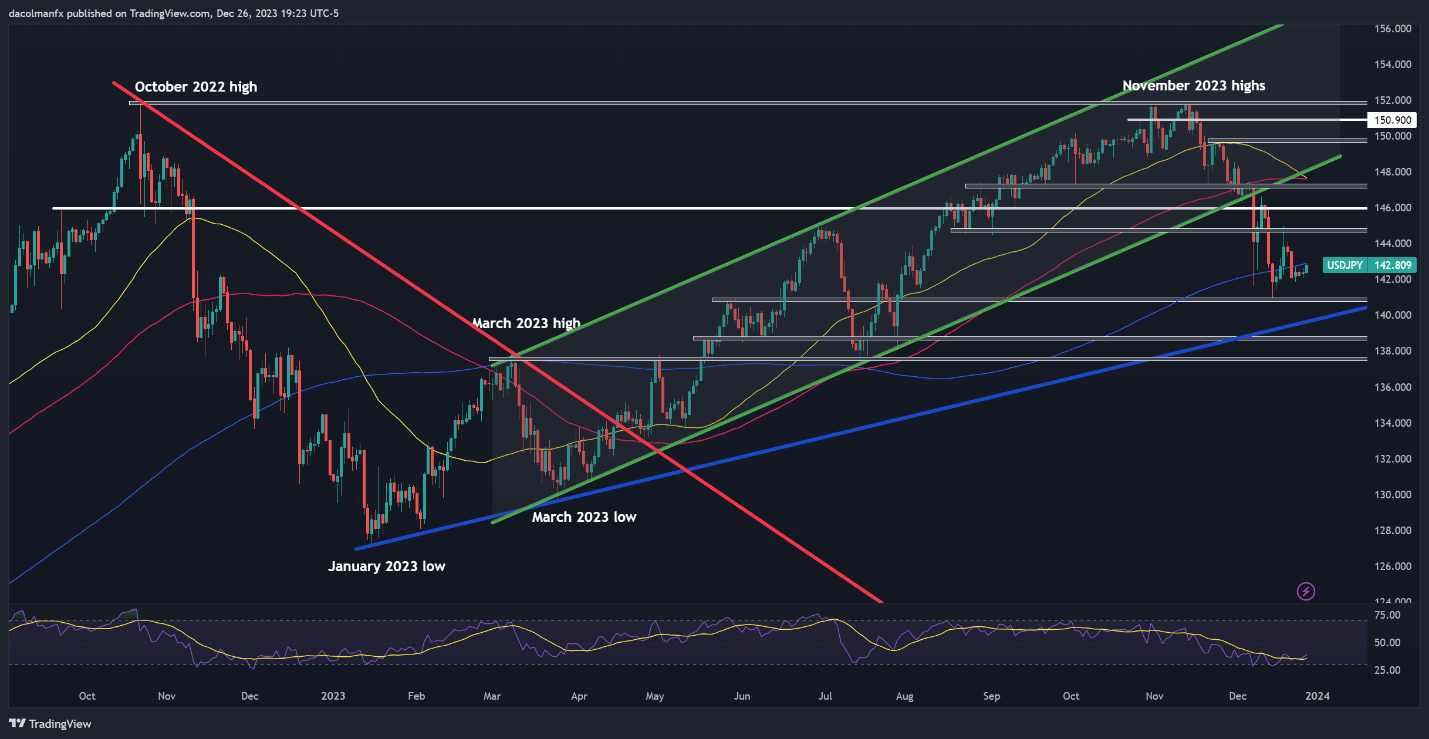

USD/JPY TECHNICAL ANALYSIS

USD/JPY ticked up modestly on Tuesday however was unable to recapture its 200-day easy shifting common. If costs stay under this indicator on a sustained foundation, promoting strain might resurface and collect impetus, paving the best way for an eventual drop towards the December lows at 140.95. Whereas this technical space might supply assist throughout a retracement, a breakdown may steer the pair in the direction of 139.50.

Then again, if patrons take cost and propel the alternate charge above the 200-day SMA, resistance is situated at 144.80. Overcoming this hurdle will show difficult for the bulls, however a profitable breakout might set up favorable situations for an upward thrust towards the 146.00 deal with. On additional energy, all eyes can be on 147.20.

USD/JPY TECHNICAL CHART

USD/JPY Chart Created Utilizing TradingView

[ad_2]

Source link