Fokusiert

First Industrial Realty Perception (NYSE:FR) is an industrial REIT that owned 424 properties with 67.9m sq. ft. of gross leasable area all through 19 states (June 30, 2024).

I’ve had the pleasure of defending FR twice since my journey on Looking for Alpha started. Every events, I assigned it with a ‘buy’ rating. To get a larger grasp of the occasion of my views on FR, please verify with the hyperlinks below:

- First Industrial Appears to be Buyable As Market Circumstances Improve

Looking for Alpha

- First Industrial Realty Perception Items The Flooring For The Upcoming Upside

Looking for Alpha

After publishing my first article on FR, I didn’t observe my very personal advice and purchase, as I targeted on completely different options, along with a primary industrial property participant – Prologis (PLD). However, not so prolonged after publishing the second time, FR’s stock expert a quick decline, and that’s after I initiated my place.

Some merchants might ponder that counter-intuitive, as a result of the Agency’s valuation has elevated significantly as a result of the April – June 2024 interval, nonetheless let me inform you:

- FR has good points going for it, which we’re going to level out later

- The highly effective market circumstances surrounding FR and creating headwinds for all the industrial property sector current way more indicators of the upcoming shift than sooner than, making industrial property players further participating, with FR as one in every of many excessive REITs on my industrial sector guidelines correct now

Let’s start with the latter – the market shift is upcoming

Sooner than we deal with the positives, let’s summarize the problems

The industrial property sector has been coping with headwinds related to the rising charges of curiosity and oversupply in most markets. The oversupply was introduced on by cooling demand (rapidly), with large-scale constructing finishes supporting the supply. The unfavourable supply-to-demand relationship led to a lot much less dynamic asking lease progress and a dynamic rise out there out there vacancy price. Primarily based on the Wells Fargo Q2 2024 report:

- the vacancy price recorded a steady improve for the eighth consecutive quarter and reached 6.5% in Q2 2024

- the lease progress has fallen to the underside annual tempo recorded since 2014. The autumn of the enlargement tempo is way more evident when considering the quarterly changes

Q2 moreover launched eight consecutive quarters of web completions above 100m sq. ft. (102.3m sq. ft. in Q2 2024), extra strengthening the industrial property present and, thus, negatively impacting the oversupply problem.

CoStar Inc. and Wells Fargo Economics CoStar Inc. and Wells Fargo Economics

The abovementioned information doesn’t paint an outstanding picture of the industrial property sector, nonetheless let’s look even broader and try to arrange some expectations for the upcoming years.

The night appears the darkest sooner than the dawn

On the demand entrance, web absorptions keep far below historic necessities. However, they recorded the first enchancment in seven quarters, amounting to 30.3m sq. ft., i.e., ~triple the amount recorded in Q1 2024. That could be a constructive signal suggesting that tenants’ decision-making processes are starting to decide on up.

Moreover, industrial space beneath constructing retains on dropping, setting the bottom for the upcoming enchancment inside the supply-to-demand relationship. With the demand selecting up the tempo and the cooling constructing begins (anticipated by most industrial property REITs’ administration teams and already mirrored inside the information), we’re vulnerable to witness the current oversupply turning into undersupply inside the upcoming years, positively impacting industrial REITs negotiating positions and enterprise metrics (lease progress and occupancy prices).

CoStar Inc. and Wells Fargo Economics

Summary of FR’s enterprise

I ponder FR among the many greatest picks inside the industrial property sector attributable to its participating risk-to-reward ratio. The margin of safety ensuing from valuation is inexpensive when compared with a number of of its buddies (we’re going to delve into that later).

I don’t have to get too in depth about FR’s enterprise or credit score rating metrics, as I’ve already talked about it intimately inside my earlier safety. However, I need to current a fast notion into its most vital numbers to supply a holistic outlook on my current funding thesis and the selection to start out out a spot in FR.

- vital lease will improve: for context, the market lease progress has significantly outpaced the lease progress ensuing from contractual lease escalators, typically amounting to low single-digit values. In consequence, industrial property players can significantly bump their rents upon lease expirations (by means of releases or leases with new entities). For instance, FR recorded cash rental will improve of 58.3% and 43.4% all through 2023 and Q2 2024, respectively. Which will proceed as FR’s historic leases terminate inside the upcoming quarters/years.

