[ad_1]

- George Soros has handed over management of Soros Fund Administration and Open Society Foundations to son Alex Soros

- Fund has continued to supply constructive returns since 2020

- All of that regardless of the fund’s largest holdings being monetary establishments

George Soros made headlines this week by resigning because the supervisor of each Open Society Foundations and Soros Fund Administration, handing over the duty to his son Alex. In George Soros’s personal phrases, “he deserved it.”

This was stunning due to Soros senior’s earlier stance in opposition to his youngsters taking the helm.

Regardless of a weak 12 months for equities in 2022, Soros’s fund has managed to rack up spectacular features over the previous three years.

Soros Fund Administration’s Valuation Over the Previous 3 Years

Supply: InvestingPro

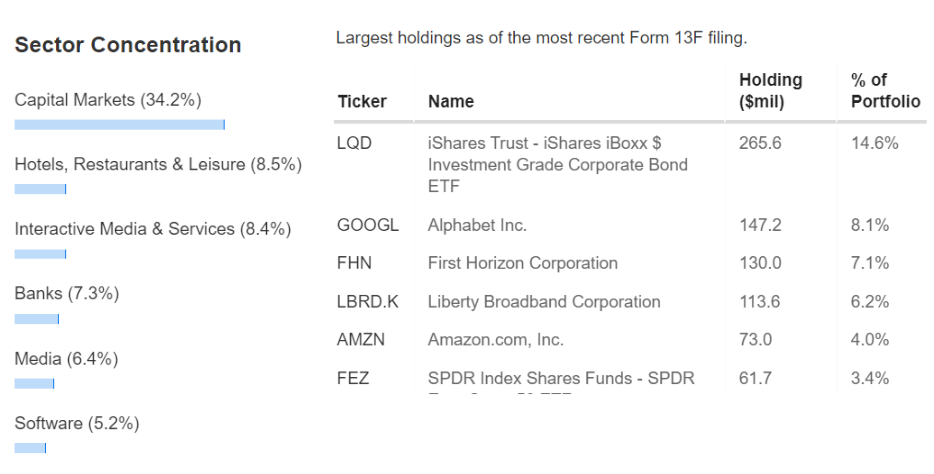

The portfolio’s main publicity is to monetary establishments by means of the iShares iBoxx $ Funding Grade Company Bond ETF (NYSE:), amongst different holdings.

Supply: InvestingPro

Let’s check out the outlook for the primary belongings within the portfolio utilizing InvestingPro.

iShares iBoxx $ Funding Grade Company Bond ETF

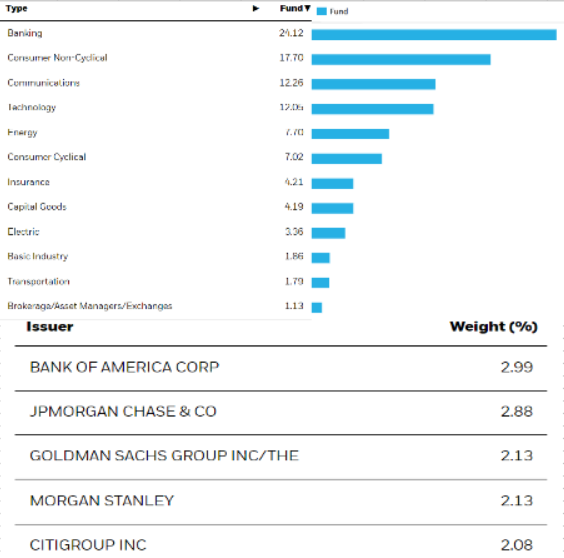

The iShares ETF, with a 14.6% share, is the biggest holding within the funding portfolio, tremendously impacting its valuation. Notably, it primarily focuses on the banking sector, which contains 25% of its whole holdings.

Struktura iShares iBoxx $ Funding Grade Company Bond

Supply: www.ishares.com

Among the many high 5 banks, three of them exhibit a constructive truthful worth outlook: Financial institution of America Company (NYSE:) with a possible upside of 10.4%, Citigroup Inc. (NYSE:) with a possible upside of 24.4%, and the main contender The Goldman Sachs Group (NYSE:) with a formidable upside potential of over 50%.

Until there may be further turmoil within the U.S. banking sector (which is a chance), the ETF’s largest holdings are anticipated to proceed their upward pattern.

Alphabet

Alphabet (NASDAQ:), a widely known tech big, is capitalizing on the present bull market within the U.S. inventory market.

The ‘s determination to pause the speed hike cycle is anticipated to offer short-term help to main U.S. indexes, though there stays a danger of additional will increase within the latter half of the 12 months.

At current, Alphabet’s inventory value is present process a interval of consolidation after a notable surge in demand.

The following goal degree for patrons appears to be the provision zone situated within the value space of $140, which can be preceded by a pure unwinding after such dynamic will increase.

In a corrective state of affairs, the native uptrend line is the primary goal to observe.

First Horizon Financial institution

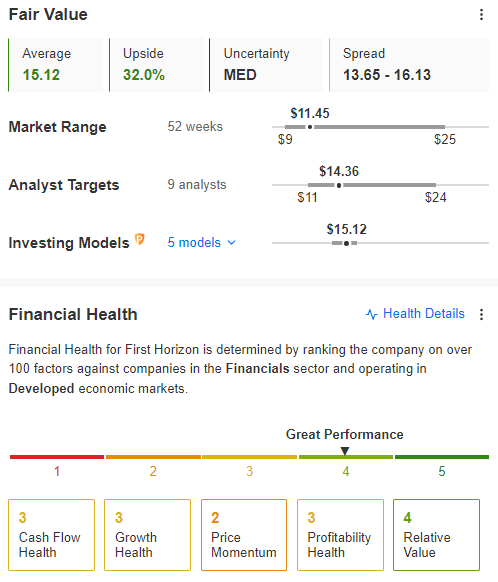

First Horizon Financial institution (NYSE:) inventory noticed vital declines in latest months, due to the problems within the U.S. banking sector following the collapse of Silicon Valley Financial institution.

Nonetheless, the scenario has stabilized, due to an intervention by the Fed, injecting substantial liquidity into the market and opening further channels for help.

From a basic perspective, the financial institution seems to be in good condition, evident in its excessive monetary well being scores and InvestingPro truthful worth indicating an upside potential of over 30% for the inventory.

First Horizon Honest Worth

Supply: InvestingPro

Dangers to the U.S. banking sector might stay excessive if the Federal Reserve raises rates of interest and reduces its steadiness sheet later this 12 months. This will increase the possibility of black swan occasions, inflicting enormous market meltdowns.

Which is why it’s best to conduct an intensive evaluation earlier than selecting shares to your portfolio.

You’ll be able to subscribe and check out the InvestingPro premium instrument, which supplies complete instruments for conducting in-depth analyses.

The InvestingPro instruments help savvy buyers in analyzing shares. By combining Wall Road analyst insights with complete valuation fashions, buyers could make knowledgeable selections whereas maximizing their returns.

You’ll be able to conveniently entry a single-page view of full and complete details about totally different firms multi function place, saving you effort and time.

Begin your InvestingPro free 7-day trial now!!

Discover All of the Information you Want on InvestingPro!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, provide, recommendation, counseling, or funding advice. As such, it isn’t supposed to incentivize the acquisition of belongings in any method. As a reminder, any kind of asset is evaluated from a number of factors of view and is very dangerous and due to this fact, any funding determination and the related danger stay with the investor. The writer doesn’t personal the shares talked about within the evaluation.

[ad_2]

Source link