Because the comfortable touchdown narrative grows, the danger of a ‘disaster occasion within the financial system will increase. Will the Fed set off one other disaster occasion? Whereas unknown, the danger appears doubtless because the Fed’s “greater for longer” narrative is compromised by lagging financial knowledge.

Such is a query price asking as we glance again on the Fed’s historical past of earlier financial actions. Such was a subject I mentioned on this from 2021. To wit:

“With everything of the monetary ecosystem extra closely levered than ever, the “instability of stability” is probably the most important threat.

The ‘stability/instability paradox’ assumes all gamers are rational and implies avoidance of destruction. In different phrases, all gamers will act rationally, and nobody will push ‘the large purple button.’

The Fed is extremely depending on this assumption. After greater than 13-years of probably the most unprecedented financial coverage program in U.S. historical past, they’re making an attempt to navigate the dangers constructed up within the system.“

Traditionally, when the Fed hikes rates of interest and yield curves invert, somebody inevitability pushes the “large purple button.”

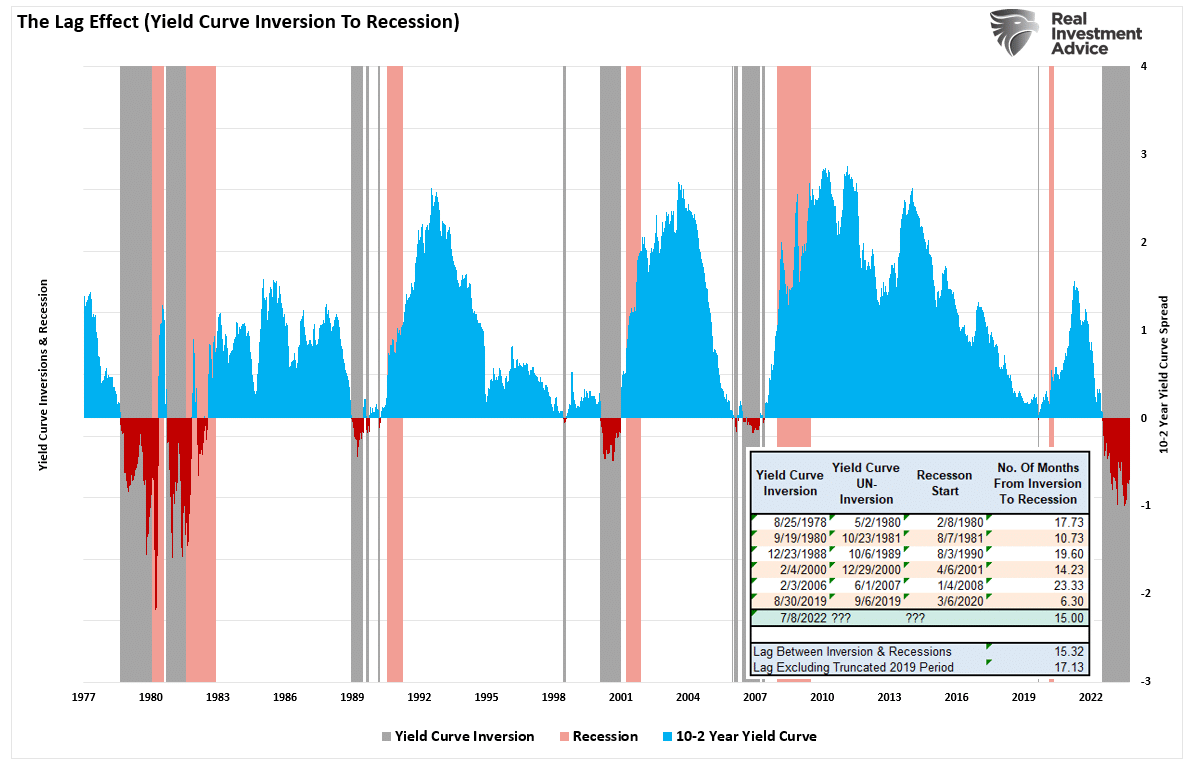

However that can be the fallacy within the 1995 “comfortable touchdown” state of affairs the media is presently pinning its hopes on. Certainly, the financial system didn’t slip right into a recession; nevertheless, there have been disaster occasions alongside the best way. Extra importantly, the yield curve didn’t invert in 1995. Nonetheless, it inverted in 1998, and a recession adopted roughly 24 months later.

