[ad_1]

International markets have been gripped by escalating tensions within the Center East, with explicit give attention to the continued battle between Israel and Hamas. Oil costs, which had barely eased final week, are as soon as once more on edge as a result of considerations that the battle may disrupt provides. The Vitality Info Administration’s latest knowledge indicated a drop in demand and an sudden rise in US crude inventories, including to the market’s cautious ambiance.

Oil Market Uncertainty:

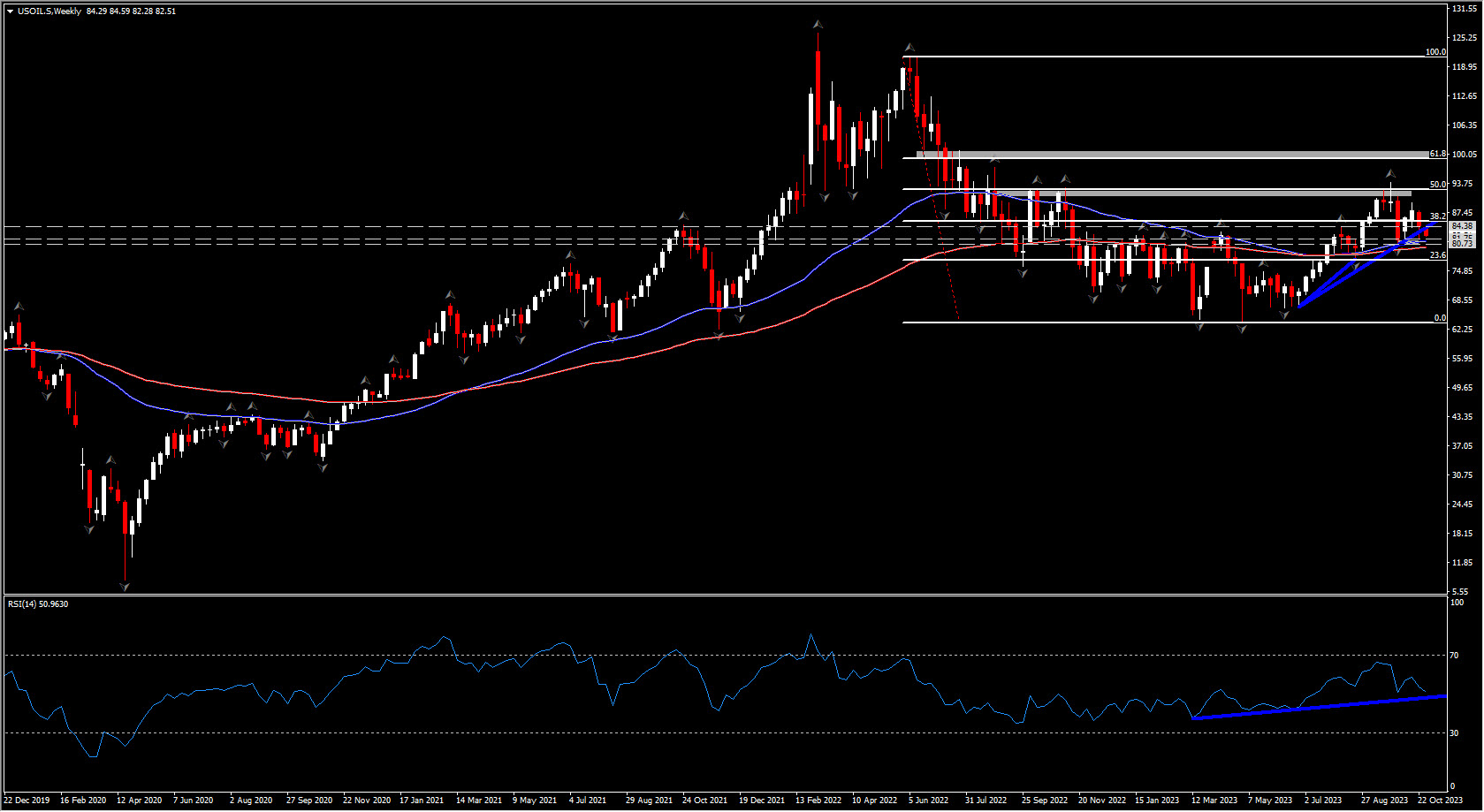

USoil is presently buying and selling at $84.07 per barrel, reflecting an extra 1.7% decline. Brent crude stands at $89.05. Regardless of a relative calm in costs in the beginning of the week, the opportunity of an escalation within the Israel-Hamas battle continues to be a major fear. The World Financial institution has warned that beneath a “giant disruption” situation akin to historic occasions just like the Arab oil boycott of the West in 1973, oil costs may soar to report highs of $150 a barrel. Even a “small disruption” situation may push costs into the vary of $93-102 per barrel.

