julief514/iStock through Getty Photos

Funding Thesis

We provoke EverCommerce (NASDAQ:EVCM) with a Impartial score because of 1) continued challenges in its advertising expertise phase dealing with demand headwinds attributable to tepid SMB setting 2) bleak restoration inside its health vertical which nonetheless stay stays considerably down in comparison with pre-COVID ranges 3) acquisitive mannequin which had been a driver of development just isn’t sustainable in present setting and 4) decelerating momentum in its funds enterprise. We’re constructive on the corporate’s value administration initiatives which has led to an upside to EBITDA margins whereas a 7% RIF (~160 staff) can also be including to the resilient outlook on the EBITDA margin. Nonetheless, we stay skeptical on the demand setting and await indicators of stability within the face of macro headwinds.

Firm Background

EverCommerce is a number one vertical SaaS utility vendor for SMB companies corporations in dwelling companies, well being companies, and health and wellness verticals. It has advanced into an finish to finish software program stack for enterprise administration, advertising, CRM and funds throughout its service segments. It has a diversified income base with about 700,000 clients out of which 90% of consumers contribute lower than $2,000 with about 5% contributing over $5,000 to the highest line. It principally generates revenues from the US that contributes greater than 90% of the income with remainder of the world contributing the steadiness quantity. The corporate primarily generates income principally from three sources

1) Subscription and license charges: Sale of software program licenses and associated help companies together with enterprise administration associated software program purposes

2) Transaction charges: Transaction charges in relation to achievement of cost processing companies

3) Advertising and marketing expertise options: Consists of digital promoting options akin to content material creation, search engine optimization and paid promoting in addition to shopper connection companies to offer fastened or variable cost primarily based on focused leads

Historic Financials

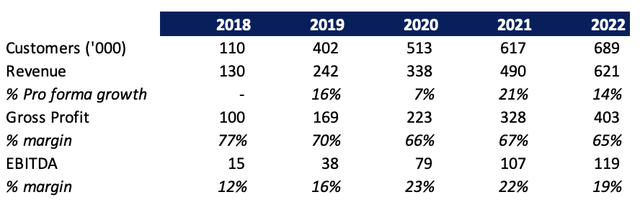

EverCommerce has primarily grown by means of acquisitions having accomplished 52 acquisitions since inception together with 14 acquisitions since 2020. Its acquisitive enterprise mannequin has allowed them to quickly develop its income at a CAGR of 48% throughout 2018-2022 interval in addition to enabled them to broaden its EBITDA margins to twenty%+.

Firm filings

Notice: Professional forma development is contemplating a like for like development of the acquired corporations.

The expansion stumbled in 2020 because of COVID-19 notably throughout the health and wellness verticals which had been probably the most affected because of shutdowns. Nonetheless, the reopening in post-COVID setting pushed by restoration in Complete funds worth (TPV) enabled them to report robust rebound in 2021. It was in a position to preserve 20%+ margins in 2020 and 2021 regardless of decline in gross margins pushed by strict value management. It reported a wholesome 14% natural development in 2022 whereas investments in product growth and personnel bills result in margins declining to sub-20%.

Combined Q3 Outcomes

EVCM reported blended Q3 with revenues rising by over 10% YoY to $175 mn, barely under the consensus and on the decrease finish of the steering. Subscription and transaction charges phase income decelerated to 10% YoY (from 31% development in Q3 2022 and 13% in 2023) because of decline in contractor gear spends and softness in sure different transactional areas. Advertising and marketing expertise phase stays challenged regardless of posting a constructive 1.5% development which displays the lingering results of the weak spot in SMB setting resulting in demand pushed headwinds. The corporate foresees continued demand pushed headwinds throughout the advertising expertise phase which is able to proceed to dampen development. The corporate has made progress in clients enabled or using greater than 1 resolution to 173k clients, nevertheless, cross-sell progress remained comparatively flattish from Q2 2023 (29% development in Q2 vs 28% development in Q3). Health vertical continues to be probably the most challenged with the phase but to completely recuperate from COVID-19 disruption.

Robust Value Management and Levered Stability Sheet

EVCM reported gross revenue margins of 64.8%, up 130 bps YoY, pushed by development in its excessive margin funds options and subscription charges together with cross promoting initiatives on YoY foundation. SG&A bills leveraged by about 350 bps YoY pushed by lively value administration on the again of decrease promoting and advertising bills and incentives and tight G&A value controls together with barely decrease product associated bills. This finally cause them to submit an Adj. EBITDA of $42 mn in comparison with analyst expectations of $36 mn with margins increasing 480 bps YoY to 23.9%. Levered FCF margin expanded by 650 bps YoY to 12.2% primarily pushed by robust money stream from operations whereas unlevered FCF margin continues to be strong at 18%.

