[ad_1]

GBP/USD and EUR/GBP – Costs, Charts, and Evaluation

- Financial institution of England (BoE) is predicted to hike charges by 25bps.

- Cable slips after US NFPs however from a lofty stage.

- EUR/GBP testing vary assist.

Advisable by Nick Cawley

Get Your Free GBP Forecast

The Financial institution of England is predicted to lift the Financial institution charge by an extra 25 foundation factors subsequent Thursday as a part of an ongoing effort to fight tremendous sturdy and sticky UK inflation. UK headline inflation (10.1%) stays in double-digit territory for the seventh month in a row, whereas UK inflation of 6.2% is simply 0.3% away from the multi-decade excessive of 6.5% seen in September and October final yr. For all of the discuss that UK inflation will fall away rapidly as we head into the second half of the yr, there’s nothing, as but, to be constructive about.

UK Headline Inflation

As all the time, what Governor Bailey says in his post-decision assertion and press convention can be key for Sterling going ahead. If the BoE stays assured that inflation goes to fall sharply, then the central financial institution might trace that future charge hikes will not be baked-in as but and stay data-dependent.

Advisable by Nick Cawley

Easy methods to Commerce GBP/USD

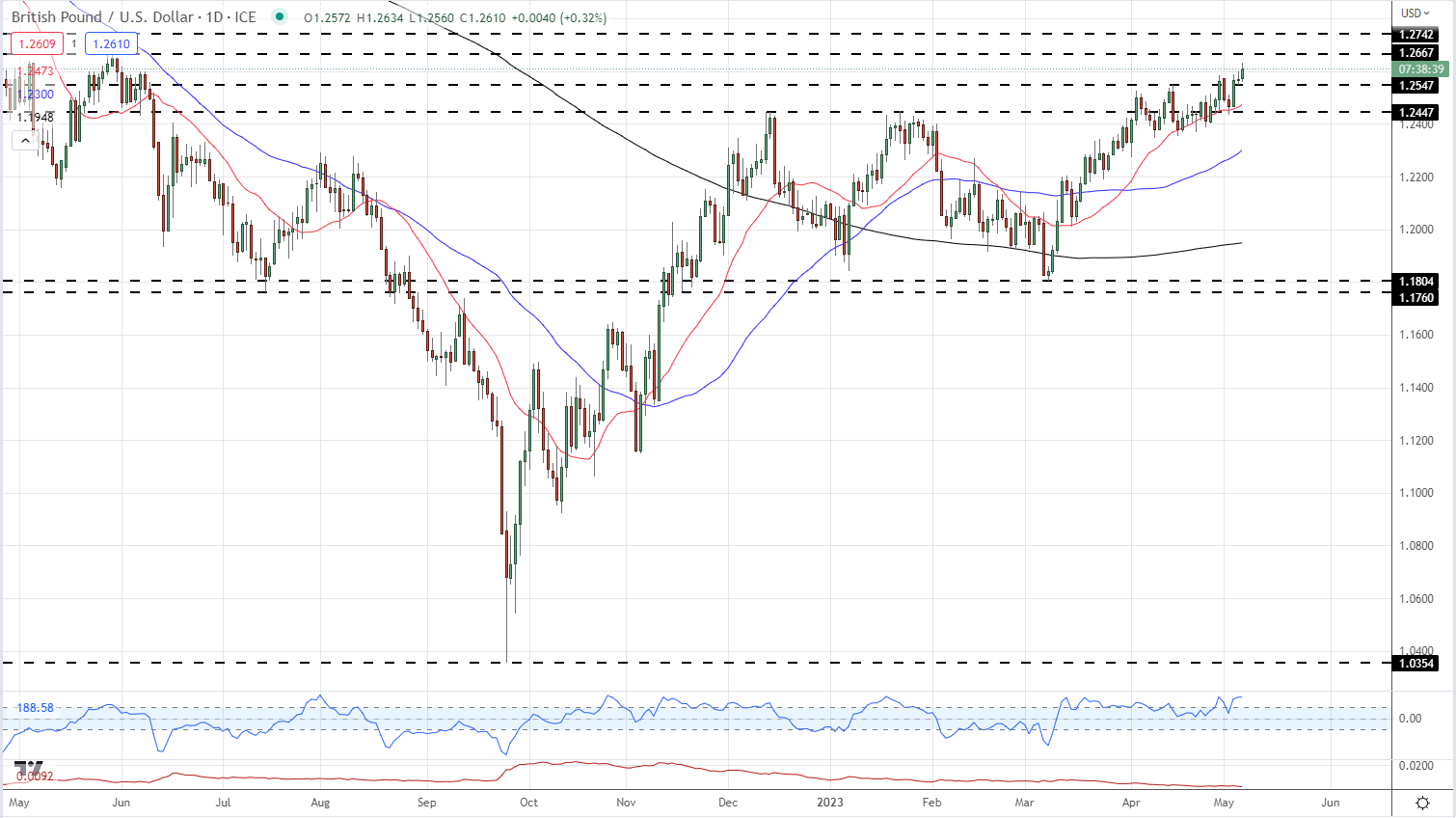

GBP/USD is giving again a small a part of its current rally that noticed the pair hit a recent multi-month excessive of 1.2634 right now. The pair might try to reclaim this mark early subsequent week forward of the BoE, with preliminary resistance seen at 1.2667 forward of 1.2742.

