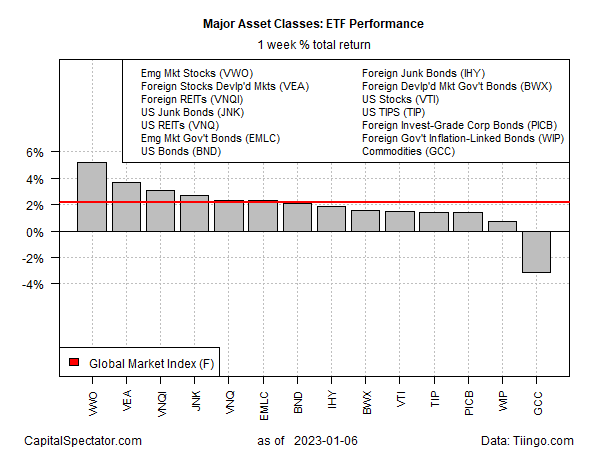

Almost all the main asset courses posted stable good points within the kickoff to the brand new 12 months based mostly on a set of proxy ETFs. The lone exception was commodities.

Shares in rising markets led the way in which increased for the buying and selling week by way of Friday’s shut (Jan. 6). Vanguard Rising Markets Inventory Index Fund () surged 5.2%, rising to its highest shut since August.

Aneeka Gupta at Wisdomtree UK Ltd. in London mentioned,

“Valuations [in emerging markets] have been depressed for a very long time they usually had been due for a correction however the actual catalyst for the outperformance was the greenback weakening and China coming again on-line,”

The remainder of the main asset courses’ predominant buckets rose final week–apart from commodities. WisdomTree Steady Commodity Index Fund (NYSE:), which holds a broad set of commodities, traded down 3.1%, falling to the low finish of its slender buying and selling vary of current months.

The World Market Index (GMI.F), an unmanaged benchmark maintained by CapitalSpectator.com, rebounded 2.1% within the opening week of 2023 – the primary weekly achieve up to now 5. This index holds all the main asset courses (besides money) in market-value weights through ETFs and represents a aggressive measure for multi-asset-class portfolio methods.

Main Asset Lessons: ETF Efficiency 1-Week Returns

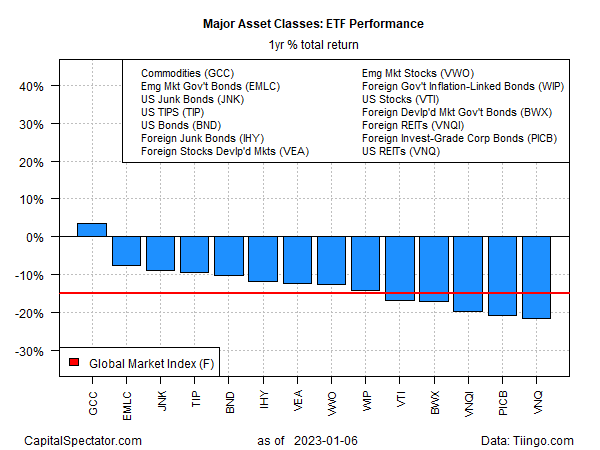

Regardless of final week’s broad-based rallies, most main asset courses proceed to endure losses for the one-year trailing window. The exception: commodities through GCC, which closed up 3.4% on Friday vs. its year-ago value.

GMI.F’s one-year efficiency is damaging, posting a 15.0% slide.

Main Asset Lessons: ETF Efficiency Yearly Returns

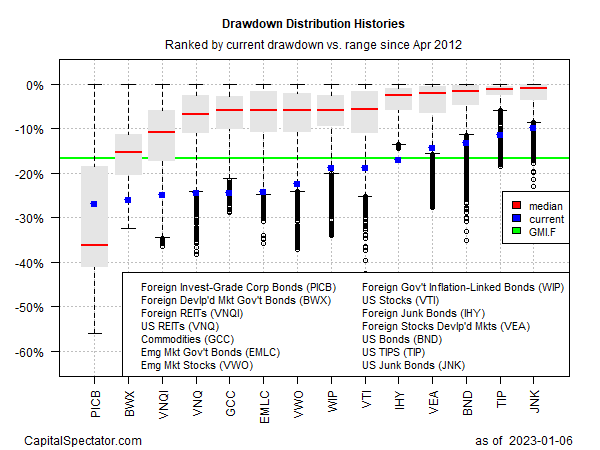

Evaluating the main asset courses by way of a drawdown lens exhibits comparatively steep declines from earlier peaks for many markets worldwide. The softest drawdown on the finish of final week: US junk bonds () with a ten.0% slide from its final peak.

GMI.F’s drawdown: -16% (inexperienced line within the chart under).

Drawdown Distribution Histories.