[ad_1]

Enes Evren

Now we have not too long ago centered on gamers within the supplies house because of the worth funding alternatives we see in these areas, in addition to the relative confidence we’ve in understanding these companies. Concurrently, we’ve been in search of potential market leaders for the worldwide vitality transition, as we really feel it’s an funding theme with large upside potential.

Fortescue Metals (OTCQX:FSUMF), because the world’s fourth-largest iron ore supplier, and with its industry-leading decarbonization plan, matches the mould. Nonetheless, we discover valuing the corporate in its present state a very difficult proposition.

The Firm

Fortescue’s core enterprise is its Western Australia-based totally built-in iron-ore producing operations, starting from mining and processing, to rail and port services. Australia is the world’s largest exporter of iron ore, and along with BHP (BHP) and Rio Tinto (RIO), the corporate has within the final decade benefitted enormously from China’s insatiable demand for the commodity.

In 2018, the corporate made a big pivot in establishing Fortescue Future Industries (‘FFI’), a nascent enterprise that’s centered solely on renewable vitality tasks. As a gaggle, the corporate is aspiring to actual zero Scope 1 and a couple of emissions by 2030 and net-zero Scope 3 by 2040, that are aggressive, industry-leading ambitions. The corporate is banking on technological advances and execution by FFI to realize these objectives.

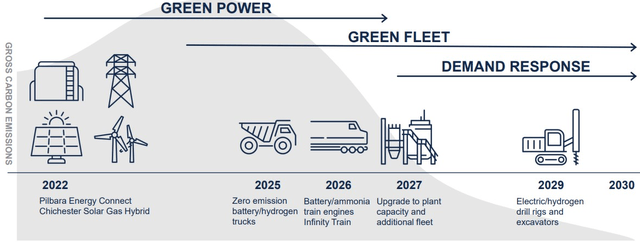

The important thing initiatives behind Fortescue’s bold plan for zero emissions by 2030 (Firm Presentation)

The core metals enterprise can also be seeking to FFI improvements to enhance its monetary efficiency. It has highlighted initiatives equivalent to a regenerating battery electrical iron ore prepare, and 0 emission haul vehicles as a approach for it to lower its prices by much less diesel consumption. In its most up-to-date quarterly replace, administration referenced anticipated $3bn in financial savings in the course of the commissioning stage to full decarbonization, and $800m financial savings in working prices yearly subsequently.

As an observer of investor and analyst calls, we famous that administration spent the vast majority of the time addressing the expansion alternatives in FFI, and it was clearly telegraphed to us that decarbonization tasks are the first focus of the corporate, with iron ore manufacturing relegated to business-as-usual standing.

The Financials

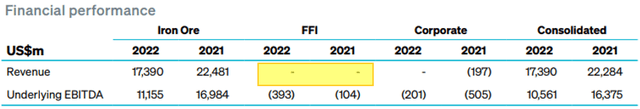

Regardless of the emphasis and substantial progress touted by administration, in the end the FFI division has but to generate revenues, in opposition to a value base of just about $400m in FY2022. Forecasted expenditure for FFI is $600-700m for FY2023, with $100m designated as capex and the rest as working bills.

Regardless of the hype, FFI has not but generated any revenues throughout its existence (FY2022 Annual Report)

Admittedly, it is a small change for a corporation which generated $17.4bn in revenues and $6.2bn in internet income (inclusive of FFI losses) in 2022. The corporate additionally paid out 75% of NPAT as dividends, which quantities to $4.3bn. Collectively, Fortescue’s setup to generate substantial income and pay out wholesome dividends makes it distinctive in having each traits of a speculative development firm, and an outdated financial system enterprise.

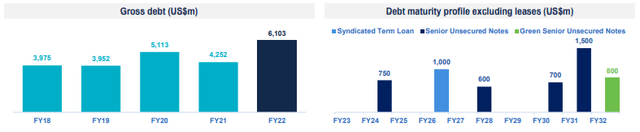

The place we see its monetary standings differ to a extra conventional supplies producer is in its debt portfolio. Regardless of coming off the 2 most worthwhile years within the firm’s historical past, in 2022 the corporate elevated its long-term borrowings to $6.1bn, together with elevating $800m from a inexperienced bond issuance. Its gross gearing ratio of 26%, though under the inner goal of 30-40%, is an unsettling degree. This contrasts with outdated financial system friends equivalent to South32 (OTCPK:SOUHY) (12%), Woodside (WDS) (14%), and Rio Tinto (19%), which have usually appeared to carry down their debt ranges after benefitting from worthwhile enterprise circumstances in the previous few years.

