- Fed lowers rates of interest by 50bps

- New dot plot alerts one other 50bps cuts by December

- Wall Avenue closes within the crimson, futures level to larger open

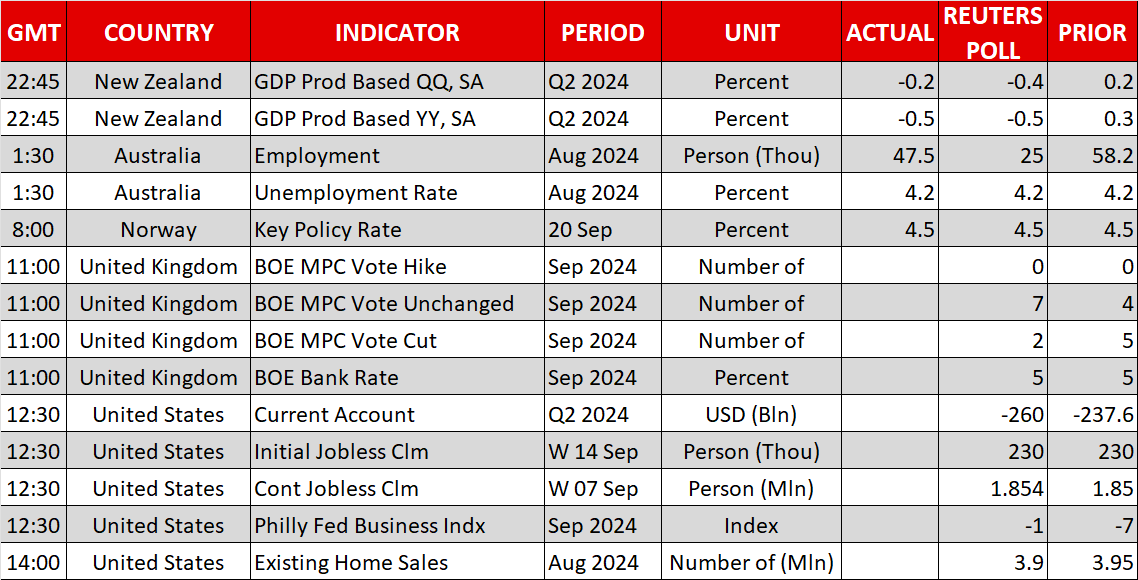

- BoE and BoJ take the central financial institution torch

It has Begun!

The determined to kickstart this easing cycle with a daring 50bps fee reduce, and to flag extra reductions earlier than the flip of the 12 months. The brand new dot plot pointed to a different 50bps price of reductions by the top of 2024, which interprets into two quarter-point cuts at every of the remaining selections in November and December, or no motion in November and one other 50bps reduce in December.

On the press convention following the choice, Powell stated that the financial system is powerful general, it’s in a great place and that the choice was designed to maintain it there. Because of this he doesn’t see a powerful chance of a downturn.

Greenback Falls however Recovers Shortly

Though a daring double fee reduce was largely anticipated by the markets, the fell on the time of the choice, maybe as most economists have been leaning in the direction of the smaller 25bps discount. Nevertheless, with Powell noting that there is no such thing as a imminent threat of recession, the bulls jumped again into motion, with the foreign money recovering a good portion of its instant losses.

But, the rebound was not robust sufficient to counsel a bullish reversal. Maybe this was as a result of, though the Fed’s actions weren’t as dovish as initially perceived by the markets, they weren’t rather more hawkish both. Forward of the choice, traders noticed the 50bps reduce as the primary case, whereas penciling in one other 65bps price of reductions by the top of the 12 months. After the choice, that quantity simply went as much as 70.

Shifting forward, for the greenback to stage a extra significant comeback, incoming knowledge could must counsel that there is no such thing as a want for the Fed to proceed reducing aggressively. Nevertheless, with different main central banks already seen continuing with additional easing at a smoother tempo than the Fed, the buck could also be destined to stay on the again foot for now.

Wall Avenue within the Crimson, However Futures Level to Strong Restoration

Wall Avenue rallied initially, however pulled again thereafter to shut within the crimson. That stated, with Powell insisting that the US financial system is in good condition and that they are going to do no matter is important to maintain it that means, futures are pointing to a powerful opening in the present day. Expectations of steep fee cuts mixed with strong financial efficiency could permit market individuals to start out cheering the prospect of decrease borrowing prices and better current values once more.

spiked to hit a brand new file excessive after the announcement of the double reduce however was fast to tug again as a result of greenback’s rebound. Nevertheless, the bulls are again in cost in the present day. With rates of interest anticipated to proceed falling, it could be a matter of time earlier than we see the valuable steel conquering uncharted territory once more.

Each the BoE and the BoJ to Stay Sidelined

Immediately, the central financial institution torch will probably be handed to the . This Financial institution is essentially anticipated to face pat, with traders assigning solely a 20% likelihood of a 25bps reduce at this gathering.

That stated, they’re totally penciling in 25bps cuts at every of the 2 remaining conferences for the 12 months. Thus, it stays to be seen whether or not the stickiness in inflation will permit policymakers to obviously sign such a state of affairs.

Through the Asian session on Friday, will probably be the flip to determine on coverage. No change is anticipated by this Financial institution both, however merchants will probably be on the lookout for hints and clues with regard to the following potential hike.