Paul Butterfield/Getty Images Entertainment

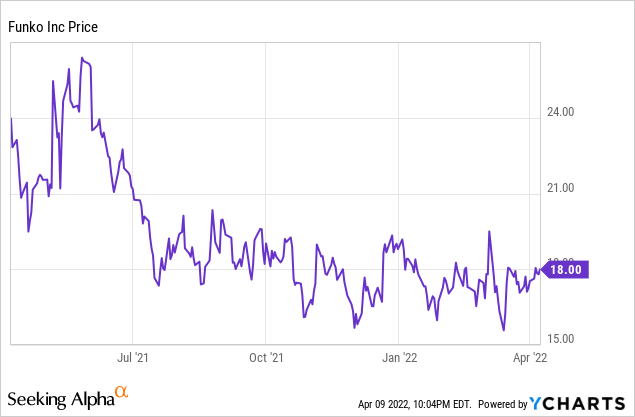

Look across the small-cap growth category and you’ll find a sea of red year to date with very few exceptions: investors just don’t want to take their chances right now. Funko (NASDAQ:FNKO), an eclectic toymaker best known for its Pop! figurines that are well-featured in toy sections of department stores in the U.S. and across the globe, is one of the few small-cap growth stocks to be enjoying a recent uptrend and avoid massive year-to-date losses.

Normally, when smaller stocks like this outperform, it’s usually due to hype and misguided mania – but in the case of Funko, it’s all about fundamentals and value. This company has continued to turn out spectacular results and drive strong execution, which is no small feat in a time period that has been very challenging for consumer products companies with constrained supply chains and elevated freight rates. While Funko’s gross margins have also taken a hit alongside the rest of the industry, its dazzling revenue growth and its plans to consolidate and economize on its operations make it stand out from the pack.

Something for everyone: the bull case for Funko revisited

I remain bullish on Funko for a number of reasons. In particular, I echo Funko’s most recognizable motto: the company offers something for everyone. It’s important to remind investors that Funko’s products span the pop culture universe and appeal to fans of almost every recognizable brand.

In the past, diversification for Funko meant adding new “properties” and brands to make figurines from. However, more recently, the company is also diversifying its merchandise types as well. Its “other” category, shown in the right side of the snapshot below, encompasses everything from apparel to plushes and accessories like backpacks and school supplies. Now roughly one-quarter of Funko’s revenue, the “other” category grew at an impressive 45% y/y pace in Q4.

Funko products (Funko Q4 investor presentation)

Here’s a full rundown of what I believe to be the key bullish drivers for Funko:

- Unparalleled ability to source and monetize the best content. From Fortnite to Pokemon to Marvel and other brands, Funko’s ability to nab the best content is unrivaled. No single brand dominates Funko’s revenue, so it’s well diversified to be the beneficiary of a general rise in entertainment and pop culture.

- International growth push. Though primarily a U.S. company now, Funko is driving strong growth overseas, especially in Europe where in the most recent quarter, Funko managed to achieve ~60% y/y revenue growth.

- NFTs. Last year, Funko acquired a company called TokenWave, which enabled it to finally get its skin in the NFT craze that kicked up amid the pandemic. Funko notes that its first few token offerings have “sold out in minutes,” potentially opening the door to an entirely new and fast-growing revenue stream going forward.

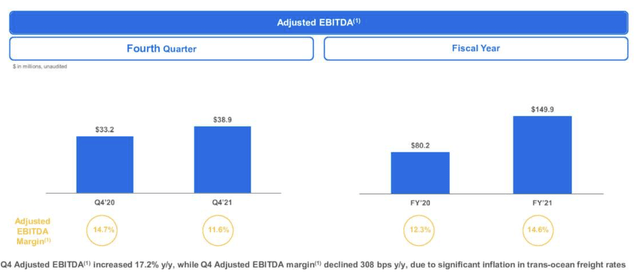

- Healthy profitability. Surprisingly enough for a small-cap company, Funko is profitable from both an adjusted EBITDA basis as well as GAAP earnings. In my view, investors’ hesitation around small-cap stocks generally stems from their favoring growth over profitability, but in Funko’s case it can brag about having both.

Valuation checkup

Not only is Funko growing like a weed and exhibiting various fundamental tailwinds, but the company is also trading at a very attractive value.

At current share prices of $18, Funko trades at a market cap of $914.2 million – still very much a small-cap company. After netting off the $83.6 million of cash and $173.2 million of debt on the company’s most recent balance sheet, Funko’s resulting enterprise value is $1.00 billion.

