Key Takeaways

- The Federal Reserve held the federal funds fee regular at 4.25% to 4.5% to evaluate inflation dangers from tariffs.

- Proposed tariffs by Trump may enhance inflationary pressures, affecting the Fed’s fee selections.

Share this text

The Federal Reserve held rates of interest regular on Wednesday at a spread of 4.25% to 4.5% as officers continued to evaluate inflation dangers and rising uncertainty sparked by Trump’s commerce agenda.

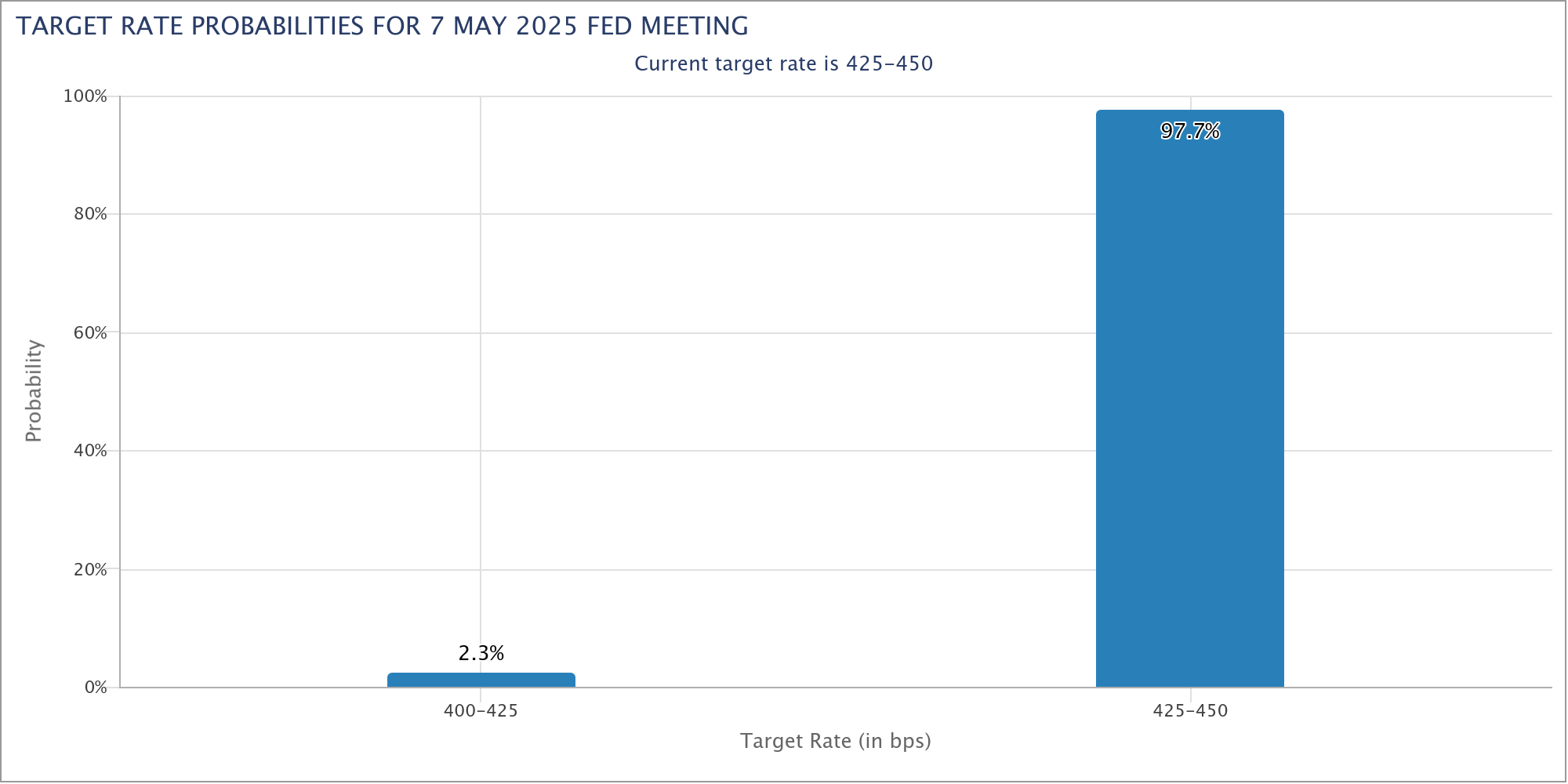

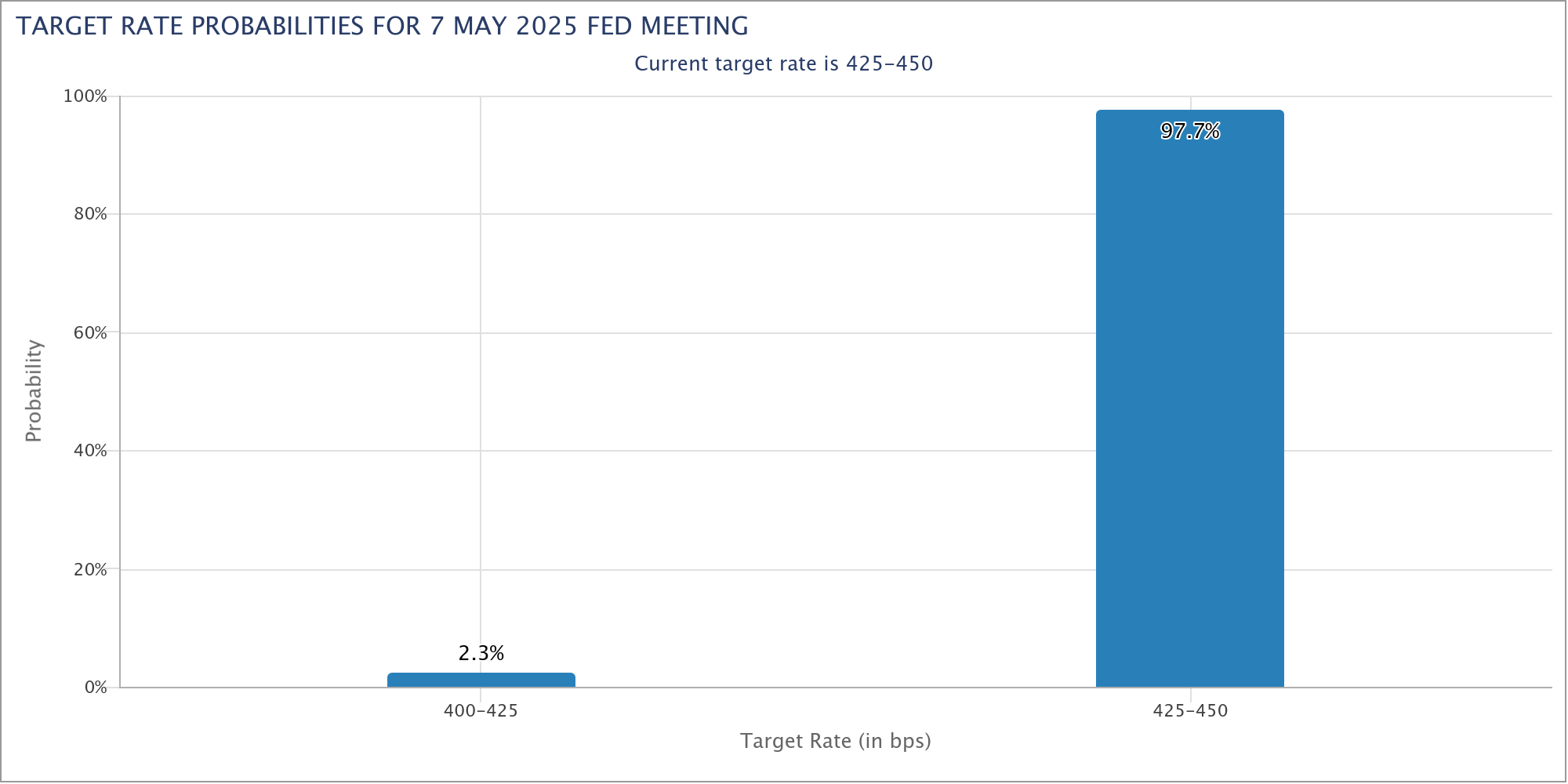

The central financial institution’s determination was in step with market expectations. In keeping with knowledge from the CME FedWatch software, markets had priced in a virtually 98% likelihood that charges would stay unchanged on the Fed’s Might assembly.

