[ad_1]

US DOLLAR ANALYSIS AFTER US INFLATION

The U.S. greenback, as measured by the DXY index, superior modestly on Wednesday following considerably combined U.S. inflation figures.

Headline CPI rose 0.6% on a seasonally adjusted foundation in August, pushing the 12-month studying to three.7% from 3.2% beforehand, one-tenth of a % above consensus estimates. In the meantime, the core gauge, which tends to mirror longer-term developments within the economic system, climbed 0.6% month-to-month and 4.3% in comparison with the earlier yr, carefully aligning with Wall Road’s projections in each cases.

US INFLATION DATA AT A GLANCE

Supply: DailyFX Financial Calendar

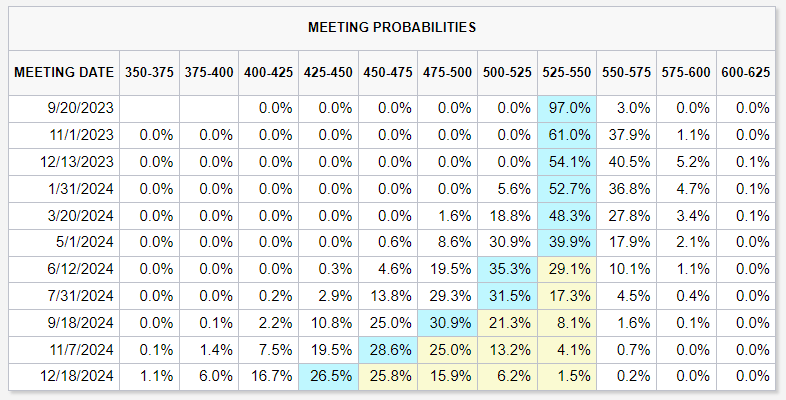

Immediately’s information had little affect on market pricing for the September FOMC conclave, with merchants principally anticipating no financial coverage motion. Relating to the November assembly, the preliminary response in swaps instructed a larger probability of a quarter-point hike, however these odds decreased once more because the day progressed, highlighting investor uncertainty.

Don’t let buying and selling alternatives slip away. Obtain the U.S. greenback quarterly forecast for key insights and methods!

Advisable by Diego Colman

Get Your Free USD Forecast

FOMC MEETING PROBABILITIES

Supply: FedWatch Device – CME Group

With rate of interest expectations in a state of flux and the Fed extremely delicate to new data, it is very important keep watch over the financial calendar as incoming information might transfer the needle for policymakers and affect the trail of financial coverage.

On this context, three pivotal reviews—retail gross sales, wholesale inflation, and shopper sentiment—stand poised to supply invaluable insights into the broader U.S. financial panorama and set up the tone for the U.S. greenback towards the British pound and the Aussie within the upcoming days. It’s advisable for merchants to maintain a vigilant watch on these occasions.

Uncover skilled methods and helpful suggestions. Obtain the “The way to commerce GBP/USD” to empower your buying and selling!

