[ad_1]

Gold had an epic bull market within the noughties – I nonetheless keep in mind the important thing numbers prefer it was yesterday.

There was the low in 1999 at $250/oz, marked for all eternity by Chancellor of the Exchequer, Gordon Brown, as he offered off two-thirds of British gold on the backside of the market when there have been no compelling causes to take action.

That low was re-tested in 2001 and we obtained a traditional double backside, adopted by six years of a bull market, which resulted in Might 2006 at $720/oz.

There was a pullback, some sideways motion, then the bull marched on to $1,030/oz.

Then the International Monetary Disaster got here alongside. Gold plummeted together with every little thing else, and it was again under $700/oz.

An unstoppable bull market lasting three extra years adopted.

First, the gold worth broke out to new highs above $1,030. On it marched till it will definitely peaked, with the Greek debt disaster, at $1,920/oz.

Then got here the bear market. 5 brutal years of ache. It went all the way in which again to $1,040/oz.

The interval between 2018 and 2020 noticed gold rally once more, heading north of $2,000/oz, albeit briefly.

However right here we’re in early 2023. And guess what? As I write, gold sits at $1,920/oz – the identical worth because it was again in 2011.

What’s subsequent for the gold worth?

Will it pull again from right here? In all probability.

It has rallied $300/ouncesin barely two months. It’s overbought. Neither silver nor the miners are main. That’s normally not a very good signal.

Charlie Morris says gold is buying and selling above truthful worth. Charlie Morris is normally proper.

You may get cute and try to commerce it, however nobody is aware of what’s going to occur. It’s a treasured steel and it’s a market. If they will throw you, they may.

However then once more, gold normally does effectively when belief in monetary markets is low. I’d say that’s the case now. Do you danger your place within the hope you could get again in decrease? What if it goes up as a substitute?

Or you may take the longer-term view. Just like the famed dealer, Outdated Partridge, in Edwin Lefevre’s Reminiscences of a Inventory Operator, who by no means wished to lose his place in a bull market, a view since echoed by a memed typo, you may simply hodl on.

We should every make our personal decisions, be taught from them and dwell with them.

What occurs to the gold worth if everybody begins shopping for?

Right here’s a pleasant little thought experiment.

I’ve heard it earlier than – however I’d forgotten it, and it was dropped at my consideration once more by Winston Miles of Canadian funding home Eight Capital.

There was a presentation by strategist Grant Williams in 2016 known as “What If?” when he requested what would occur if pension funds, which presently had a 0.15% weighting to gold, elevated that allocation. Miles determined to run that situation in immediately’s market.

“In line with the OECD’s most up-to-date knowledge, international pension belongings are $56 trillion. I may simply see pension funds getting as much as 1% of their portfolio in treasured metals on common. However let’s be a bit extra conservative and go along with two-thirds of 1%, or 66bps… which is $373,903,924,800.

“That amount of cash … may purchase each single firm that makes up the Philadelphia Gold and Silver Index… which might set them again a cool $297 billion. Then they may purchase each share of GLD, even taking supply of all that gold in the event that they wished, because it’s all sitting in a vault someplace. That might price one other $56 billion. Then with the scraps left over, they may purchase each share of the GDX… GDXJ… SIL… AND the SILJ.” (These are the gold and silver mining ETFs).

In brief, there’s some huge cash on the market. On a relative foundation, there isn’t a variety of tradeable gold, and there aren’t that many gold mining firms. A small shift within the narrative may ship the gold and silver markets a great distance larger.

“It’s an atmosphere,” says Miles, “the place nearly no main pensions have a portfolio supervisor targeted on metals and mining. The infrastructure is completely gone. It’s laborious so as to add provide, the mines are outdated, it takes ten+ years to construct new ones, these are actually lengthy lead time initiatives.”

You may conduct the identical thought experiments with oil, gasoline and coal. Little or no allocation (largely due to ESG), and little or no funding resulting in tight provide and lengthy lead occasions.

You may conduct the identical experiments with bitcoin. What occurs to the bitcoin worth, if bitcoin had been to turn into a core, mainstream portfolio holding?

All of them go so much larger.

You may’t say the identical about tech, the S&P 500, or authorities bonds.

The narratives might not change, but when they do, look out above.

On this be aware, right here is the S&P500 relative to gold since 2000. When the chart is rising, gold is rising relative to the inventory market and vice versa.

At $1,920/ouncesgold is so much cheaper immediately than it was when it was $1,920/ouncesback in 2011. It’s a 3rd of the worth.

To get again to these equal ranges, assuming no change within the worth of the S&P500, gold must triple. I just like the sound of $5,700/ouncesgold!

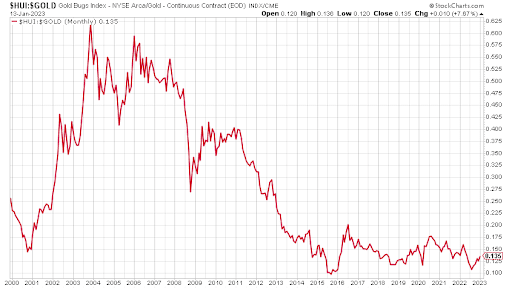

Listed below are the gold miners relative to gold.

With the plethora of recent ways in which opened as much as get publicity to gold – ETFs, on-line bullion sellers, CFDs, unfold bets and all the remainder of it – traders stopped bothering with miners, and who can blame them?

An excessive amount of incompetence, too many frauds, an excessive amount of political and environmental danger – and all the remainder of it.

They’ve been falling since 2003.

However they stopped falling in 2015. Since then they’ve gone sideways. They’re, because the technicians say, “constructing trigger”.

I reckon the low is in. It got here in 2015. And we re-tested it final yr.

What do you assume?

[ad_2]

Source link