The chart above exhibits that yield curve inversions happen roughly 10-24 months earlier than recognizing a recession or disaster occasion. It’s because it takes time for the “lag impact” of upper borrowing prices to negatively affect the financial system.

Whereas the Fed hopes people will act rationally as they tighten financial coverage, buyers have a tendency to not act that approach. However what the markets are doubtless lacking is that we’re not simply speaking in regards to the Fed’s financial coverage choices in isolation.

A Collision Of Occasions

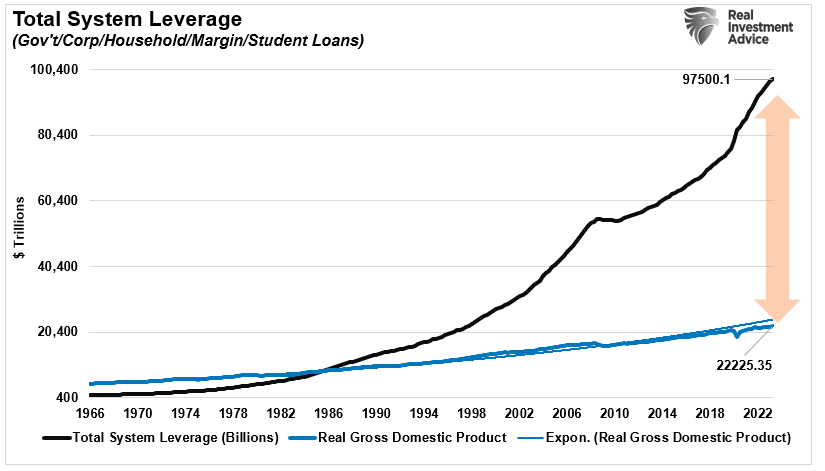

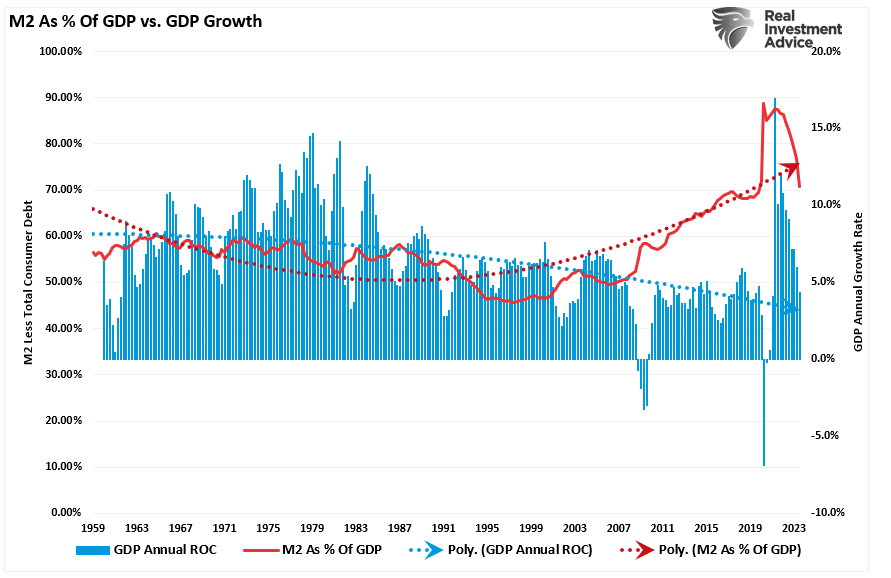

We presently reside in probably the most extremely leveraged financial period in U.S. historical past. As of Q2 of 2023, the whole measurable leverage within the financial system is $97 Trillion. The whole financial system is presently at $22.2 Trillion, so it requires $4.36 in debt for every $1 of financial development.