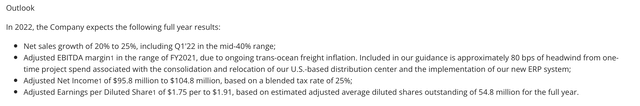

Meanwhile, as shown in the snapshot below, Funko is guiding to 20-25% y/y revenue growth (indicating $1.23-1.29 billion in revenue), $1.75-1.91 in pro forma EPS, and EBITDA margins that are expected to be roughly flat to FY21 (which came in at 14.6%) – translating to adjusted EBITDA of $180-188 million.

Funko FY22 outlook (Funko Q4 investor presentation)

With these parameters, Funko’s valuation stands at:

- 5.4x EV/FY22 adjusted EBITDA

- 9.8x FY22 EPS

For a company expecting to maintain ~40% y/y revenue growth through Q1, I’d say these are quite attractive multiples to pay.

Q4 download

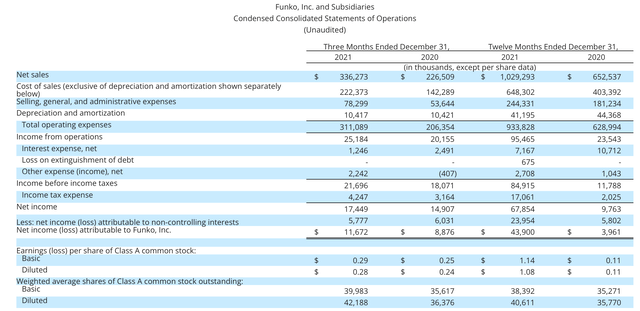

Let’s now go through Funko’s latest Q4 results in greater detail, which drove a lot of renewed enthusiasm for this stock. The Q4 earnings summary is shown below:

Funko Q4 results (Funko Q4 investor presentation)

Funko’s revenue grew at a stunning 49% y/y pace to $336.3 million, beating Wall Street’s expectations of $271.9 million (+20% y/y). Funko’s revenue growth also accelerated significantly versus 40% y/y growth in Q3.

Some other metrics worth mentioning: figurine revenue grew 50% y/y, while “other” products grew 45% y/y. In particular, Funko noted strong performance in its relatively new board games category. The company launched 40 new titles in 2021 alone.

Funko also grew in every geographic region, but performance was especially robust in Europe, where revenue grew 59% y/y.

Here’s some commentary from CEO Andrew Perlmutter’s prepared remarks on the Q4 earnings call, detailing the company’s growth drivers for FY22 as well as the standout performance drivers from the fourth quarter:

With this new brand structure, we’re better aligned to execute against our four growth pillars. Our first growth pillar is continued innovation within our core collectible brands category, while our second growth pillar is sustained revenue diversification through products and brands adjacent to our core portfolio.

Our third growth pillar is continued expansion of our D2C e-commerce platform. And finally, our fourth pillar is international expansion. Here we will continue to leverage the breadth of our brands and selectively add resources and capabilities to open up key international markets.

I’ll now share some of the highlights from the quarter. Under our first strategic growth pillar, we delivered another excellent quarter with strength across our collectible brands and in all channels. The Pop! brand grew 41% year-over-year in the fourth quarter. Our sustained success with Pop! Steps, not only from our industry-leading breadth of properties but also our strong fan engagement and innovation we bring to the Pop! product line.

We’ve introduced innovative new figures and designs and highly successful seasonal product lines. Our participation in the Macy’s Thanksgiving Day Parade with our balloon, featuring Grogu from the hit series, The Mandalorian, is a great example of the strong fan engagement and innovation we continue to bring to the brand.”

The one black mark that marred the strong top-line performance was freight costs, which is a concern all consumer-products companies are citing. Due to these logistics constraints, Funko’s gross margins fell 330bps to 33.9%.

The company was, however, able to offset this slightly with a 40bps reduction in selling, general and administrative expenses in the quarter as a percentage of revenue. Adjusted EBITDA margins fell 310bps to 11.6% in the quarter, but still grew 11% y/y to $38.9 million. Full-year adjusted EBITDA margins, however, still expanded 210bps to 14.6%, while on a dollar basis adjusted EBITDA grew 87% y/y to $149.9 million.

Funko adjusted EBITDA (Funko Q4 investor presentation)

Optimistically speaking, COVID-driven port logjams and logistics price spikes are a temporary phenomenon. Funko’s guidance already incorporates heightened freight rates in the first half of 2022, with expected easing in the second half of the year.

Key takeaways

Though hardly recognizable to the mainstream investor, Funko represents an incredible combination of investable merits: rapid growth rates, strong bottom-line performance, clear drivers for further expansion, and an attractive valuation. Keep riding the recent upward momentum here.