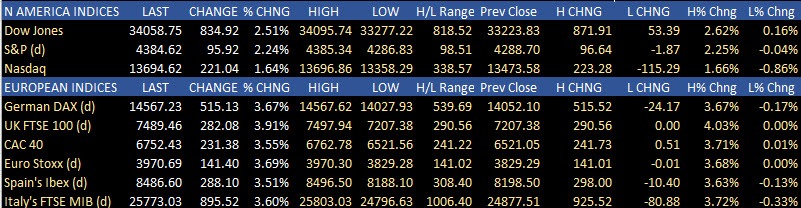

The US inventory indices tacked on one other constructive efficiency with the Dow taking the middle stage with it is greatest day in 2022. The Dow rose 834 factors on the day or 2.51%. The Nasdaq was the weakest performer however it nonetheless added 1.64% after yesterday’s 3.35% achieve. The S&P rose 95.95 or 2.24%. European shares additionally shut sharply increased with good points 3.5% or extra within the main indices.

For the week, the Nasdaq, S&P and Russell 2000 closed increased (by 0.8%, 1.07% and 1.58% respectively) however the Dow closed unchanged and the European shares have been decrease for the week.

However, the good points right now have been spectacular given the elevated threat of a Russian takeover of Ukraine (with a brand new puppet authorities put in cost).

Now there have been stories that Russia can be prepared to satisfy with Ukraine, and maybe that squeezed shorts and pushed underinvested to get extra invested, however come subsequent week, it could be a distinct story if conferences with Ukraine finish with “Your alternative is to step apart and let me put in new leaders”. NATO might not like that concept, particularly given the Russian’s chief seeming need to carry construct extra monopoly items, and Ukraine’s bordering of Belarus, Poland, Slovakia, Hungary, Romania, Moldova as potential properties.

NATO nations imposed extra sanctions on Russia, and the US and Europe introduced sanctions on Putin freezing his private belongings.

In different information right now,

- Sturdy items got here in higher than anticipated with revisions to the prior month increased as properly

- January core PCE got here in increased at 5.2% vs 5.1% anticipated. Inflation stays stubbornly excessive preserving the hopes for 50 BP hike a risk in March. Fed’s Waller stated as a lot final evening – CLICK HERE – becoming a member of Fed’s Bullard (Bullard continues to be calling for 100 bp by July implying one 50 BP transfer between from time to time). The Fed Chair testifies on Capitol Hill subsequent week and his feedback can be eyed carefully for clues on HIS intentions.

Within the foreign exchange market, the stream of funds took it is clues from the rising shares and a “threat on” theme. The strongest of the majors have been the AUD and the NZD. The weakest have been the JPY and the USD (basic threat on flows).

Some technical feedback on among the main pairs:

- The EURUSD is closing close to highs at 1.1270. The pair can be testing the 100 hour MA at 1.12726 (and transferring decrease). The pair has almost retraced all of the declines submit the Russian invasion (1.1285ish). A transfer again above the 100 hour MA may have merchants trying towards the 1.1300 and the 200 hour MA at 1.1315

- The GBPUSD consolidated in up and down buying and selling on Friday closing at 1.3412. The 38.2% of the transfer down from the Feb 18 excessive is available in at 1.13134. That could be a barometer for consumers and sellers subsequent week.

- USDJPY traded down and again up on Friday. The low stalled proper on the 200 hour MA at 115.14 and bounced again to and thru the week excessive from Thursday at 115.685 to a brand new week excessive of 115.75 earlier than settling again decrease at 115.53. Watch 115.368 early subsequent week for assist. That’s the 50% of the vary for the reason that Feb 10 excessive. Transfer beneath and we might be heading again to the 200 hour MA.

- NZDUSD moved increased right now and traded above the 100 hour MA at 0.6729 presently for a lot of the NA session. That stage can be a bias defining stage at the beginning of the week. Keep above is extra bullish. Transfer beneath and we should always see additional draw back probing. The value is settling at 0.6745

- AUDUSD. The AUDUSD additionally moved again above it is 100 hour MA at 0.7205 and stayed above within the North American session on Friday. Keep above is extra bullish within the new buying and selling week.

In different markets:

- Spot gold is buying and selling down -$14.86 or-0.78% at $1888.08. That’s $86 decrease than the intraday excessive reached yesterday and takes the value decrease on the week. Final Friday, the spot gold value closed at $1898.23

- Crude oil futures are closing at $91.94 which is down $-0.87or -0.94%. Like gold, it too is properly off the Thursday spike excessive at $100.15 and likewise decrease on the week (final week, the contract closed at $92.00.

Mushy commodities like wheat and corn took middle stage this week as Russia and Ukraine are large exporters of these commodities.

- For wheat, a day after being restrict up, it closed down the $0.75 every day restrict right now at $8.59 after buying and selling as excessive as $9.60 earlier within the day (down -10.5% from the excessive).

- For corn futures, it adopted up buying and selling up restrict throughout elements of yesterday at $7.189 and was down at $6.59 right now (-8.39% from the excessive yesterday)

Within the US debt market, the yields are closing off their highs of the day however blended. For the week, the two 12 months yield ticked to the very best stage since December 2019 at 1.644%, however backed off to 1.57% on the shut of the week. The ten 12 months yield every week in the past closed at 1.934%. This week the low yield moved to 1.847% (on flight to security bid), however is again up at 1.963% for a modest achieve on the week. This week, the treasury auctioned off $52B of two 12 months notes, $53B of 5 12 months notes and $50B of seven 12 months notes all with sturdy worldwide and home demand. What we all know is with inventory markets iffy, the demand for US debt at increased charges is an effective various.

Subsequent week is a busy week:

- RBA charge choice on Tuesday (10:30 PM on Monday). No change is predicted however market can be in search of nuances from the assertion

- US ISM on Tuesday at 10 AM ET

- OPEC assembly on Wednesday. No change from the rise manufacturing anticipated

- ADP non farm payroll (it has been approach off of late) at 8:15 AM on Wednesday

- BOC charge choice on Wednesday with expectations for a 25 bp hike

- Fed’s Powell testifies at 10 AM on Wednesday and once more on Thursday

- ISM service on Thursday at 10 AM ET

- US employment on Friday at 8:30 AM ET (+400K estimate).