[ad_1]

Day Trading with Order Flow (Step by Step)

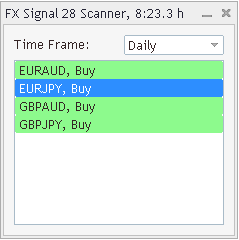

1. Launch the FX Signal 28 Scanner on the Daily Time Frame

2. Click on the pairs listed on the dashboard to open a chart

3. Look for a Breakout supported by Order Flow

4. Apply the Stop Order Strategy

- Place a Buy Stop Order at the high of the breakout candle

- Place a Stop Loss at the low of the breakout candle

- Take Profit when order flow is no longer present

4. Recognise the trend, is this the first leg, second or third?

Here are some General Rules for Trend Analysis:

- A trend is defined by three to four legs.

- The first leg highlights the beginning of a trend: with a distinct V-Shape.

- If the second leg is larger than leg one: expect a third leg.

- If the second leg is smaller than leg one: do not expect a third leg.

- If the third leg is larger than leg two: expect a fourth leg.

- If the third leg is smaller than leg two: do not expect a fourth leg.

- Order flow that occurs at the end of the trend (third/fourth leg) is dangerous to trade!

- The second leg is the best to trade because it is often the longest.

In the picture below we can see that EUR/JPY is currently in the progress of creating “Leg 2”.

I will update this blog post later this week when there is more information on EUR/JPY…

[ad_2]

Source link