Advisable by Diego Colman

The way to Commerce GBP/USD

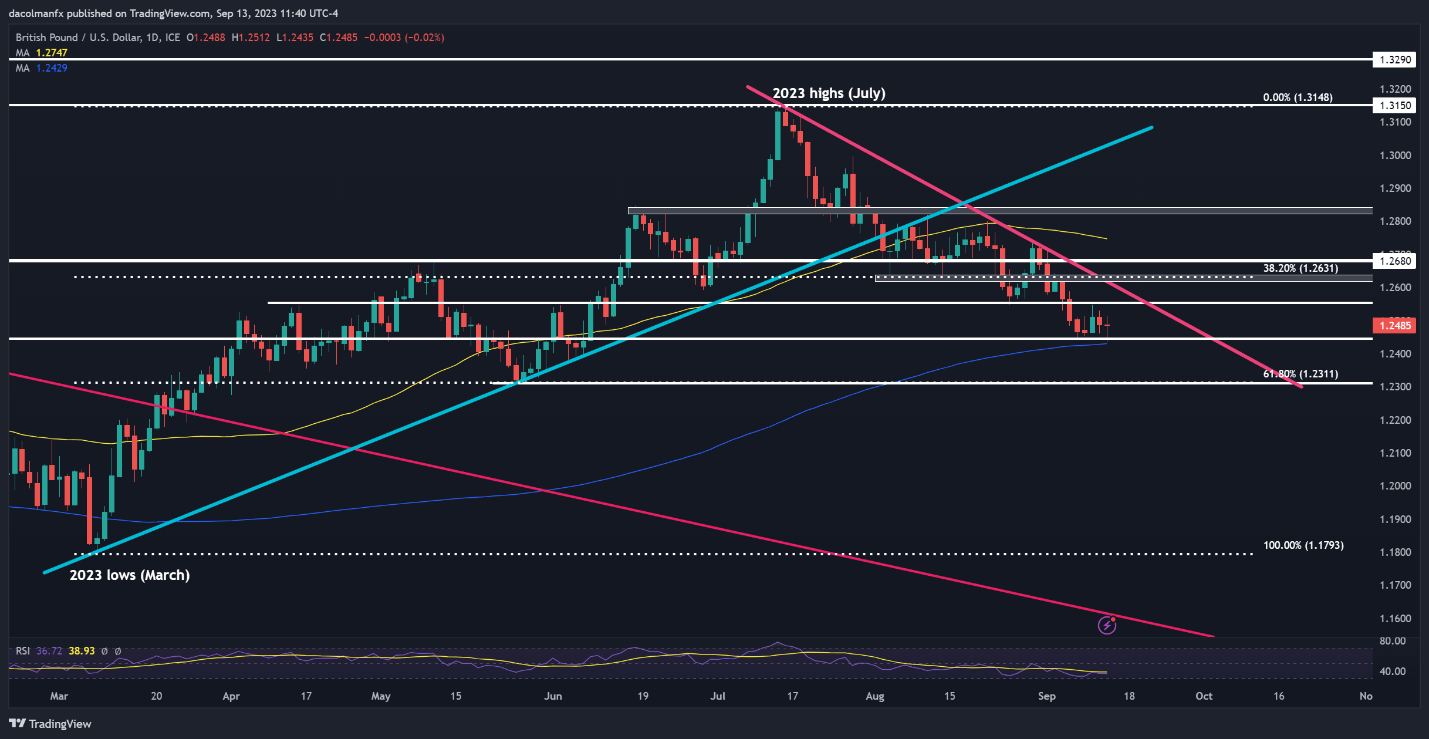

GBP/USD TECHNICAL ANALYSIS

GBP/USD has suffered heavy losses since mid-July however has held above its 200-day easy transferring common round 1.2450, with the bulls defending this technical help tooth and nail up to now, an indication that the worst could also be over for sterling.

If the 200-day SMA holds within the coming days, it will be the clearest indication that the pair has bottomed out and {that a} restoration section may quickly start. Beneath this state of affairs, we may see a transfer in direction of 1.2550, adopted by a potential retest of trendline resistance close to 1.2600. On additional energy, the main target shifts to 1.2685.

On the flip facet, if 1.2450 offers means, all bets are off. Such a breakdown might be a foul omen for the pound, reinforcing draw back stress and setting the stage for a pullback in direction of 1.2311, a key flooring created by the 61.8% Fibonacci retracement of the March/July rally.

GBP/USD TECHNICAL CHART

GBP/USD Chart Ready Utilizing TradingView

Decode worth motion and keep forward of AUD/USD developments. Obtain the sentiment information to know how positioning can provide clues concerning the market route!