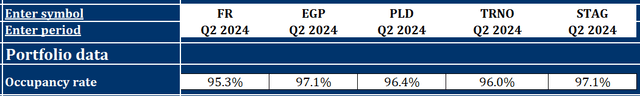

- occupancy price: as talked about sooner than, the oversupply-related headwinds have pushed the market vacancy price upwards, which is successfully mirrored in newest occupancy price information of primary industrial REITs. Please overview the desk below for particulars in regards to the occupancy price of FR and some of its buddies.

Author based totally on FR, PLD, EGP, STAG, and TRNO

- dynamic FFO and DPS progress: FR’s DPS recorded a ~8% CAGR in the midst of the 2019 – 2023 interval, and I don’t take into account this dynamic to range, significantly considering FR’s funding pipeline and upgraded 2024 FFO per share steering. Its current steering assumes FFO per share ranging from $2.57 to $2.65, representing a 3-cent improve on the midpoint. Must FR get hold of its midpoint steering, which will signify a 7% FFO per share progress year-over-year.

- steadiness sheet energy: the dividends are supported by an inexpensive, ‘sleep sound’ steadiness sheet with BBB credit score standing, 4.4x mounted value safety, and no debt maturities until 2026. Then once more, its whole debt maturity schedule is relatively fast time interval, standing at 4.3 years on widespread, and choices exposition to the speed of curiosity menace attributable to its ~11% floating-rated debt wonderful.

The valuation outlook and menace elements

Market-related and company-specific risks accompany each stock market funding. Throughout the case of FR, it’s value mentioning:

- extreme charge of curiosity environment negatively impacts the Agency’s value of capital, as a result of it has some publicity (~10.8% of its wonderful debt) to the floating-rated debt. Moreover, such an environment causes a big gap between patrons’ and sellers’ expectations, slowing down the transactional market

- there isn’t any explicit reply to how prolonged the oversupply factors will keep. Such an environment negatively impacts FR’s ability to uplift its occupancy price and sign new / expiring leases

- the valuation stays participating compared with a number of of its buddies, and the Agency’s valuation elevated significantly over the previous couple of months. On the same time, industrial property players are comparatively extraordinarily valued, so merchants accustomed to retail-oriented REITs might uncover it discouraging

With that said, let’s switch on to the valuation outlook. As an M&A advisor, I typically rely upon a a variety of valuation methodology that may very well be a primary instrument in transaction processes, as a result of it permits for accessible and market-driven benchmarking.

The forward-looking P/FFO a variety of stood at:

- 21.6x for FR

- 23.6x for PLD

- 16.7x for STAG Industrial (STAG)

- 28.3x for Terreno Realty (TRNO)

- 23.9x for Americold (COLD)

- 22.4x for EastGroup Properties (EGP)

Given that remaining time I coated FR, its P/FFO a variety of has appreciated by ~70 bps. Subsequently, this suggests a lot much less room for potential upside ensuing from the a variety of enlargement. Beforehand, I indicated that the 22-23x P/FFO range is attainable for FR.

However, with the way more most likely constructive shift inside the supply-to-demand relationship upcoming, I’m a stronger advocate of FR’s a variety of appreciation. Subsequently, I ponder 23x P/FFO a further relevant (and nonetheless conservative) scenario. Whereas that alone wouldn’t finish in a substantial upside, combining it with a dynamically rising (8% CAGR in the midst of the 2019 – 2023 interval) DPS, one may hope for low double-digit full returns at a common menace diploma.

Funding Thesis and Key Takeaways

Even though FR’s stock worth recorded steady will improve inside the remaining couple of months, I take into account there’s further upside to be realised, considering its valuation compared with buddies. The Agency offers a double-digit upside potential, which I nonetheless ponder a ‘buy’.

- income-oriented merchants will revenue from dynamically rising dividends

- cautious merchants will respect the safe financing building and stability and predictability of FR’s cash flows

- advocates of Benjamin Graham’s margin of safety technique ought to essentially really feel taken care of given the valuation gap between FR and some of its buddies

FR is doubtless one of many excessive industrial players on my guidelines and one in every of many solely two industrial REITs by which I’m presently invested. I take into account the Agency will revenue its current and new shareholders, as a result of it has set the underside to capitalize on the upcoming constructive shifts out there out there environment (considering every the speed of curiosity environment and the industrial property sector). I’m bullish on FR.