[ad_1]

GBP/USD Information and Evaluation

- Financial institution of England’s Mann involved by optimistic fee reduce estimates

- Put up-FOMC rebound on the playing cards for GBP/USD?

- IG consumer sentiment blended regardless of majority net-long positioning

Financial institution of England’s Mann Involved by Optimistic Price Minimize Estimates

One of many staunch ‘hawks’ throughout the Financial institution of England’s Financial Coverage Committee (MPC) is Catherine Mann and he or she has lately clarified why she now not voted in favour of a hike. Mann is of the opinion that market expectations round fee cuts is just too excessive, one thing that seems to be supporting the native forex.

She has expressed that wage dynamics within the UK are stronger than within the EU and US which she suggests makes it onerous to argue that the BoE can be forward of each nations in terms of rate of interest cuts. One thing the market would have been attentive to was the February inflation report which revealed an encouraging drop on the way in which to the Fed’s 2% goal by mid-year.

Study the ins and outs of buying and selling probably the most liquid foreign exchange pairs. GBP/USD:

Really helpful by Richard Snow

Learn how to Commerce GBP/USD

Put up FOMC Rebound on the Playing cards for GBP/USD?

The each day GBP/USD chart reveals an try and carry off the strict zone of assist discovered on the 200-day easy transferring common and the 1.2585 stage that assist up costs for giant elements of early 2024 when costs exhibited a range-bound choice.

Since spiking above the prior vary, not for the primary time both, GBP/USD heads again into acquainted territory because the pair appears to recuperate from the sharp decline. 1.2736 is the following stage of resistance ought to bulls take over from right here. Sterling stands to profit from a barely weaker greenback at the beginning of the holiday-shortened week which additionally occurs to be very quiet from a scheduled threat perspective with simply PCE knowledge scheduled for launch on Good Friday.

GBP/USD Day by day Chart

Supply: TradingView, ready by Richard Snow

| Change in | Longs | Shorts | OI |

| Day by day | -10% | 17% | -1% |

| Weekly | 6% | 3% | 5% |

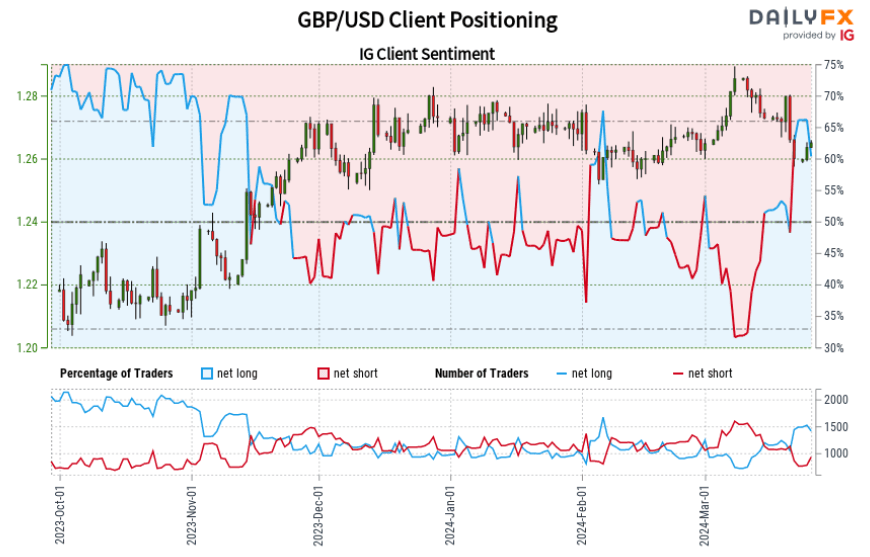

IG Retail Consumer Sentiment Blended Regardless of Majority Lengthy Positioning

Supply: TradingView, ready by Richard Snow

GBP/USD:Retail dealer knowledge reveals 59.14% of merchants are net-long with the ratio of merchants lengthy to quick at 1.45 to 1.

We usually take a contrarian view to crowd sentiment, and the actual fact merchants are net-long suggests GBP/USD costs could proceed to fall.

Learn the detailed GBP/USD sentiment report to search out out why current modifications in positioning has clouded the outlook for the pair from a contrarian view level.

Positioning is much less net-long than yesterday however extra net-long from final week. The mix of present sentiment and up to date modifications provides us a additional blended GBP/USD buying and selling bias.

Keep updated with the newest breaking information and themes driving markets by signing as much as out e-newsletter under:

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX crew

Subscribe to E-newsletter

— Written by Richard Snow for DailyFX.com

Contact and comply with Richard on Twitter: @RichardSnowFX

[ad_2]

Source link