The US economic system stays on monitor to put up a average progress fee within the upcoming first-quarter report, however the growth exhibits indicators of slowing.

Output for the January-through-March interval is estimated at a 2.0% improve (seasonally adjusted actual annual fee), primarily based on the median for a set of nowcasts compiled by CapitalSpectator.com.

If appropriate, the average improve will mark one other downshift in progress from This autumn’s robust 3.2% advance.

US Actual GDP Change

A 2.0% rise in GDP is comfortably above the extent that may ring alarm bells for recession danger, however in the present day’s revised median nowcast marks one other downshift for the present quarter.

The earlier Q1 median estimate: 2.1%, . On the , the median nowcast was larger nonetheless at 2.3%.

Though the current draw back revisions have been slight, the directional bias means that financial exercise is shedding momentum, albeit on the margins.

The important thing query is whether or not the softer pattern will stabilize at or close to present ranges or deteriorate additional within the months forward.

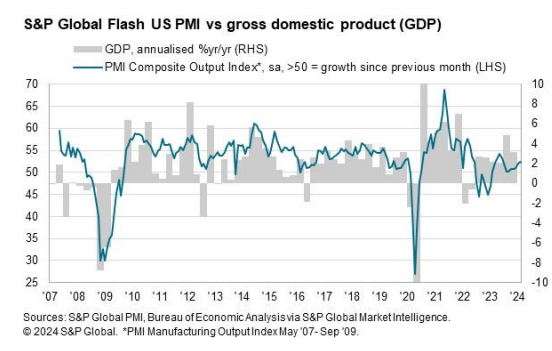

The same profile of barely softer progress was highlighted in yesterday’s PMI survey information. The US Output Index (a GDP proxy) eased to 52.2 in March, down barely from February’s 52.5.

Each readings are modestly above the impartial 50 mark that separates progress from contraction. The most recent replace nonetheless alerts “a stable month-to-month enchancment in enterprise exercise at US firms,” advises S&P International, which publishes the PMI information.

US Flash PMI vs GDP

Maybe the Federal Reserve’s inclination to chop charges later this yr, regardless of current sticky inflation information, is a recognition that financial momentum is easing and that the present coverage fee is simply too excessive to maintain output buzzing.

Regardless of the softer pattern in US financial exercise, the percentages stay low that stall pace or worse is a near-term danger. That’s partly because of the ongoing resilience of the US labor market, a key financial issue.

Yesterday’s replace on weekly , as an example, highlights the continuing constructive pattern as new filings for unemployment advantages dipped, printing close to a multi-decade low.

“The labor market is regularly rebalancing, however the adjustment seems to be coming from much less hiring reasonably than a surge in firings,” says Rubeela Farooqi, chief US economist at Excessive Frequency Economics.

“We count on job progress to gradual considerably however the unemployment fee to stay low this yr.”