GBP/USD Each day Worth Chart – Could 5, 2023

Chart through TradingView

| Change in | Longs | Shorts | OI |

| Each day | -13% | 2% | -3% |

| Weekly | -3% | 6% | 4% |

GBP/USD Retail Sentiment is Blended

Retail dealer information present 34.24% of merchants are net-long with the ratio of merchants brief to lengthy at 1.92 to 1.The variety of merchants net-long is 3.58% greater than yesterday and 12.29% decrease from final week, whereas the variety of merchants net-short is 0.21% decrease than yesterday and 18.32% greater from final week.

We usually take a contrarian view to crowd sentiment, and the actual fact merchants are net-short suggests GBP/USD costs might proceed to rise. Positioning is much less net-short than yesterday however extra net-short from final week. The mix of present sentiment and up to date modifications offers us an extra combined GBP/USD buying and selling bias.

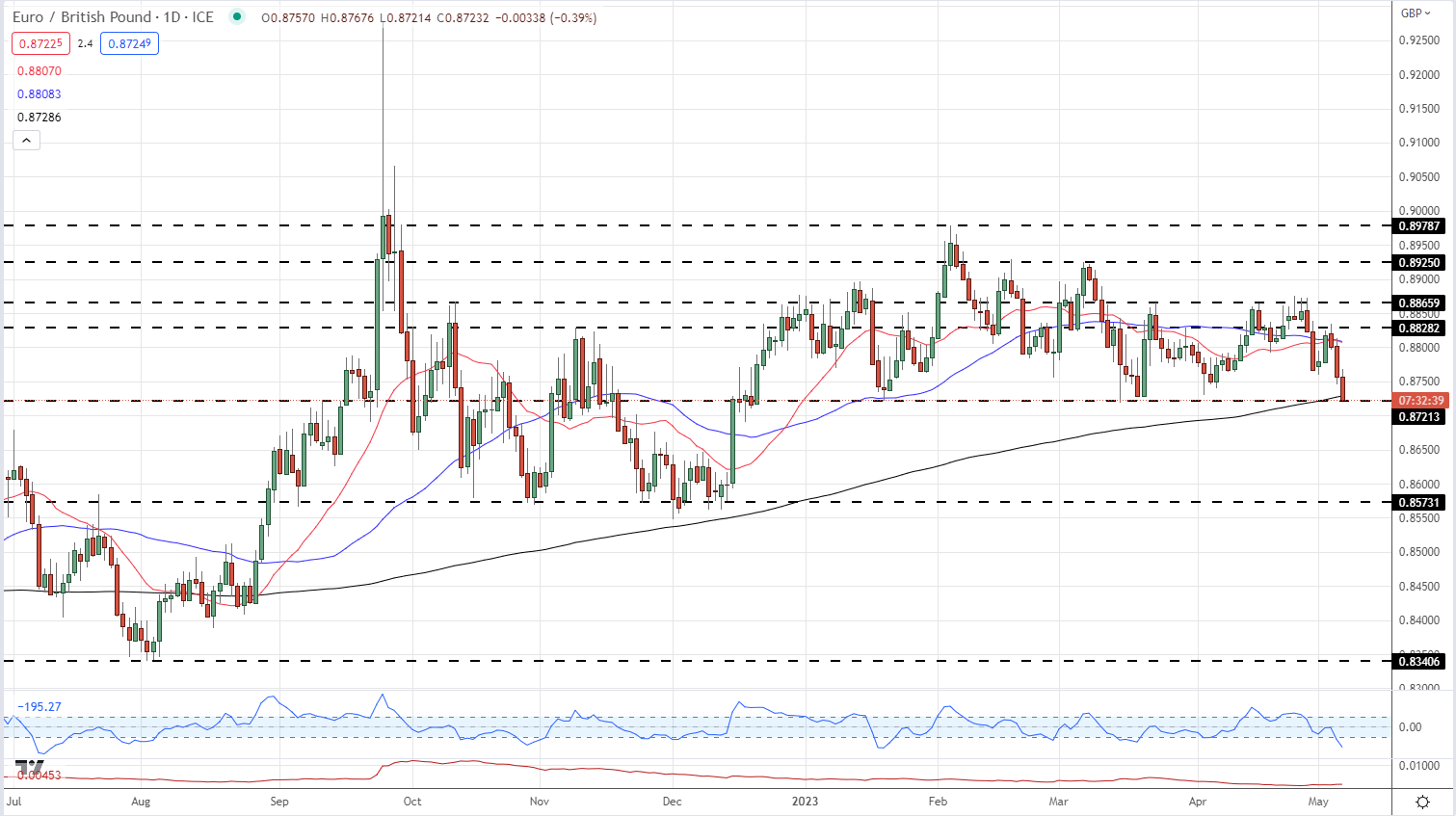

EUR/GBP is sitting on a previous stage of horizontal that has held agency this yr. The pair are additionally testing the 200-day shifting common for the primary time since late August final yr. Beneath right here there may be little in the way in which of current technical assist till one other space of prior assist across the 0.8570 comes into view.

EUR/GBP Each day Worth Chart – Could 5, 2023

Chart through TradingView

Retail dealer information present 63.17% of merchants are net-long with the ratio of merchants lengthy to brief at 1.71 to 1.Merchants are additional net-long than yesterday and final week, and the mixture of present sentiment and up to date modifications offers us a stronger EUR/GBP-bearish contrarian buying and selling bias.

What’s your view on the GBP/USD and EUR/GBP – bullish or bearish?? You may tell us through the shape on the finish of this piece or you possibly can contact the writer through Twitter @nickcawley1.

[ad_2]

Source link