[ad_1]

- US inflation surprises to the upside, however markets shrug it off

- Greenback and shares shut unchanged as Fed narrative stays intact

- Oil and gold spike greater as US and UK launch airstrikes on Yemen

Merchants dismiss US inflation shock

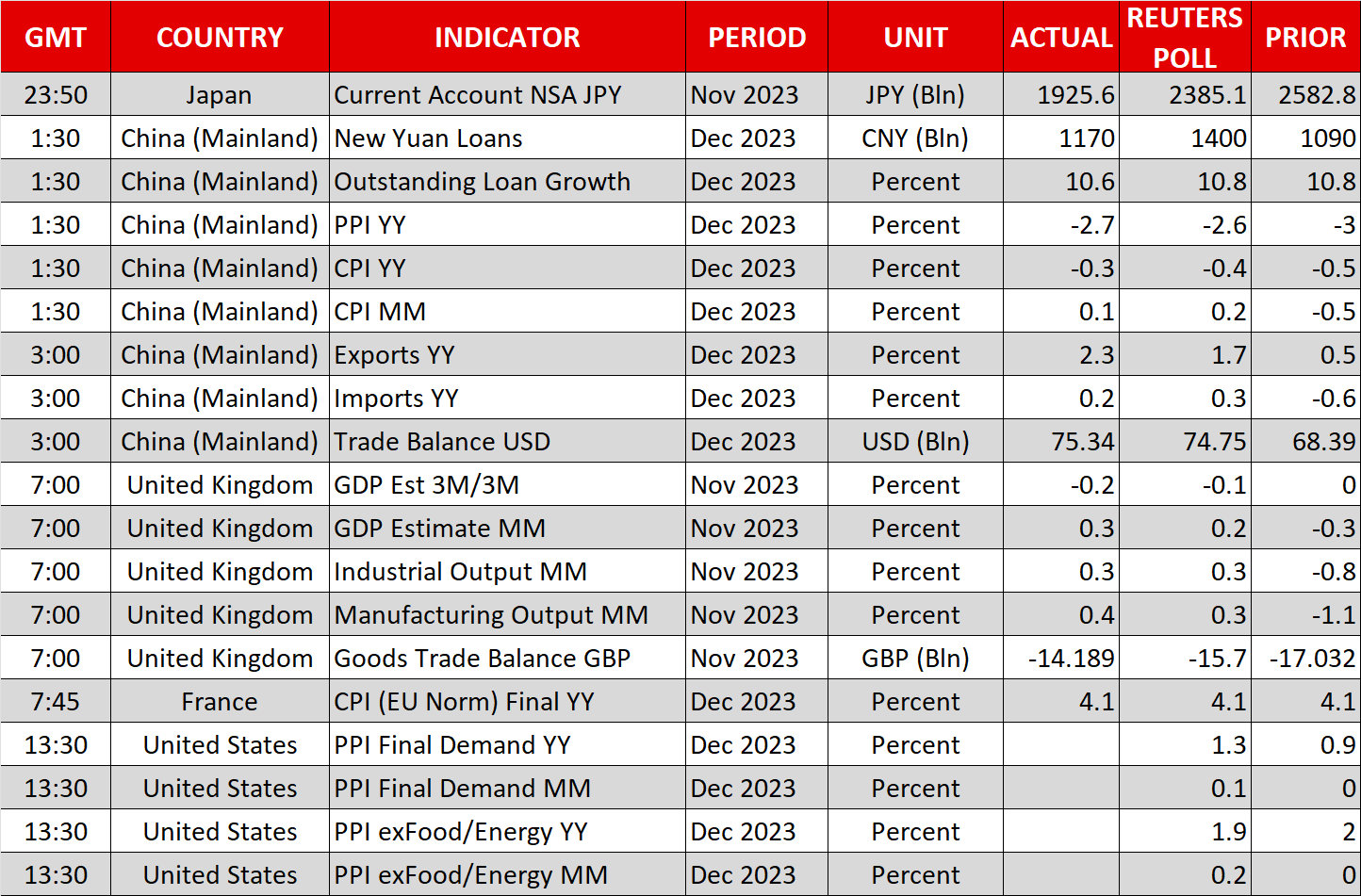

International markets went on a rollercoaster experience on Thursday after the US inflation report, however in the end ended precisely the place they began. Inflation as measured by the buyer worth index got here in hotter than anticipated in December, clocking in at 3.4% on an annual foundation, above the consensus estimate of three.2%. The core price was additionally a contact greater than economists had anticipated.

The preliminary market response was hawkish. The greenback spiked greater whereas equities and gold costs fell, as merchants trimmed some bets on rapid-fire Fed price cuts this yr. Nevertheless, these reactions quickly light, with all of those devices reversing course to shut the session virtually unchanged. Therefore, numerous volatility however with nothing to indicate for it in the long run.

In actual fact, the implied likelihood of a Fed price reduce in March rose barely as soon as the CPI mud settled. Sifting by means of the small print of this report, traders appear to have concluded that the CPI print was not surprising sufficient to change the trajectory of rates of interest, as a lot of the overshoot mirrored rising shelter prices which are thought of a lagging element of inflation.

It’s essential to spotlight that the Fed pays extra consideration to the PCE worth index, which places far much less weight on housing prices than the CPI does. Therefore, there’s a sense that the subsequent PCE print can be far more favorable for the disinflation story, holding the Consumed observe to launch an easing cycle as early as March.

Airstrikes in opposition to Yemen increase oil and gold

Within the geopolitical enviornment, the USA and Britain launched airstrikes in opposition to Iranian-backed Houthi militants in Yemen yesterday, in retaliation to assaults on industrial ships within the Pink Sea in latest weeks.

With tensions within the Center East already sky-high, this army strike fanned fears a couple of broader escalation within the area, which translated into a lift for oil and gold costs. That mentioned, this battle has had little direct impression on oil manufacturing to date, so it’s questionable whether or not such issues will help costs for lengthy with out additional escalation that truly takes some crude barrels offline.

Gold got here underneath promoting stress yesterday following the new CPI readings, however discovered contemporary purchase orders at its 50-day shifting common and rebounded with pressure, because the airstrikes in opposition to Yemen fueled demand for protected haven devices and pushed bond yields decrease.

The following main check for gold costs will come within the type of US retail gross sales on Wednesday, which can be a key piece of the puzzle about whether or not the Fed will slash charges in March, one thing markets at present assign a 70% likelihood to.

UK GDP beats estimates, China caught in deflation

The UK economic system grew barely greater than anticipated in November based on GDP information launched earlier at this time, calming some fears a couple of recession. But, the British pound was not impressed, as a result of though the UK would possibly dodge a downturn, financial development remains to be stagnant.

In China, figures for December confirmed that the world’s second-largest economic system remained trapped in deflation for a 3rd month operating. On the brilliant facet, the nation’s exports rose by greater than anticipated, fueling optimism that world manufacturing demand is lastly selecting up steam.

As for at this time, the limelight will fall on the most recent version of US producer costs. Over the weekend, all eyes will flip to the election in Taiwan, which may have repercussions on the worldwide stage contemplating the tensions between the island and China.

[ad_2]

Source link