Svetlana Sultanaeva/iStock by way of Getty Photographs

The U.S. monetary system has loads of cash to help itself.

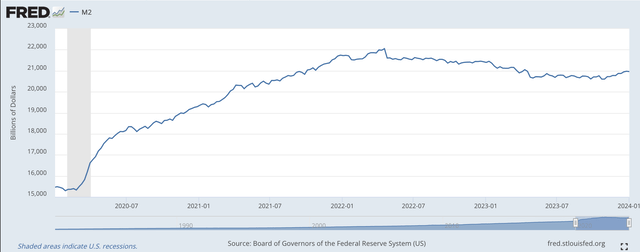

Check out the M2 inventory of cash within the economic system.

M2 Cash Inventory (Federal Reserve)

Sure, the M2 cash inventory has declined a bit since early 2022, however it’s nonetheless up an unlimited quantity since early in 2020.

That is what I’ve been attempting to emphasise over the previous few months.

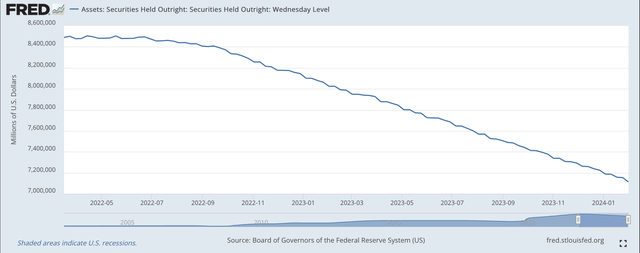

The Federal Reserve is steadily decreasing the dimensions of its securities portfolio.

We will see this from the next chart,

Securities Held Outright (Federal Reserve)

In reality, the quantity of securities held outright by the Federal Reserve has declined by nearly $1.4 trillion for the reason that center of March 2022.

This decline is a really massive quantity, however the Fed nonetheless has over $7.1 trillion in securities held outright on its steadiness sheet.

One can see from the primary chart above that the Fed was busy injecting reserves into the banking system from early 2020 via to the center of March 2022.

So, the banking system nonetheless has an unlimited quantity of funds floating across the monetary system.

And, that is the narrative I’ve been attempting to speak about in posts just like the one I wrote yesterday, “the place are rates of interest going?”

And, that is the state of affairs that Jerome Powell and the Federal Reserve are attempting to work their means out of.

The Federal Reserve responded to a monetary disaster because the Covid-19 pandemic sped via the U.S. economic system and the world. In combating this case, the Fed labored to err on the facet of channeling an excessive amount of liquidity into the banking system. The Fed didn’t wish to be accused of doing too little to maintain the monetary system collectively.

And, it appears as if the Fed did its job and prevented the U.S. economic system and monetary system from falling aside.

However, there may be now the “different facet of the coin to take care of.” Now, the monetary system now has heaps and plenty and plenty of cash, sitting on steadiness sheets that could possibly be used to go on a spending spree. This might generate extreme inflation once more.

However, the Federal Reserve has responded with its coverage of quantitative tightening, and this effort appears to be containing inflation whereas not jerking the economic system round with a very tight financial coverage.

The Federal Reserve has been decreasing the dimensions of its securities portfolio in a constant, regular trend. The Fed has been decreasing the dimensions of its securities portfolio for over twenty months, and has seemingly satisfied the funding neighborhood that it’ll proceed to take action for a for much longer time.

The enterprise and funding communities have responded by not pumping up costs once more. The Federal Reserve has apparently satisfied these people that it’ll proceed to stick with quantitative tightening so long as it seems that it’s wanted.

What does this do?

The Federal Reserve is decreasing the surplus liquidity that’s within the U.S. monetary system. It appears to be doing the decreasing at a quick sufficient pace that the economic system has pulled again from making the most of all of the liquidity and “earning profits” by producing increasingly inflation.

The economic system at the moment appears to be utilizing the cash to accumulate property, monetary and bodily, a lot in the way in which it acquired property through the interval of financial growth following the Nice Recession within the 2010s.

One place the place funds have been used has been within the inventory market. That is what occurred within the 2010s, and I wrote and referred to the exercise that was occurring as “credit score inflation.”

The economic system expanded, though modestly, worth inflation remained low, and inventory costs and different asset costs rose persistently.

It appears as if buyers and enterprise individuals at the moment are performing a lot as they did on this interval of credit score inflation.

Why, simply final week, the Normal & Poor’s Inventory Index hit a brand new historic excessive. Moreover, it appears as if buyers have positioned themselves to maneuver extra closely into shares. This motion appears warranted to me.

In reality, this appears to be the precise narrative for buyers to maneuver ahead with.

There may be loads of cash out there within the U.S. monetary system.

These monies are “on the market” due to the Fed’s previous efforts to struggle the consequences of the Covid-19 pandemic. These monies won’t be used for shopper worth inflation as we transfer ahead as a result of the Federal Reserve will proceed its coverage to cut back the dimensions of its securities portfolio via quantitative tightening.

This may hold shopper worth inflation down within the U.S. economic system.

The “extra money” that’s round shall be used for buying shares and different property that buyers consider are enticing. It must be a fairly good time for buyers.

The economic system will proceed to develop, however the progress fee won’t be extreme. However, unemployment mustn’t turn into an issue within the close to future.

As I argued in my publish of yesterday, on this setting, I don’t see short-term rates of interest coming all the way down to any diploma. Any additional financial progress coming from additional financial stimulus can be solely of minor profit.

And, it may stir inflationary expectations as soon as once more. We do not wish to do this.

If this image works out, buyers must be working in a really good setting for the close to future.