Valuable Steel Rally:

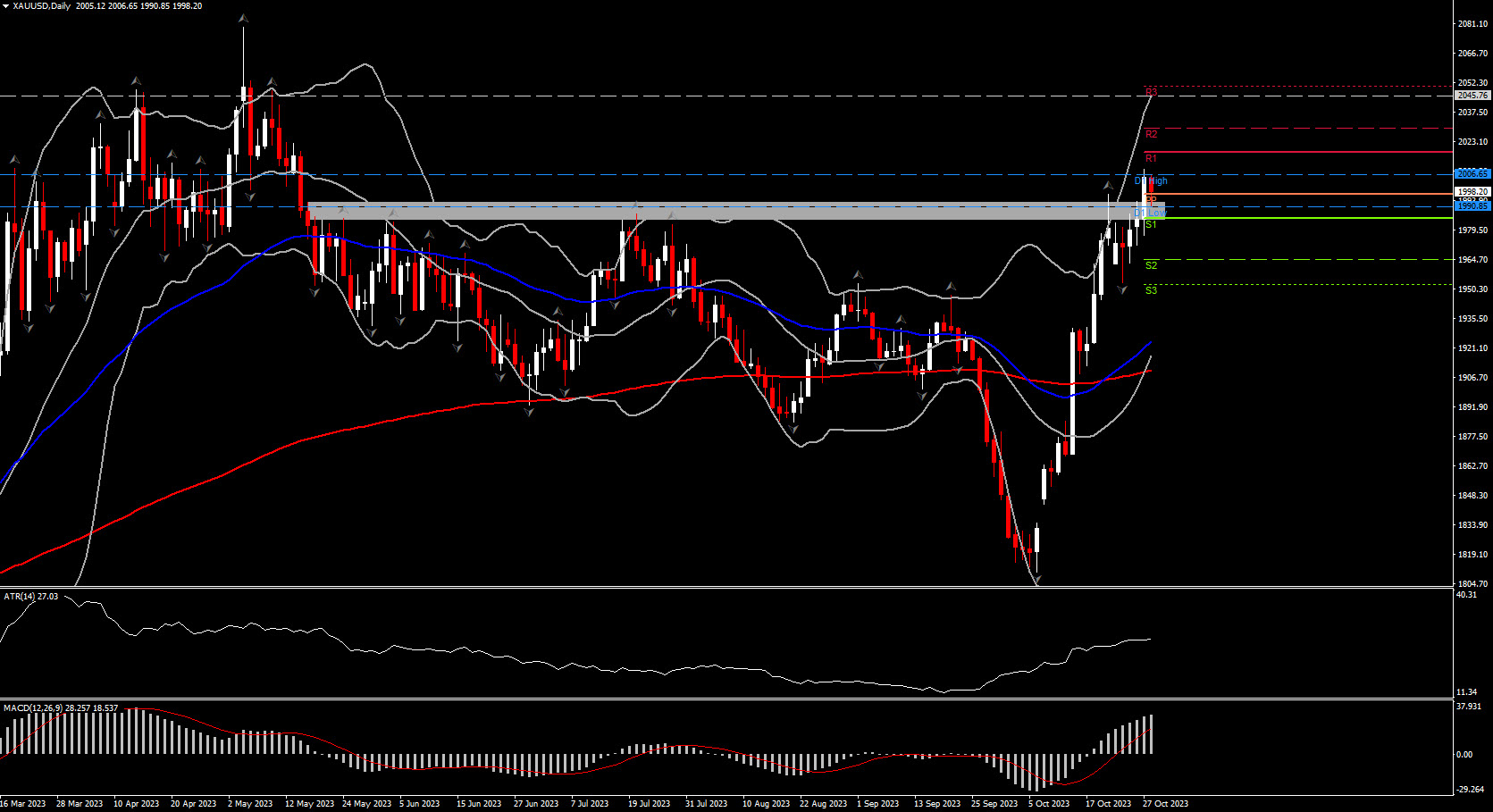

On the dear metals entrance, gold breached the $2,000 degree for the primary time since Could, sustaining its place at $2,002.29. The steel’s value surge is attributed to elevated threat aversion, pushed by geopolitical tensions. Secure-haven demand continues to bolster gold costs, with buyers intently monitoring developments within the Center East and awaiting the Federal Reserve’s upcoming announcement, which may additional affect market dynamics.

Gasoline Value Volatility:

Within the gasoline market, costs have skilled fluctuations. Whereas US gasoline costs fell, European gasoline costs, particularly within the Netherlands and the UK, noticed vital hikes as a result of renewed considerations about provide disruptions from the Center East. Egypt’s suspension of pure gasoline imports, mixed with Israel’s halting of gasoline manufacturing from its Tamar gasoline area, has heightened worries about potential provide shortages. Moreover, safety considerations concerning Qatari LNG vessels passing via the Strait of Hormuz have added to market jitters.

Amidst these uncertainties, Norway’s state-backed vitality firm Equinor reported that European gasoline provides are in a greater place than final winter, regardless of Russia’s diminished gasoline provides. Equinor’s CEO highlighted that the corporate has overcome challenges associated to upkeep, making certain gasoline and oil manufacturing is again to regular ranges.

As international markets navigate these uncertainties, buyers stay on excessive alert, intently monitoring geopolitical developments and their implications on vitality provides and valuable steel costs. The state of affairs within the Center East continues to be a focus, shaping market sentiments within the days to return.

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is supplied as a basic advertising communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication comprises, or needs to be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the data supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link