Critically, that degree of debt has almost doubled since 2008, when it stood at $54 Trillion and the financial system was roughly $16 Trillion in worth. In different phrases, in simply 13 years, the financial leverage rose from $3.38 per $1 of development to $4.36. That large surge in leverage was made doable by near-zero rates of interest throughout that interval.

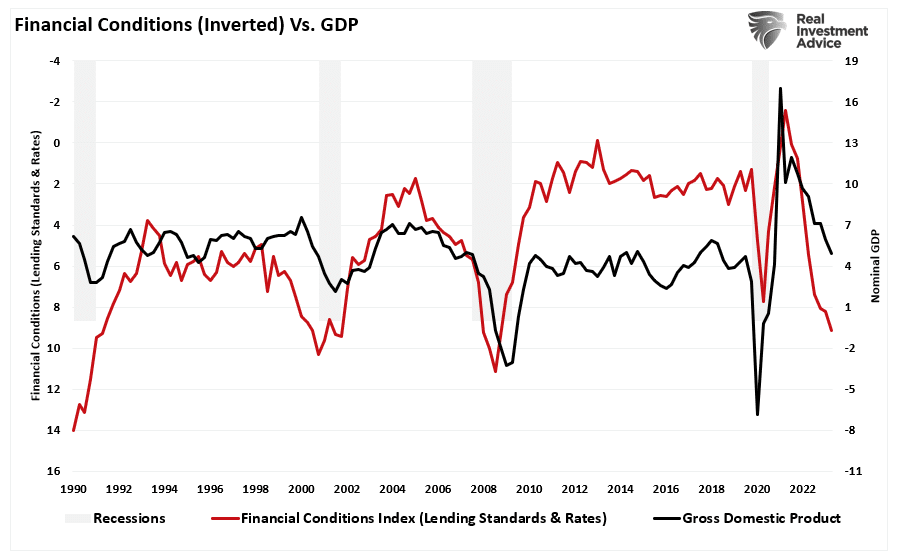

Given the monetary system’s leverage, the collision of debt-financed exercise with restrictive monetary situations will result in weaker development. Traditionally, such will increase in monetary situations have at all times preceded recessionary onsets and disaster occasions. Notably, these occasions occurred at considerably decrease ranges of general leverage.

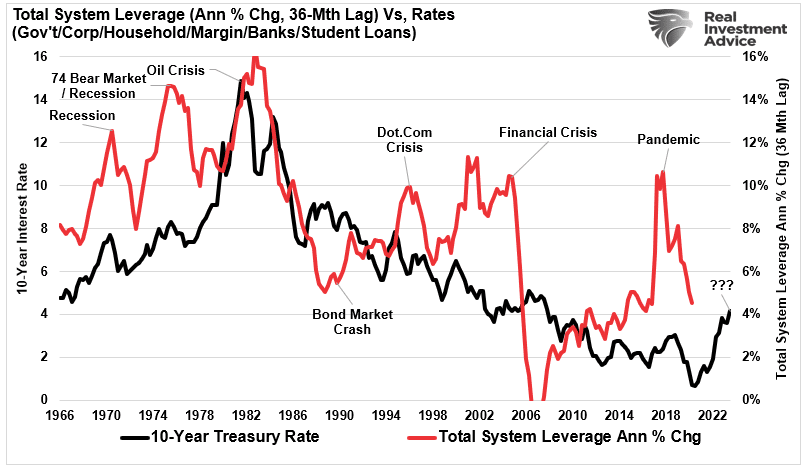

If we have a look at the annual charge of change in whole system leverage versus modifications in rates of interest, we discover a few 36-month lag from when charges improve to a disaster occasion. Provided that charges began to rise in 2021, such suggests the following disaster occasion will happen later in 2024.

As famous above, affirmation of the timing of the following recession or disaster occasion in 2024 comes from the yield curve inversions. Traditionally, when yield curves invert, the media proclaims a recession is coming. Nonetheless, when it doesn’t instantly manifest, they assume it’s “completely different this time.” We simply aren’t there but, because the “lag impact” has but to take maintain.

