FX Evaluation: USD/JPY, AUD/JPY

- Markets present reduction after yesterday’s international sell-off

- USD/JPY sell-off pauses, however risk of the carry commerce unwind stays

- AUD/JPY embodies the danger off commerce throughout the FX house

Really useful by Richard Snow

Get Your Free JPY Forecast

Markets Present Aid after Yesterday’s World Promote-off

The results of yesterday’s international sell-off look like easing on Tuesday. Danger gauges just like the VIX, the yen and the Swiss franc have seen the promoting maintain up in the meanwhile. The sharp international sell-off has been influenced by quite a few elements however one stands on the coronary heart of it, the carry commerce unwind.

With the Fed posturing up for a charge minimize and the Financial institution of Japan normalizing its financial coverage via charge hikes, a drop in USD/JPY all the time appeared doubtless. Nonetheless, the pace of its unravelling has shocked markets. For years buyers took benefit of ultra-low rates of interest in Japan to borrow yen after which make investments that low-cost cash in greater yielding investments like shares and even treasuries.

Markets at present worth in a 75% probability the Fed will kickstart the reducing cycle with 50 foundation level (bps) discount in September, as an alternative of the standard 25 bps, after to the US unemployment charge rose to 4.3% in July. Such concern, despatched the greenback decrease and the BoJ shock hike final month helped to strengthen the yen on the identical time. Due to this fact, the rate of interest differential between the 2 nations will likely be decreased type either side, souring long-standing carry commerce.

Buyers and hedge funds that borrowed in yen, had been compelled to liquidate different investments in a brief house of time to finance the settlement of riskier yen denominated loans/money owed. A quick-appreciating yen means it should require extra items of international forex to buy yen and settle these yen denominated loans.

USD/JPY Promote-off Pauses, however the Risk of the Carry Commerce Unwind Stays

This week Fed members tried to instill calmness to the market, accepting that the job market has eased however cautions towards studying an excessive amount of into one labour report. The Fed has admitted that the dangers of sustaining restrictive financial coverage are extra finely balanced. Holding charges at elevated ranges hinders financial exercise, hiring and employment and so at some stage the struggle towards inflation can jeopardise the Fed’s employment mandate.

The Fed is predicted to announce its first charge minimize because the mountain climbing cycle started in 2022 however the dialogue now revolves across the quantity, 25 bps or 50 bps? Markets assign a 75% probability of a 50 bps minimize which has amplified the draw back transfer in USD/JPY.

Whereas the RSI stays properly inside oversold territory, it is a market that has the potential to drop for a while. The unravelling of carry trades is prone to proceed so long as the Fed and BoJ stay on their respective coverage paths. 140.25 is the following rapid stage of assist for USD/JPY nevertheless it wouldn’t be stunning to see a shorter-term correction given the prolong of the multi-week sell-off.

