Anthony Bradshaw

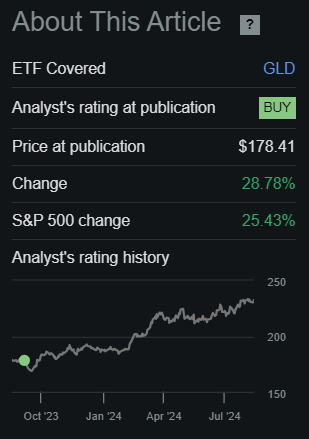

Practically a 12 months in the past, I printed an article titled “Shares In The Rearview: A Golden Outperformance Approaches” through which I highlighted the bullish case for gold and the SPDR Gold Shares ETF (NYSEARCA:GLD). My core thesis was that gold will outperform shares as a result of numerous macro components and the multi-decade ebb and circulation of the “SPX to gold ratio.” So far, the prediction has confirmed right.

Change since article (Searching for Alpha)

GLD outperformed the SPX by 3% over this time. This can be a follow-up to that article. The underside line up entrance is that I nonetheless assume gold is ready to outperform equities, for largely the identical causes as acknowledged earlier than.

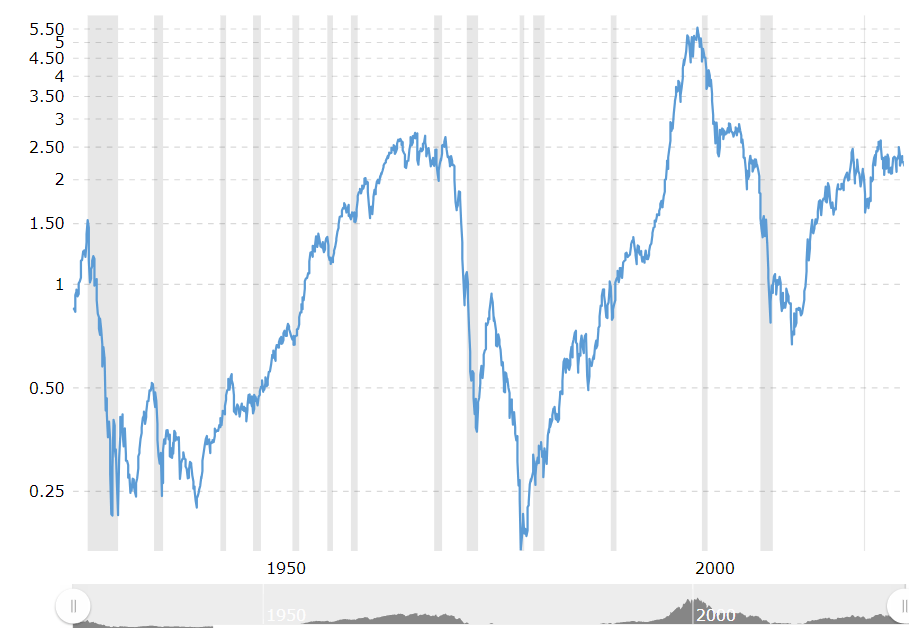

The SPX to gold ratio will be seen right here on Macrotrends. Simply to make clear, this time collection represents what number of troy ounces of gold it takes to purchase 1 unit of the S&P 500 index. With the index at round 5400 and the gold value at round 2400 per troy ounce, the present measure of the SPX to gold ratio needs to be round 2.25.

SPX to Gold ratio (Macrotrends)

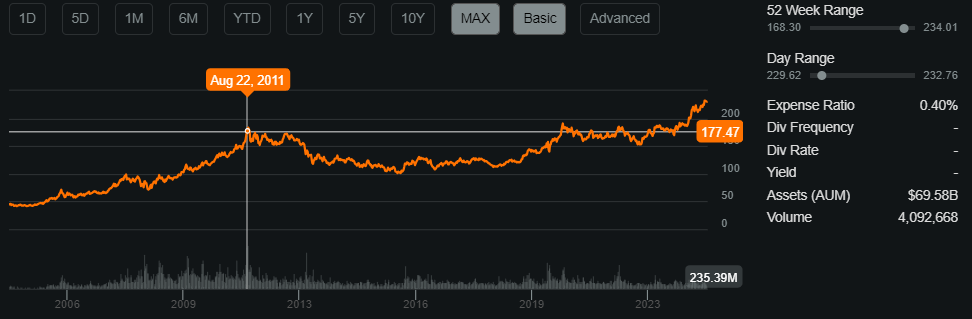

Primarily based on the relative overvaluation of the SPX in gold phrases, I feel we’re on the early levels of a decade-long bull marketplace for gold. I feel the SPX to gold ratio may fall beneath the 0.67 backside set in August 2011. This was additionally the beginning of what was basically a misplaced decade for gold, as you’ll be able to see within the chart of GLD.

GLD (Searching for Alpha)

At immediately’s SPX, the implied worth of gold at a 0.67 SPX to gold ratio can be round 8000. In actuality, I’m considerably anticipating a misplaced decade in equities, so the true long-term value for gold may fall in need of that.

The Catalysts For Gold

I feel what have to be acknowledged earlier than anything is that markets are largely pushed by sentiments. As a lot as there may be robustness in basic evaluation, value will solely ever finally come from two forces: provide and demand. And sentiments have a big impact on each.

The sentiment over the previous 12 years has been that index funds are the most secure wager available on the market and a certain option to monetary freedom. And in actuality, the idea of passive index funds dates again a minimum of to the early Nineties. Ever for the reason that Nineteen Eighties, the SPX to gold ratio has taken off and by no means fell beneath 0.6.