Because of the quantity of “stimulus” injected into the financial system and the nonetheless elevated ranges of cash provide as a proportion of the financial system, the recessionary onset doubtless might be akin to the 2006 episode.

Merely, simply because the collision of upper borrowing prices, diminished cash provide, and slowing financial development hasn’t brought on a disaster or recession but doesn’t imply it gained’t.

The Danger Of A Coverage Mistake Is Huge

In , we mentioned how a disaster occasion is feasible if rates of interest rise, the Fed tightens financial coverage, or the financial restoration falters.

“Within the quick time period, the financial system and markets (as a result of present momentum) can DEFY the legal guidelines of economic gravity as rates of interest rise. Nonetheless, they act as a ‘brake’ on financial exercise as charges NEGATIVELY affect a extremely levered financial system:”

- Charges improve debt servicing necessities, decreasing future productive funding.

- Housing slows. Individuals purchase funds, not homes.

- Larger borrowing prices result in decrease revenue margins.

- The huge derivatives and credit score markets get negatively impacted.

- Variable charge curiosity funds on bank cards and residential fairness traces of credit score improve.

- Rising defaults on debt service will negatively affect banks.

- Many company share buyback plans and dividend funds have been completed utilizing low cost debt.

- Company capital expenditures are depending on low borrowing prices.

- The deficit/GDP ratio will soar as borrowing prices rise sharply.

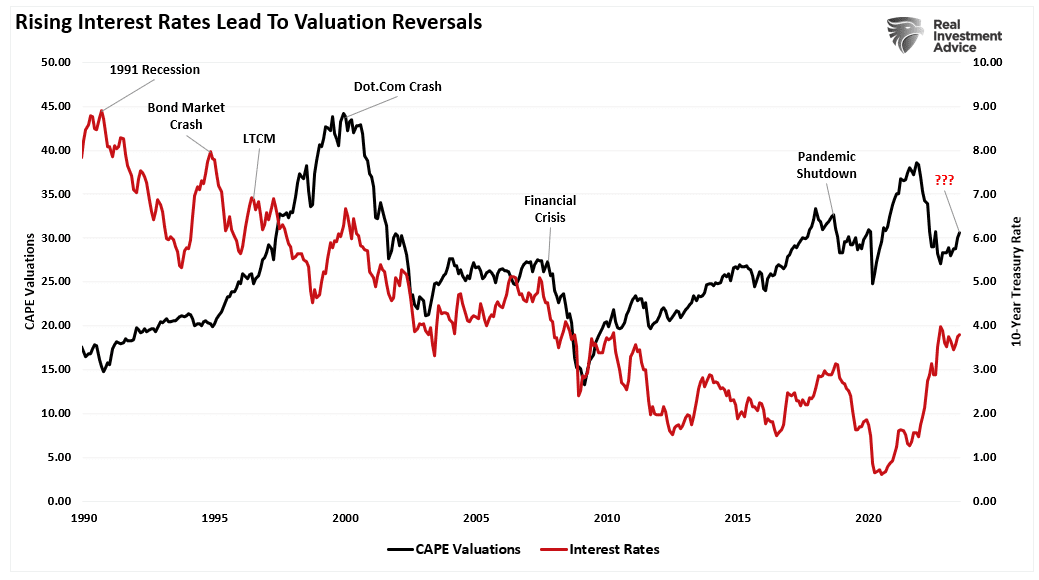

Most significantly, over the past decade, the first rationalization for overpaying for fairness possession is that low charges justify excessive valuations. Sadly, with inflation elevated, which shrinks revenue margins, and excessive rates of interest, valuations are doubtless a extra important challenge than most suspect.

As Mohammed El-Erian acknowledged:

“Traders ought to regulate the danger of an abrupt shift from a relative valuation market mindset to an absolute valuation one. If that occurs, it’s best to cease worrying in regards to the return in your capital and begin worrying in regards to the return of your capital.”

In the meanwhile, we don’t know when the following “disaster occasion” will arrive.

Nonetheless, it’s only a perform of time till the Fed’s “greater for longer” causes somebody to push the “large purple button.”