[ad_1]

Really useful by Diego Colman

Get Your Free Prime Buying and selling Alternatives Forecast

Most Learn: Euro Forecast: EUR/USD Breakout Good points Momentum however Fibonacci Resistance on Radar

Final week, merchants in search of volatility had loads of it. There have been vital strikes throughout all asset courses, however maybe most notable was the sharp drop within the U.S. greenback within the run-up to the June inflation report and, extra importantly, after it.

The CPI numbers launched on Wednesday and the next day’s PPI knowledge stunned to the draw back, reinforcing the argument that value pressures are cooling extra quickly than initially envisioned. This sentiment led merchants to reprice decrease the Fed’s tightening path, decreasing the chance of extra tightening past the quarter-point hike already discounted for the July FOMC assembly.

With U.S. rates of interest expectations shifting in a much less hawkish path, gold costs took off after subdued habits in current weeks. Danger belongings additionally commanded bullish momentum, particularly rate-sensitive shares within the know-how sector. When it was all mentioned and carried out, the Nasdaq 100 superior 3.52% on the week, whereas the S&P 500 managed to realize 2.42%

In foreign money markets, the DXY index plummeted about 2.23%, breaking beneath the psychological 100 mark and hitting its weakest level since April 2022. In the meantime, EUR/USD and GBP/USD staged an explosive rally, with each pairs overcoming key technical hurdles and reaching their strongest ranges for the reason that first quarter of 2022.

WEEKLY PERFORMANCE KEY ASSETS

Supply: TradingView

Turning to subsequent week’s high-impact occasions, the spotlight of the U.S. financial calendar will likely be June retail gross sales knowledge, with estimates calling for a month-to-month rise of 0.5%. A robust readout would sign strong family spending, bolstering bets for one more Fed hike someday within the fall. Conversely, a weak print would have the other impact: it might additional cut back the percentages of a tightening past July.

Throughout the pond, UK inflation figures for June will take heart stage. Annual headline CPI is seen slowing to eight.2% from 8.7% beforehand, whereas the core indicator is forecast to stay unchanged at 7.1%. If value pressures keep sticky, expectations for the Financial institution of England’s terminal fee may drift larger, boosting sterling within the brief time period.

