[ad_1]

Knowledge studies indicating a fall in UK wages in October triggered Sterling to say no, however draw back dangers had been restricted as this knowledge is unlikely to alter the Financial institution of England’s coverage stance on Thursday (14/12).

Payrolls fell barely by -13k in November, in comparison with October. Comparatively to November 2022, paid employment rose by 1.1% y/y or 333k. In the meantime, month-to-month wages elevated by 5.3% y/y, slowing from 6.2% y/y. Within the three months to October, the unemployment price was unchanged at 4.2% y/y. Common earnings progress (together with bonuses) slowed from 8.0% y/y to 7.2% y/y, beneath expectations of seven.7% y/y. Common earnings progress (excluding bonuses) slowed from 7.7% y/y to 7.3% y/y, beneath expectations of seven.4% y/y. Supply: ONS.

Following the info, cash market charges present merchants are actually totally anticipating the Financial institution of England’s first lower of 25bp for June, whereas the primary lower was anticipated in August earlier within the week. The Pound Sterling has weakened on account of continued price lower hypothesis.

The Financial institution of England is of the opinion that wages, that are a significant component in home inflation, are nonetheless too excessive to be per lowering inflation to the two.0% goal. Whereas this may be a constructive consequence, the BOE is predicted to maintain rates of interest at 5.2% for a while based mostly on the info.

The probability of the BOE being extra ‘hawkish’ in its assertion on Thursday stays low, as this wage knowledge suggests a looser labour market, beginning to result in slower wage progress. The financial institution believes it’s on observe to decrease inflation, however want to see an additional decline in wage pressures earlier than contemplating a price lower.

In the meantime, Japan’s PPI slowed from 0.9% y/y to 0.3% y/y in November, however beat expectations of 0.1% y/y. Nonetheless, it was nonetheless the weakest tempo since February 2021. November marked the eleventh consecutive month that the tempo slowed. Export costs had been unchanged at 0.9% y/y. The decline in import costs slowed from -12.7% y/y to -9.7% y/y, remaining unfavourable for the eighth month. On a month-to-month foundation, PPI rose 0.2% m/m. Import costs rose 0.7% m/m. Export costs fell -0.2% m/m. Producer worth progress remained beneath the newest client inflation determine for the third month. Shopper worth progress excluding recent meals edged as much as 2.9% in October.

JPY has seen a pointy decline, falling beneath 180.00 towards GBP, fuelled by a shift in investor sentiment relating to a possible price hike from the BOJ. Traders, who initially wager on a possible BOJ price hike, are actually reconsidering their positions. BOJ officers look like in no hurry to implement coverage tightening, until there may be clear proof of considerable wage progress that helps sustainable inflation. This cautious strategy has buyers questioning the timing and extent of future coverage changes. This, in flip, might imply that the yen’s strengthening is just non permanent.

The latest surge within the Yen was triggered by Governor Kazuo Ueda’s feedback, which signalled the potential for the central financial institution abandoning its unfavourable rate of interest coverage sooner than anticipated. Nevertheless, this optimism was short-lived as market dynamics rapidly modified.