Stability sheet place stay secure with the corporate ending with money steadiness of $66 mn and an undrawn RCF facility of $190 mn with whole debt excellent of $539 mn. This factors to a internet leverage ratio of ~4.5x which additional factors to restricted flexibility to pursue additional transformational acquisitions to drive development amidst weakening basic outlook.

Bleak Outlook

EVCM guided This fall revenues to be $172 mn at midpoint, up 6% YoY which was under the consensus expectation of $182 mn additional pointing to demand deceleration and drag from advertising expertise and health phase. The corporate introduced a 7% RIF amid demand deterioration which is anticipated to offer a cushion on the margins. Its income development in 2023 was primarily pushed by pricing initiatives which can be difficult going ahead and we count on a extra modest profit because of damaging overlap with the corporate dealing with a twin problem of buyer retention and pricing development. We just like the tuck-in acquisition of KickServ (Supply: Firm presentation), which is able to add about 1,000 paying clients will proceed to assist incremental revenues. Nonetheless, the corporate’s acquisitive mannequin which was driving strong incremental development just isn’t very sustainable given the present setting and its slowing tempo of acquisitions (only one acquisition since final 18 months in comparison with 6-7 acquisitions in a 12 months) additional factors to decelerating development developments.

Valuation

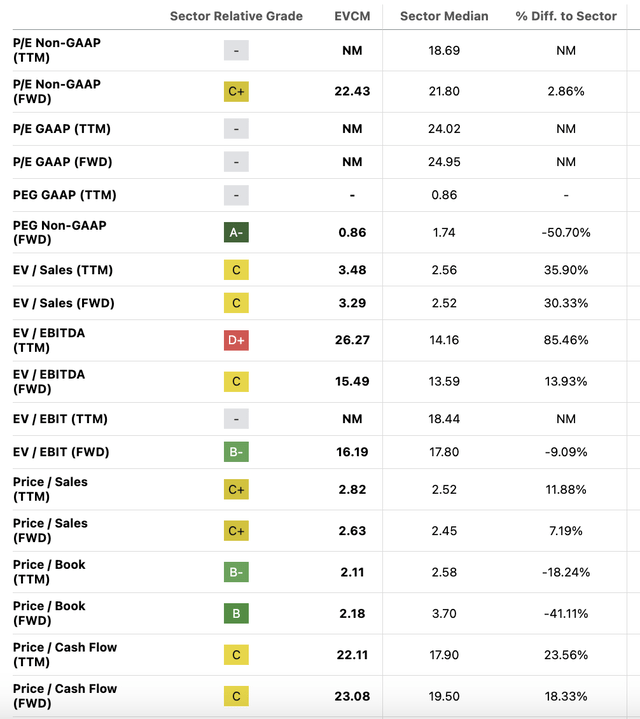

Looking for Alpha Quant’s Valuation grade assigns a ‘C’ score primarily because of restricted margin of security in comparison with sector median. On a Fwd P/E foundation, the corporate trades at 22.4x largely in line in comparison with sector median of 21.8x. On PEG foundation the corporate does look engaging, nevertheless, given the weak macro setting and cautious outlook in its core cost options enterprise together with continued challenges inside advertising expertise and health vertical, estimates are more likely to be revised downwards. As well as, on Value to money stream foundation, the corporate trades at 23.1x which is at a slight premium in comparison with 19.5x.

Looking for Alpha

Regardless of the lukewarm response with shares tumbling by as a lot as fifth of its worth on print, we consider the draw back dangers stay which may result in derating of the multiples. We provoke with a Impartial score and await enhancements on its funds enterprise and indicators of stability in its advertising expertise enterprise.

Dangers to Ranking

Dangers to score embody

1) Macro headwinds might intensify which may considerably have an effect on the SMB clients that are comparatively much less capitalized and might result in an extra slowdown in expertise spends

2) EVCM development has been pushed primarily from acquisitions and its lack of ability to drive environment friendly acquisitions together with execution challenges can affect development and margin profile

3) Upside dangers embody enchancment in macro setting, larger than anticipated development in its funds resolution enterprise, restoration in health vertical and continued shareholder exercise akin to share repurchases (which was just lately upsized to $50 mn by means of 2024)

Ultimate Ideas

EVCM has carried out nicely on reporting strong margin growth in YTD in addition to most up-to-date quarter on the again of stringent value management. Nonetheless, demand headwinds persists inside its advertising expertise phase (~20% of whole) which has been extremely delicate to financial system together with lingering challenges in health phase from COVID-19. The funds phase stays the point of interest which has additionally been lauded by the administration as a key development driver, nevertheless, additionally factors to decelerating developments. Regardless of the steep fall on print, we consider there are pronounced draw back dangers and provoke at Impartial.