| Change in | Longs | Shorts | OI |

| Day by day | -2% | -8% | -4% |

| Weekly | -10% | 17% | -6% |

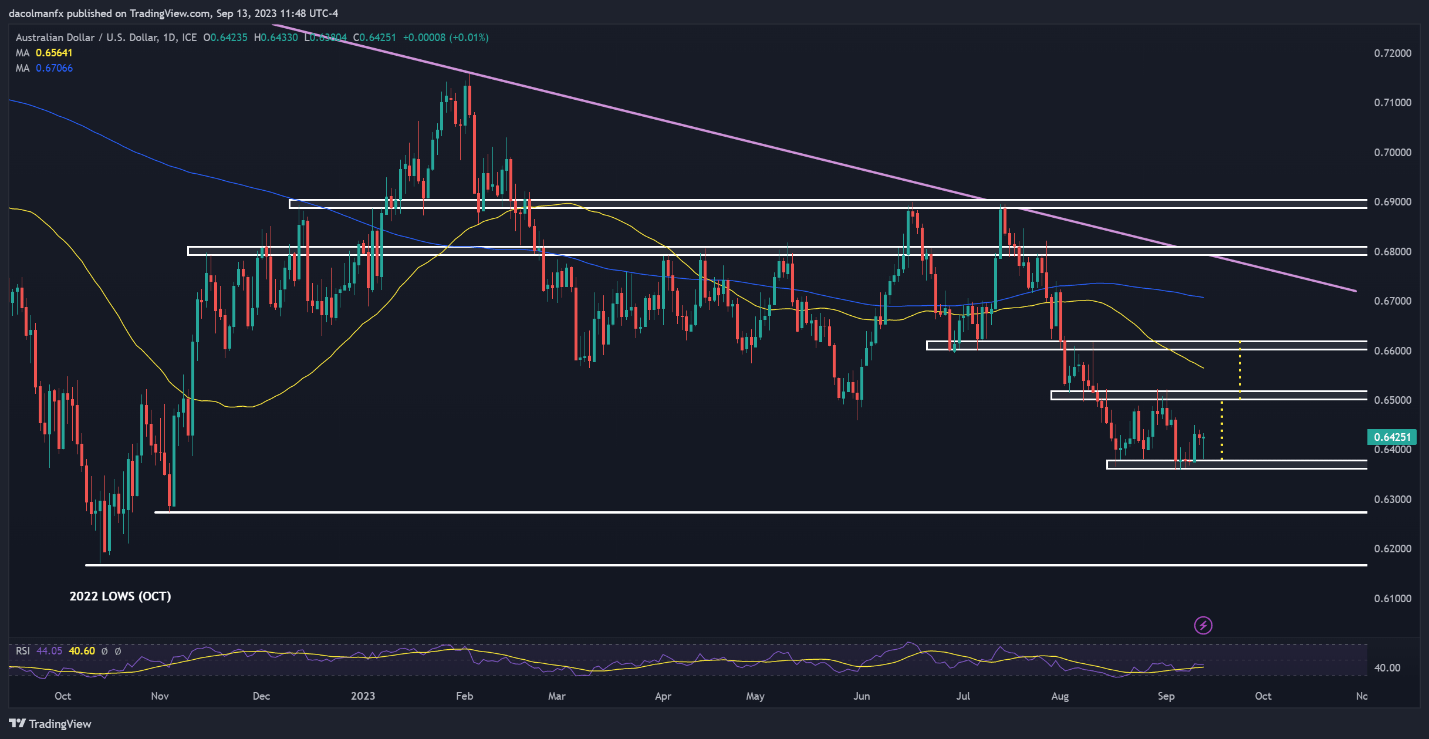

AUD/USD TECHNICAL ANALYSIS

The Australian greenback was uneven on Wednesday, oscillating between small features and losses however missing agency directional conviction. Regardless of the indecision, AUD/USD seems to be within the strategy of creating a double backside, which often tends to herald the exhaustion of draw back stress earlier than a rebound.

To dig deeper into the particulars, a double backside is a reversal technical formation consisting of two related troughs separated by a crest within the center. Affirmation of this bullish configuration happens when costs full the “W” form and break above the neckline resistance outlined by the intermediate peak.

To evaluate the potential extent of the value rise following the validation of the sample, merchants can undertaking its top vertically from the breakout level. This estimate gives a sensible approximation of the anticipated magnitude of the transfer, providing useful steering when contemplating buying and selling methods and danger administration.

Within the case of AUD/USD, the neckline resistance at present sits within the vary of 0.6500 to 0.6510. If the pair can convincingly breach this barrier, shopping for momentum may collect tempo, doubtlessly opening the door for a climb past the psychological degree of 0.6600.

Conversely, if sellers regain management of the market and spark a bearish turnaround, help will be discovered at 0.6360. A drop under this degree would invalidate the double backside, setting the stage for a decline in direction of 0.6275, adopted by 0.6170 within the occasion of additional weak spot.

Grasp AUD/USD buying and selling like a professional. Obtain the “The way to Commerce the Australian Greenback Information” for skilled insights and suggestions!

| Change in | Longs | Shorts | OI |

| Day by day | -2% | -8% | -4% |

| Weekly | -10% | 17% | -6% |

AUD/USD TECHNICAL CHART

AUD/USD Technical Chart Created Utilizing TradingView

[ad_2]

Source link