Really useful by Diego Colman

Foreign exchange for Freshmen

INCOMING ECONOMIC DATA

Supply: DailyFX Financial Calendar

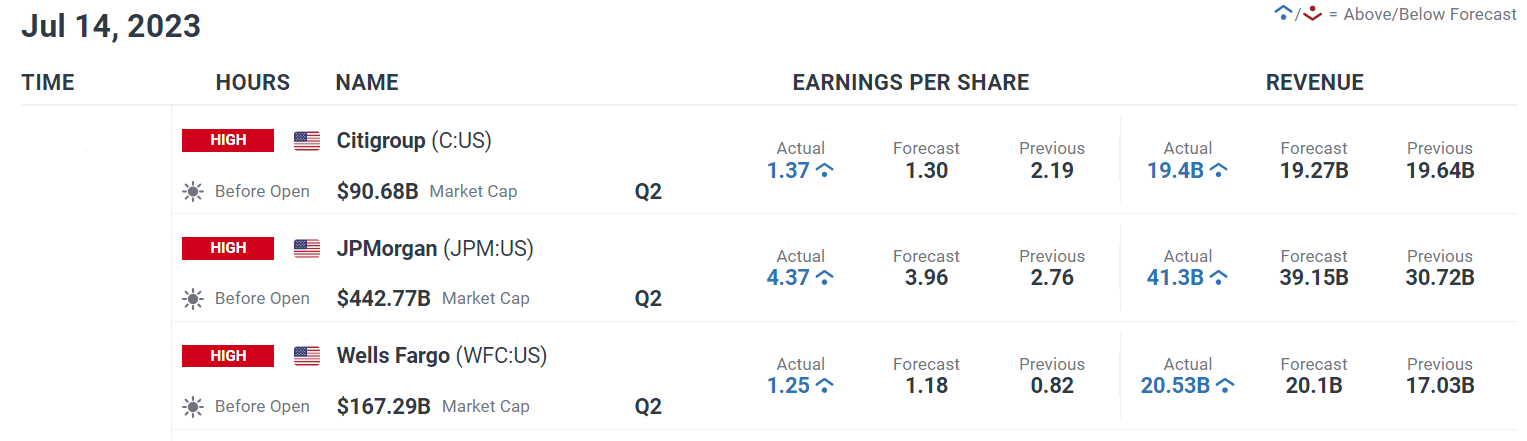

Final however not least, merchants also needs to control the U.S. earnings season, which bought formally underway on Friday after main banks introduced numbers. Heavy gamers corresponding to JP Morgan Chase, Wells Fargo and Citi all delivered better-than-expected outcomes, however their steering didn’t impress buyers, main a number of monetary shares to return beneath stress heading into the weekend.

Subsequent week, extra monetary establishments will unveil their outcomes, with Financial institution of America, Morgan Stanley and Goldman Sachs being the highest three to look at. Industrial and funding banks have a entrance row view of the economic system, so their forward-looking feedback could supply perception into the outlook. That mentioned, any indicators of worsening financial situations could possibly be damaging for confidence.

Within the tech house, Netflix and Tesla’s quarterly outcomes will steal the limelight. Each corporations are big when it comes to market capitalization, so fluctuations of their share costs can have an outsize impact on the efficiency of the S&P 500 and Nasdaq 100. Try DailyFX’s earnings calendar for a extra full record of the highest corporations asserting their income and EPS within the coming days.

Really useful by Diego Colman

Get Your Free USD Forecast

FUNDAMENTAL AND TECHNICAL FORECASTS

British Pound Outlook: Inflation Information Will Drive GBP/USD and EUR/GBP

US inflation is on the best way down, taking the wind out of the US greenback’s sails. Will subsequent week’s UK inflation report mood Sterling’s current surge?

Australian Greenback Outlook: US Greenback Rout Boosts the Aussie

The Australian Greenback bought a spring in its step final week because the US Greenback tumbled following comfortable inflation readings. A brand new RBA Governor would possibly imply extra of the identical for financial coverage.

Euro Forecast: EUR/USD Breakout Good points Momentum however Fibonacci Resistance on Radar

EUR/USD rallied aggressively this previous week, rising to its finest degree since February 2022. With momentum on its facet, the pair’s outlook stays optimistic, however Fibonacci resistance could cap its upside going ahead.

S&P, Nasdaq Weekly Forecast: US Shares Eye Additional Upside as Q2 Earnings Get Underway

US shares loved one other affluent week as US inflation stunned to the draw back, sending the greenback sharply decrease and shares larger. Q2 Earnings up subsequent

Gold Weekly Forecast: Breakout Fails to Kick on as Technicals Flash Combined Indicators

Spot Gold tried a slight restoration on Friday because the $1960 deal with continues to carry agency. Can Gold costs lastly kick on towards the coveted $2000/oz mark?

US Crude Oil Weekly Forecast: Upbeat Market Seems to China GDP

Crude oil costs have risen for a 3rd straight week bolstered by all kinds of assist and this pattern seems more likely to proceed.

Renewed Weak spot in US Greenback: EUR/USD, GBP/USD, USD/JPY Value Setups

The US greenback’s fall to new multi-month lows in opposition to its friends coupled with the break beneath key assist ranges is an indication of renewed bearishness within the buck. What’s the outlook for EUR/USD, GBP/USD, and USD/JPY?

Really useful by Diego Colman

Get Your Free Equities Forecast

Article Physique Written by Diego Colman, Contributing Strategist for DailyFX.com

— Particular person Articles Composed by DailyFX Workforce Members

[ad_2]

Source link