The passive indexing commerce is so crowded at this level and so many individuals are relying on it persevering with to work out because it at all times has. For this reason it’s presumably time for this sentiment to shift. The fact is each conventional metric of valuation multiples just like the Shiller PE or the market cap to GDP ratio suggest nosebleed highs in valuation. These have finally been supported economically by the simple cash of ZIRP and sentimentally by the doubtful proposition that indexing is completely foolproof. This additionally trusted the financial hegemony of the greenback. These are the legs of the passive indexing “bubble.”

Sadly, all of those are most likely in for a dramatic reversal. The aftermath of COVID-19 marked the tip of ZIRP and the beginning of deglobalization. The forex polarization of the greenback in the course of the Russian invasion of Ukraine in 2022 marked the tip of the greenback’s financial neutrality. The breaking of the US banking sector in 2023, which pushed the Fed to orchestrate a smooth bailout by way of the BTFP, arguably marked the start of fiscal dominance (which simply implies that financial coverage will begin to develop into more and more secondary to fiscal insurance policies like nationwide debt; the BTFP confirmed that the system was breaking when the Fed tried to conduct prudent financial coverage).

At this level, the final remaining domino is the understanding that US equities are infallible autos of wealth accumulation. Word that this was at all times only a concept too. There’s no financial regulation stating that fairness holders will enhance their wealth. Certainly, when plotting the SPX towards the expansion of broad cash provide, we are able to see that a lot of the nominal development within the index can be a results of elevated fiat liquidity. The one distinction between SPX and gold, on this respect, is that the SPX was the popular goal for liquidity inflows whereas gold has been comparatively much less favored. Why is that? I argue that it’s actually simply sentiment!

While you take a look at the prevailing sentiment for gold, what will we see? It’s a boring, yellow rock that occurs to be shiny. No money flows. No productive enterprise behind it. We are able to’t actually clarify why it even has a market worth. Nicely, as I coated in my final article, gold has worth because the final reference level to sound cash (earlier than Nixon closed the gold window in 1971), and this characteristic successfully marries its market value to financial productiveness, which is identical underlying logic for why equities have worth:

In a method, the returns of sound cash and fairness indices needs to be almost equal over the long run, assuming a completely free market. It’s because the market cap of all companies is a market estimation of the discounted money circulation of all companies – an estimation of all future manufacturing discounted to the current day. The worth of cash at any given second is all the things it could actually purchase proper now plus a reduced worth of issues it may purchase sooner or later (one may consider this as embedded optionality or a liquidity premium, each interpretations are logically sound). Each calculations reference estimates of future productions, and each calculations low cost these estimates to the current day. Subsequently, a shift in expectations of future manufacturing should have an effect on each numbers by the identical proportion, inflicting the long-term returns to trace carefully collectively.

If the sentiment round gold reverses, we’ll see capital circulation into gold like we haven’t seen in many years. A lot of this capital will probably be sucked out of the fairness markets. That is exactly how the SPX to gold ratio will begin falling.

Are there any catalysts for this future sentiment shift?

I feel the unwinding of the yen carry commerce could be very underrated on this dialogue. For a few years, US property have loved a synthetic “pump” because of the carry commerce. This was predicated upon Japan’s adverse and ultra-low rate of interest coverage. That period is now ending. Each nation must defend their very own financial pursuits, and this contains intervening in FX markets by promoting reserves of US debt to prop up their forex. The long-term affect is increased long-term yields, compressed fairness valuations, weaker greenback, and weaker US property. The sentiment will probably be fairly dangerous and gold will probably be in favor.

The reflexivity of markets implies that this generally is a self-fulfilling prophecy. As soon as the SPX has a sustained interval of weak spot, we may see revenue taking and a rush for the exits and a rush into gold.

In the meantime, there may be fairly a positive backdrop for gold. As talked about, sentiment hasn’t been nice within the final 12 years. However de-dollarization and deglobalization are each taking place. Populism rises within the Western nations and society is turning into extra unstable. It’s turning into very clear that US management is neither sustainable nor desired by a rising variety of stakeholders within the international populace. These traits enhance the necessity for impartial, stateless, bearer-asset, exhausting cash. This has been gold’s position for 1000’s of years. As soon as the sentiment begins shifting, it’ll be very exhausting to place the genie again within the bottle.

I view the latest outperformance of gold because the sign that this shift has begun.

Dangers

This evaluation is an excellent long run (decade or extra) view of the asset class. I feel the primary threat of this thesis is a drastic change to the course the world is headed. As talked about, the present trajectory is a decline in US management, necessitating the necessity for exhausting cash which isn’t controllable by any authorities. If the US authorities had been to one way or the other provide you with a method of paying down its debt with out inflating the forex and bringing again belief within the US greenback, then the greenback will clearly harden towards alternate options. This is able to be dangerous for the value of gold. It might additionally restore extra belief in US property just like the SPX, which might enable the SPX to gold ratio to not mean-revert as I’ve predicted right here.

I additionally assume that AI is a doable threat to the thesis. If the productiveness positive factors of AI had been to materialize because the markets have seemingly priced in, then it may offset the rising instability on this planet by way of large wealth creation. For example, populism is turning into extra prevalent as a result of individuals really feel that the system is rigged towards them with costs rising, the very best tax burdens in many years, and the rising wealth hole. If AI may generate a lot wealth for society that it mainly ameliorates this more and more widespread dissatisfaction, then there can be no need to reset the present system. On this case, index funds may proceed to get pleasure from large capital inflows and there can be no long-term outperformance by gold: the sentiment would have by no means shifted.

Conclusion

I anticipate gold to dramatically outperform the SPX over the following few years. This can be a Purchase. Gold has handled poor sentiment for a really very long time. And this logic largely applies to silver as properly. It’s affordable to be extra closely allotted to metals going ahead.