This marks the third consecutive pause in fee cuts since January. The central financial institution had beforehand lowered charges thrice in late 2024 in response to softening employment knowledge and easing inflation.

The newest coverage stance comes on the heels of cooling worth pressures and continued labor market energy. In March, the Shopper Value Index (CPI) fell 0.1% on a month-to-month foundation, whereas annual inflation eased to 2.4%, down from 2.8% in February.

In the meantime, April noticed strong job positive factors, reinforcing the resilience of the financial system regardless of uncertainty about Trump’s tariffs.

The mixture of average inflation and sturdy employment supported the Fed’s alternative to carry charges regular.

The Fed’s coverage assertion mentioned that latest indicators counsel financial exercise has continued to develop at a strong tempo, with labor market circumstances remaining robust and the unemployment fee stabilizing at low ranges. Nevertheless, it famous that inflation stays considerably elevated and uncertainty in regards to the financial outlook has elevated additional.

The Committee mentioned the dangers of each larger unemployment and better inflation have risen and emphasised that future selections will rely upon incoming knowledge and the evolving stability of dangers. It additionally reaffirmed its dedication to lowering its stability sheet and to reaching its twin mandate of most employment and a pair of% inflation.

President Trump has persistently pressured the Fed to decrease rates of interest, however latest robust employment knowledge has decreased the possibilities of a fee minimize in June.

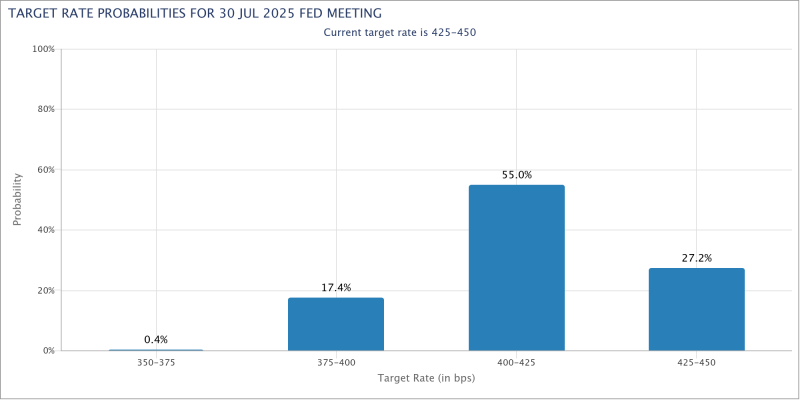

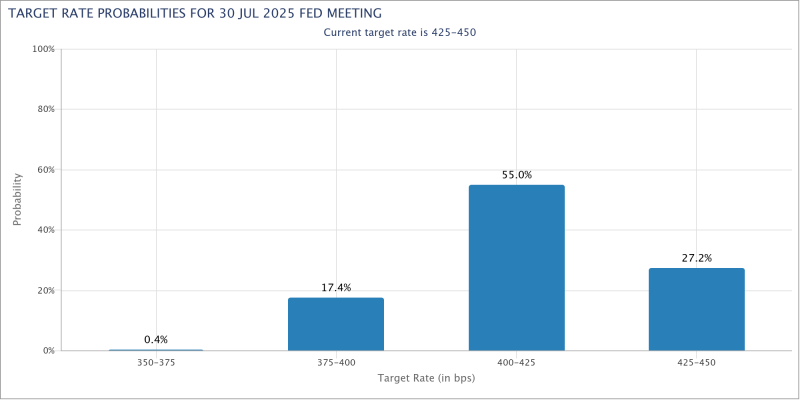

The market has shifted its expectation of fee cuts, with members much less assured about reductions going into the third quarter. Buyers now anticipate the Fed will start slicing charges in July, with two to a few further reductions projected by year-end.

Share this text