[ad_1]

Gold, XAU/USD, Retail Gross sales, IGCS, Technical Evaluation – Briefing:

- Gold costs are heading for the worst month since June 2021

- Retail merchants boosted lengthy bets on Wednesday, a bearish signal

- XAU/USD confirmed a breakout below a key transferring common

Advisable by Daniel Dubrovsky

Get Your Free Gold Forecast

Gold costs sank about 1 p.c on Wednesday, with the valuable steel closing at its lowest for the reason that finish of final yr. Markets digested a better-than-expected US retail gross sales print, which adopted a hotter-than-anticipated CPI report on yesterday. Each occasions helped drive up the US Greenback, which tends to inversely monitor XAU/USD.

The anti-fiat yellow steel is on the right track for the worst month-to-month efficiency since June 2021 if losses maintain. Fading Federal Reserve fee lower bets have been boosting Treasury yields, additional pressuring gold costs. Over the remaining 24 hours, gold merchants ought to be careful for US PPI knowledge, due at 13:30 GMT. Unexpectedly hotter wholesale inflation might additional stress the valuable steel.

IG Consumer Sentiment Evaluation

In line with IG Consumer Sentiment, about 72% of retail merchants are net-long gold. IGCS tends to operate as a contrarian indicator. As such, since most merchants are net-long gold, this might trace at additional ache forward. That is as upside publicity elevated by 11.83% and three.61% in comparison with yesterday and final week, respectively. With that in thoughts, these readings provide a stronger bearish contrarian buying and selling bias.

Technical Evaluation

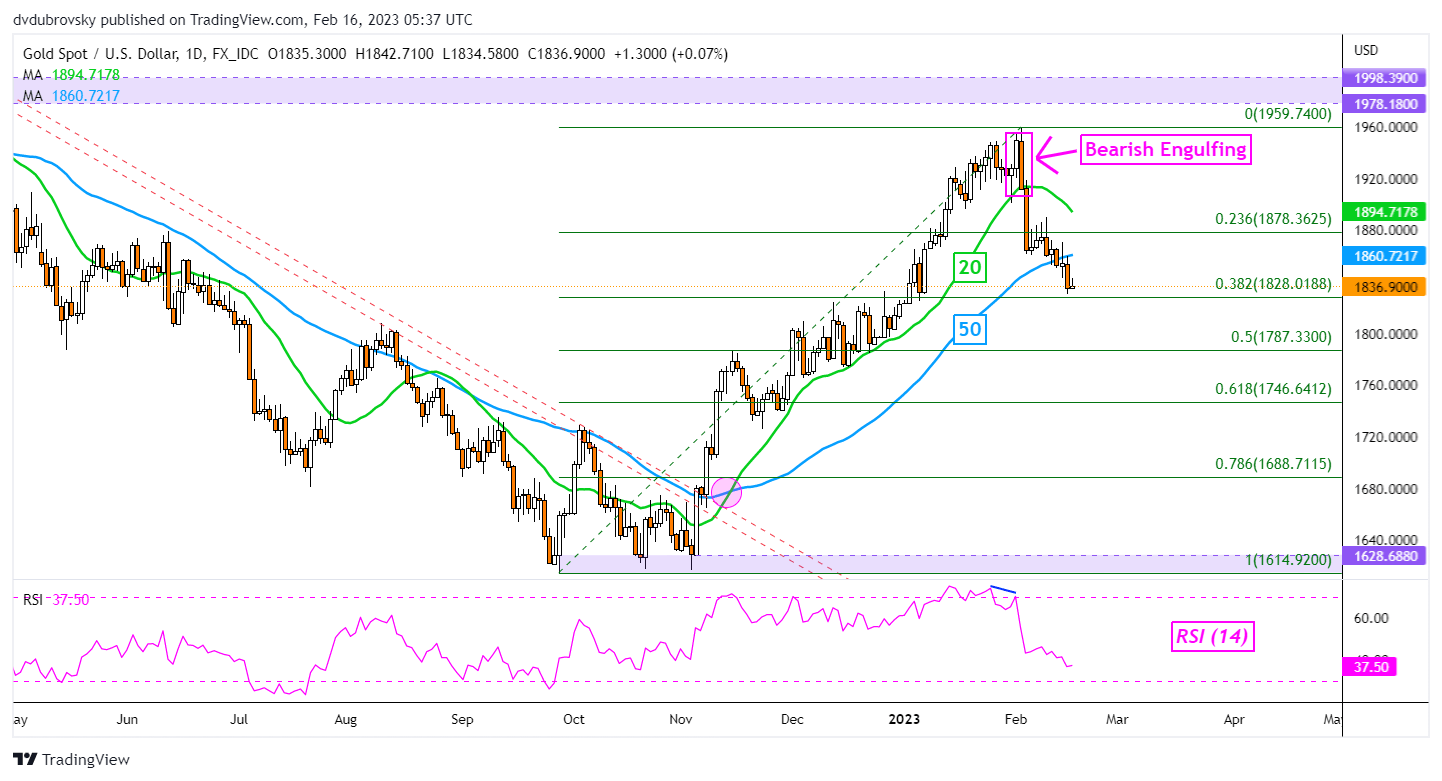

On the every day chart, gold has confirmed a breakout below the 50-day Easy Shifting Common (SMA). This follows the emergence of a Bearish Engulfing candlestick sample from January, which hinted at a reversal. Now, costs are more and more susceptible to extending losses. Speedy help is the 38.2% Fibonacci retracement stage at 1828. Clearing this value exposes the midpoint at 1787. In any other case, a flip again above the 50-day SMA will place the give attention to the 20-day line. The latter might maintain as resistance, reinstating a near-term draw back bias.

Advisable by Daniel Dubrovsky

Learn how to Commerce Gold

XAU/USD Each day Chart

Chart Created Utilizing TradingView

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

To contact Daniel, observe him on Twitter:@ddubrovskyFX

[ad_2]

Source link