USD/JPY Every day Chart

Supply: TradingView, ready by Richard Snow

Really useful by Richard Snow

How one can Commerce USD/JPY

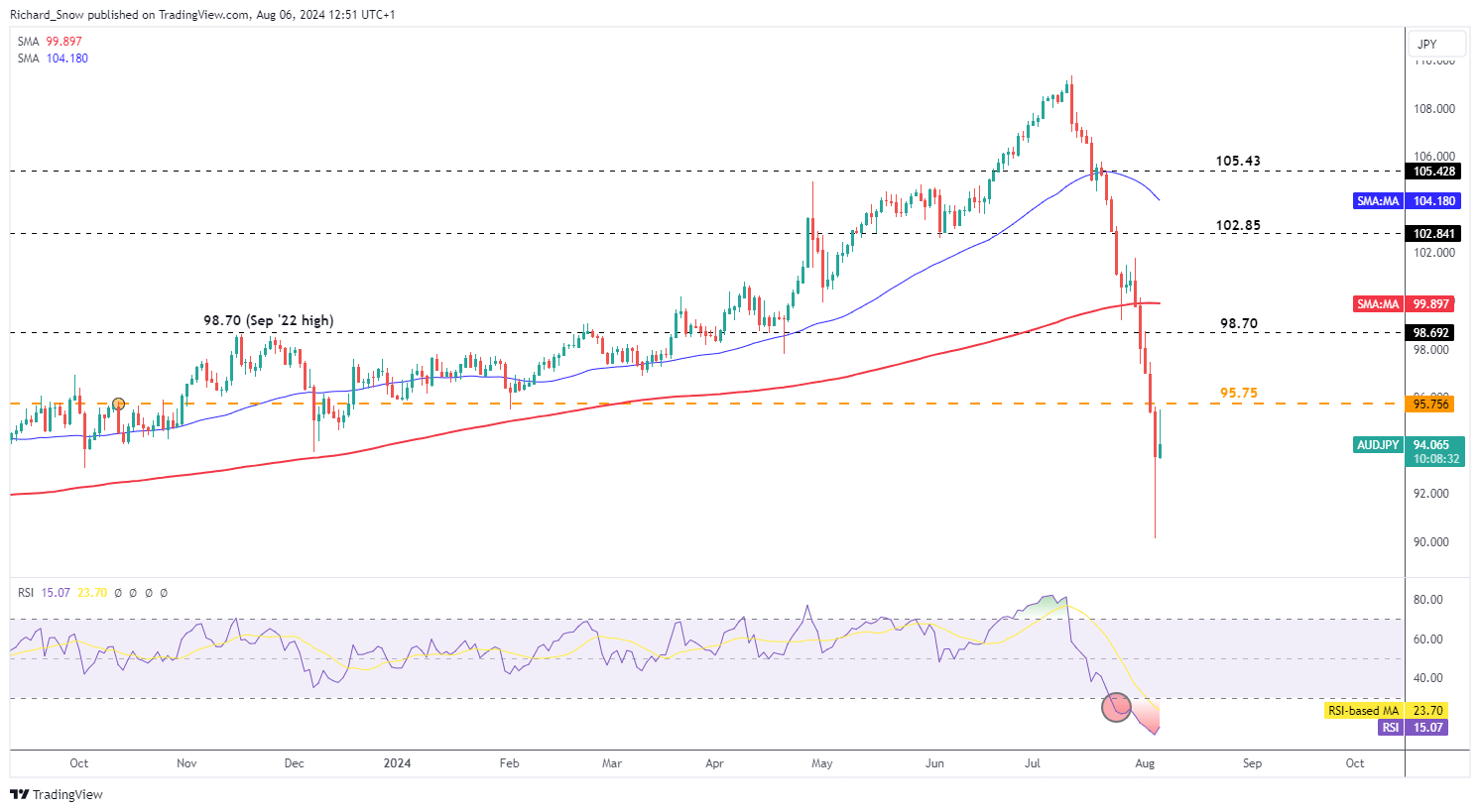

AUD/JPY Embodies the Danger off-Commerce throughout the FX World

AUD/JPY could be seen as a gauge for threat sentiment. On the one hand, you may have the Australian greenback which has exhibited a longer-term correlation with the S&P 500 – which itself, is named a threat asset. Due to this fact the Aussie sometimes rises and falls with swings in optimistic and unfavorable threat sentiment. Alternatively, the yen is a secure haven forex – benefitting from uncertainty and panic.

The AUD/JPY pair has revealed a pointy decline since reaching its peak in July, coming crashing down at a fast tempo. Each the 50 and 20-day SMAs have been handed on the best way down, providing little resistance.

Yesterday’s intra-day spike decrease and subsequent pullback suggests we could also be in a interval of short-term correction with the pair managing to rise on the time of writing. The AUD/JPY carry has been helped by the RBA Governor Michele Bullock stating {that a} charge minimize isn’t on the agenda within the close to time period, serving to the Aussie achieve some traction. Her feedback come after optimistic inflation information which has put prior discuss of charge hikes on the backburner.

95.75 is the following stage of resistance with assist at yesterday’s spike low at 90.15.

AUD/JPY Every day Chart

Supply: TradingView, ready by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and observe Richard on Twitter: @RichardSnowFX