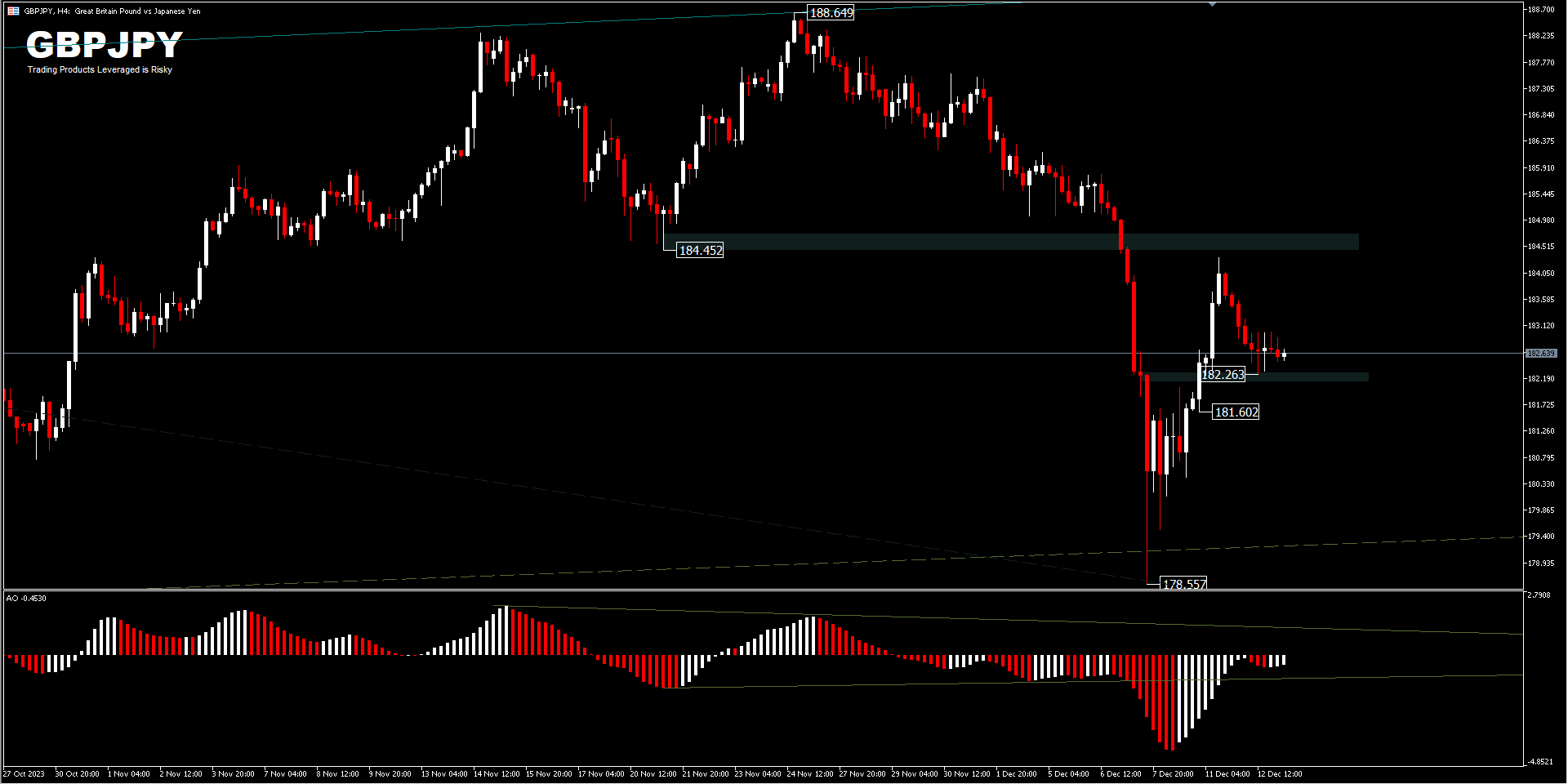

Within the FX market, GBPJPY’s decline was contained on the 200-day EMA and unexpectedly bounced again to the neckline vary. Technically, the decline that occurred final week doesn’t totally point out a change in development, till it’s confirmed that the pair has moved beneath 176.29 assist. If, certainly, that’s the case, then costs are projected to FE100 from 188.64-178.55 drawdown and 184.31 at 174.22. In the meanwhile, nevertheless, GBPJPY worth stays in an upward worth trajectory.

In the meantime, the intraday of the GBPJPY cross pair turned impartial with the present pullback. On the draw back, a break of 182.26 minor assist is more likely to take a look at 181.60 assist and can point out that the rebound is full. The intraday bias will return to the draw back to retest the 178.55 low. The general outlook will stay bearish so long as the 184.45 neckline generated from the double high sample holds, as in any other case a retest of 188.65 nonetheless stays.

Click on right here to entry our Financial Calendar

Ady Phangestu

Market Analyst – HF Academic Workplace – Indonesia

Disclaimer: This materials is supplied as a common advertising communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication accommodates, or must be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data supplied is gathered from respected sources and any data containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the data supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link