On the again of an $800m inexperienced bond issuance, Fortescue has bucked the development and elevated their debt liabilities (Firm Presentation)

Due to the expansion technique being pursued, the elevated debt ranges are unsurprising, though it could possibly be construed that Fortescue is definitely borrowing to fund shareholder returns. We see this straddle in sustaining dividend payouts commensurate to {industry} requirements, while taking over extra debt to fund development, as a dilemma administration is struggling to take care of.

Valuations

Buying and selling at 6-7x earnings and round 2.5x e book worth, valuations are inside the {industry}’s market vary (e.g., Rio Tinto trades at P/E 6-7x, P/B 2.3; South32 at P/E 4-5x, P/B 1.1; Woodside at P/E 7-9x, P/B 1.5). To be honest, the comparisons supplied aren’t like-for-like as a result of solely Rio Tinto has an iron ore enterprise. However broadly talking, we predict all these companies could be bifurcated into core operations, and a development enterprise (loosely described as diversification into manufacturing of future-facing commodities).

If there was any alpha Fortescue had over the comparisons chosen, we predict it will lie inside FFI vs the expansion technique of the others. The present ranges the inventory finds itself buying and selling at recommend that traders do not discover Fortescue’s enterprise mannequin any extra engaging than various choices within the uncooked supplies universe. If traders have been genuinely involved about future money burn from FFI, we might have anticipated valuations to be less expensive; conversely, if traders have been significantly bullish about FFI’s prospects, we might have anticipated valuations to be a lot greater.

For us as worth traders, with no clear indication as to when FFI will generate its first income, not to mention flip a revenue, we’re out of our depth in making an attempt to attribute a valuation to this enterprise. Quite the opposite, we’re mildly cautious of the danger that an overrun on the spending required to get FFI commercially viable may consequence within the cutback of dividend funds, the buildup of additional debt, and maybe a worst-case state of affairs of further capital elevating having a dilutive impact on present shareholders. We observe that non-executive chairman Andrew Forrest made a passing remark throughout an analyst name that FFI could possibly be valued round $20bn; at this juncture, we might attribute no worth (constructive or destructive) to the division.

I’ve not ever tried to worth the corporate (FFI), however I’ve had expressions of curiosity made to me by fund managers, by large infrastructure managers. They’ve talked round US$20 billion. (Andrew Forrest, FY22 Annual Outcomes analyst name)

Returning again to the core iron ore enterprise, the current tailwind that was the China development story seems to have subsided considerably. In its absence, we don’t see a transparent catalyst that may maintain sturdy future demand, though we acknowledge doubtless constructive second-order results from the buildout of inexperienced infrastructure globally. Moreover, we predict the demand for Fortescue’s core choices from Chinese language clients could also be weakened by the eventual manufacturing ramp-up out of Simandou, though we do not see international provide to be affected considerably sufficient for it to have a structural impact on iron ore costs. Broadly talking we assume future costs for iron ore to stay secure, however over the long term, we search for it to underperform extra forward-facing commodities equivalent to copper, nickel, and lithium.

Last Ideas

For traders with enterprise capital-like enthusiasm and mindset, Fortescue might supply a gorgeous alternative, with the iron ore enterprise performing like a buffer in producing constructive money flows and dividends whereas ready for the expansion arm to generate revenues and ultimately income.

We aren’t so cavalier with our funding method and might solely worth the extra sure a part of the enterprise, which is as an iron ore producer. With an absence of conviction on the longer term value of iron ore, working prices for FFI a destructive drag on total earnings, and considerations about ample capital to fund FFI on its path to profitability, we see uncertainty in Fortescue’s future trajectory. Regardless of this, we observe that the inventory is priced at round par for the {industry}, and subsequently really feel the funding risk-reward paradigm is negatively skewed.

We just like the ambition and course of Fortescue’s decarbonization challenge usually, although, and are trying ahead to revaluing FFI when revenues are ultimately achieved. We can be additionally maintaining a tally of developments at Simandou, as though manufacturing is just not imminent, we predict Fortescue’s standing could possibly be adversely impacted.

(Reported $ quantities reference USD because the reporting foreign money of Fortescue)

(AUDUSD=0.67 assumed in evaluation)

[ad_2]

Source link