[ad_1]

German Dax Outlook:

- Dax 40 dips as bullish momentum fades – can bulls overcome the following technical barrier of resistance and drive costs again in the direction of 15000?

- Equities proceed to observe modifications within the elementary backdrop forward of US CPI whereas Greenback stays blended.

- German Dax bullish above 14700

Advisable by Tammy Da Costa

Get Your Free Equities Forecast

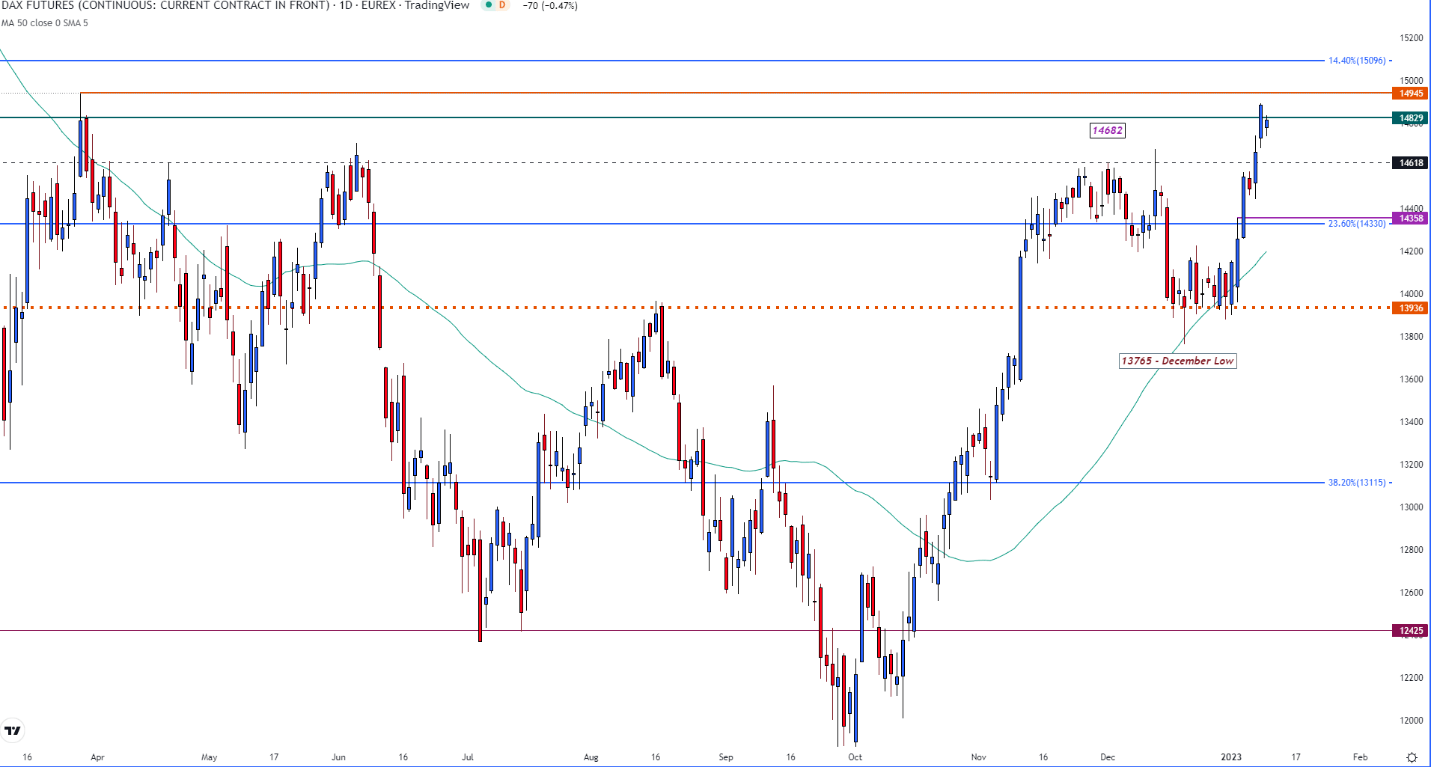

Fairness futures have taken a breather forward of tomorrow’s US CPI knowledge as traders awaited Fed Chair Jerome Powell’s speech. With Friday’s fairness rally driving Dax futures again above 14000, an extension of the upside transfer allowed bulls to drive costs greater earlier than peaking at 14894.

Regardless of central banks reaffirming their intentions to proceed to hike charges regardless of rising dangers of a world recession, technical ranges have offered a further catalyst for worth motion.

After rebounding off the October low of 11829, the performance-based Dax loved nine-weeks of positive factors earlier than stalling on the November excessive of 14618. With the formation of a doji candle on the weekly chart suggestive of indecision, the zone between 14618 and the December excessive of 14682 stays key for the upcoming transfer.

Dax Futures Weekly Chart

Chart ready by Tammy Da Costa utilizing TradingView

Whereas Dax futures dip under 14829, the 14700 and 14900 psychological ranges proceed to supply assist and resistance for the short-term transfer. A maintain above 14900 might then convey the March 2022 excessive again into play at 14945 opening the door for 15000.

Dax 40 Each day Chart

Chart ready by Tammy Da Costa utilizing TradingView

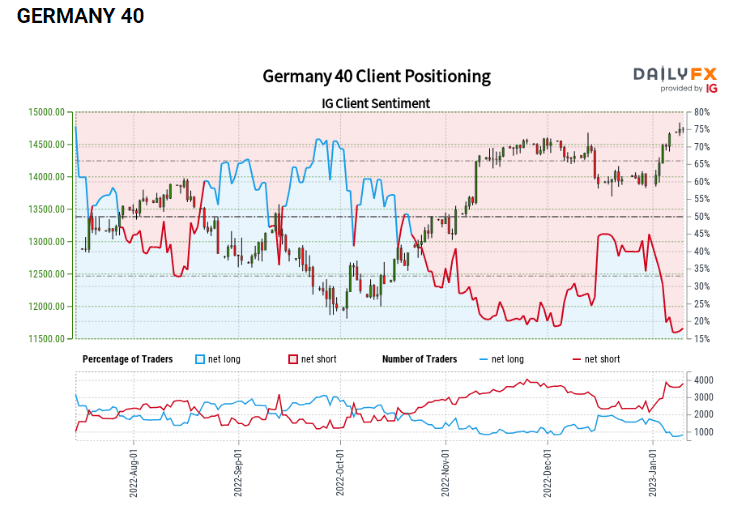

Dax Positioning Reaches Extremes – Bullish Sentiment Persists

We usually take a contrarian view to crowd sentiment, and the actual fact merchants are net-short suggests Germany 40 costs might proceed to rise.

Merchants are additional net-short than yesterday and final week, and the mix of present sentiment and up to date modifications offers us a stronger Germany 40-bullish contrarian buying and selling bias.

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and comply with Tammy on Twitter: @Tams707

[ad_2]

Source link