[ad_1]

Article by IG Senior Market Analyst Axel Rudolph

FTSE 100, DAX 40, Nasdaq 100 Evaluation and Charts

FTSE 100 falls off the bed as UK inflation unexpectedly rises

The FTSE 100, which on Tuesday slid by way of the 200-day easy transferring common (SMA) at 7,570, opened a lot decrease on Wednesday as UK inflation got here in at a stronger-than-expected 4.0% in December and core inflation at 5.1%.

The 7,450 mark is in sight, beneath which the early October low and the late November low might be discovered at 7,384 to 7,383. Minor resistance sits on the 11 December low at 7,493 and might be seen across the minor psychological 7,500 mark.

FTSE 100 Each day Chart

Retail dealer information exhibits 66.70% of merchants are net-long with the ratio of merchants lengthy to quick at 2.00 to 1 – What does this imply for FTSE 100 Merchants?

| Change in | Longs | Shorts | OI |

| Each day | 30% | -23% | 10% |

| Weekly | 58% | -41% | 9% |

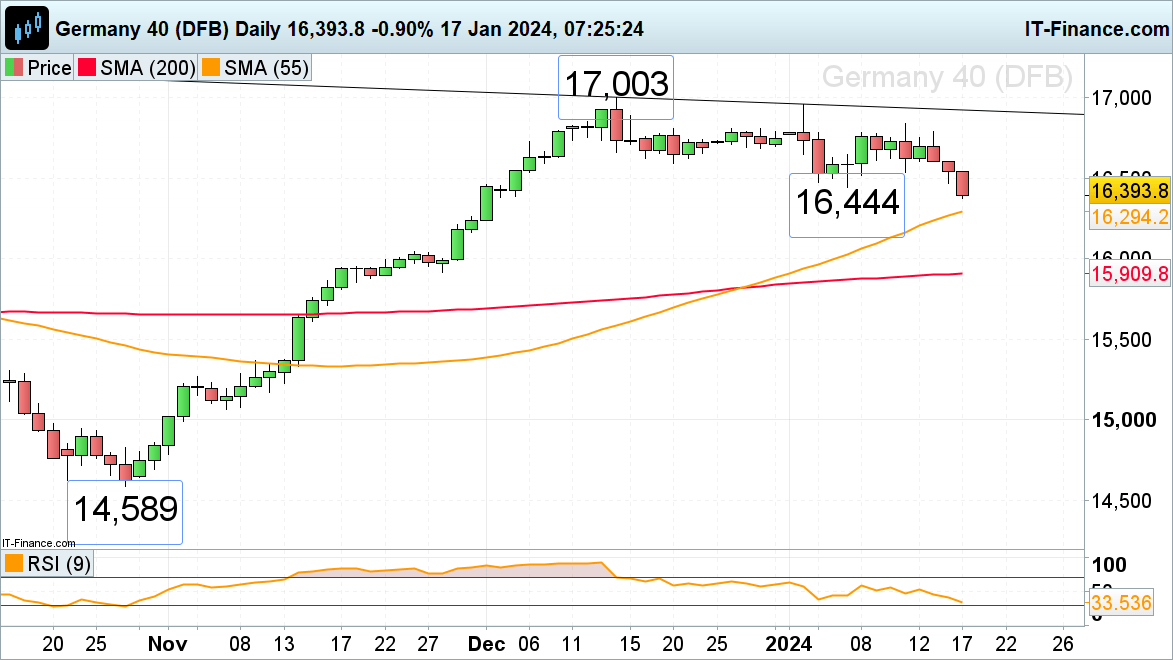

DAX 40 drops to six-week low

The DAX 40 index is on monitor for its third consecutive day of falls and is now buying and selling at six-week lows amid hawkish central financial institution discuss and as price minimize expectations are being pared again.

The 55-day easy transferring common (SMA) at 16,294 represents the subsequent draw back goal whereas the early January and Tuesday’s lows at 16,444 to 16,471 are anticipated to behave as minor resistance. Whereas no bullish reversal and rise above Thursday’s low at 16,535 is seen, the medium-term development continues to level down.

DAX 40 Each day Chart

Beneficial by IG

Get Your Free Equities Forecast

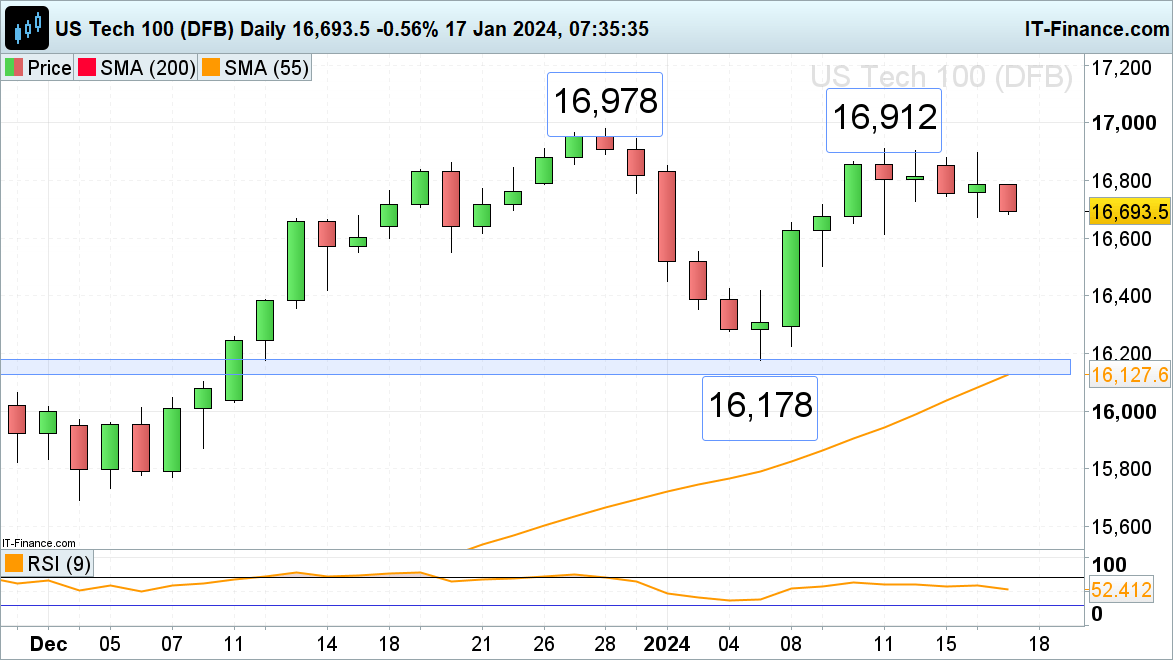

Nasdaq 100 anticipated to open decrease

The Nasdaq 100 stays underneath strain amid combined US earnings and a speech by US Federal Reserve (Fed) governor Waller wherein he advocated transferring ‘rigorously’ with price cuts and talked about decreasing quantitative tightening however didn’t give a timeline.

Tuesday’s low at 16,674 could also be revisited, a slip-through which might interact the 11 January low at 16,614 and maybe additionally the 20 December low at 16,552.

In case of a rebound, minor resistance between Friday and Monday’s lows at 16,726 to 16,743 could stall the index. If not, final and this week’s highs at 16,897 to 16,912 would possibly stay in play.

Nasdaq 100 Each day Chart

Discover ways to construct confidence in buying and selling with our complimentary information.

Beneficial by IG

Constructing Confidence in Buying and selling

[ad_2]

Source link