ipopba/iStock through Getty Photos

Thesis

In an unstable international setting, phased by the Covid-19 pandemic, geopolitical threats and widespread financial uncertainty, planning for vital, catastrophic occasions is turning into a precedence for a lot of established corporations in addition to for native and state governments. Everbridge (EVBG) presents high-quality providers in that space and is already trusted by main companies, authorities authorities and organizations. Regardless of some downgrades in steerage Everbridge’s administration provided through the newest This autumn earnings report, the corporate has nonetheless loads of room for development forward because it seeks profitability.

Service Choices

Everbridge is a U.S primarily based software program firm, providing Crucial Occasion Administration (NYSE:CRM), a software program platform with numerous functions that addresses procedures and duties a corporation has to carry out to handle a vital occasion and alleviate its impression. CRM’s service choices embody mass notifications functionality for people or teams as a way to distribute correct info earlier than, throughout, and after pure disasters, and different emergencies, workflow automation and communications safeguarding, IT alerting and extra. Everbridge’s choices cater to many various industries and organizations, starting from power, transportation, manufacturing and utility corporations, to state and native governments, faculties and healthcare and monetary organizations. Shoppers embody names like Goldman Sachs (GS), CVS Well being (CVS) and Nokia (NOK).

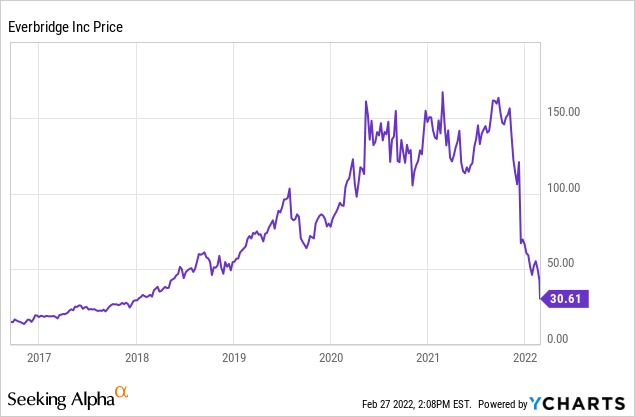

Value Developments

Everbridge entered the general public markets by way of an IPO in September of 2016, with shares initially priced at $12.00. Sturdy income development and a decent, increasing shopper base led to an aggressive inventory value run-up throughout late 2020, when EVBG began displaying elevated volatility ranges, buying and selling sideways till the tip of 2021. Because the markets intensified a rotation away from high-multiple development names, the corporate’s CEO resigned and earnings had been reported, Everbridge skilled a freefall with the inventory retreating greater than 80% from 52-week excessive ranges of $167.00, right down to $30.60, as of the time this text is written. Inventory value efficiency since late 2016 is illustrated within the chart beneath.

Simply Launched: This autumn Outcomes

Within the newest earnings launch, the software program agency reported a This autumn, 2021 adj. internet lack of $2.1 million (vs. $0.6 million revenue in This autumn 2020), whereas issuing underwhelming, blended steerage for 2022. Whole income grew 36% Y/Y to $102.8 million for the quarter, whereas for the complete 2021 fiscal 12 months income additionally grew at a formidable 36% price at $368.4 million. On a non-GAAP foundation, internet revenue got here in at $9.5 million, in comparison with a internet lack of $0.9 million in 2020, indicating that Everbridge may lastly be capable to get on the profitability observe.

Regardless of encouraging outcomes, 2022 steerage got here in weaker than anticipated, turning into the final word purpose for the selloff following the discharge. The frustration was instantly expressed by buyers and analysts alike, as administration introduced they’re anticipating Non-GAAP EPS of $-0.18 – $-0.17 versus the consensus of $-0.09 and income of $98.8-99M vs. $103.60M consensus for the primary quarter of 2022. For the complete 12 months, income is predicted to succeed in $426-432 million versus the $447.91 million consensus, whereas FY2020 EPS are between $0.22 and $0.26 vs -$0.10 consensus.

Monetary Efficiency

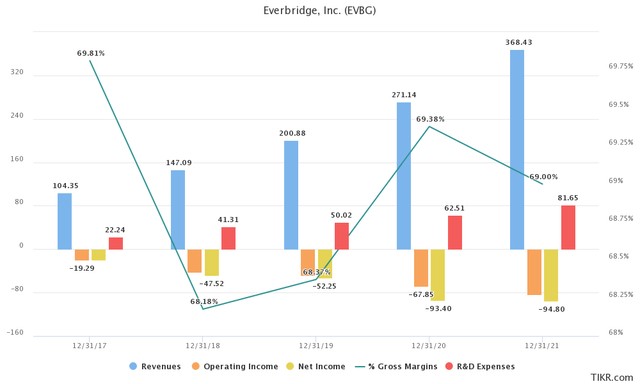

There is no such thing as a query that income development has been spectacular over the previous 5 years. Rising a CAGR of 36.82%, gross sales reached $368 million, with steerage for round $430 million in 2022 (17% forecasted YoY development), Everbridge’s gross sales enlargement appears to be slowing down a bit. That is exactly the purpose when the corporate has to ascertain a sustainable path in the direction of profitability for the long run. Like most software program companies Everbridge maintains robust gross margins, within the 60-70% vary, whereas on the identical time R&D spending, though rising, will not be extreme. Monetary metrics for the corporate over the previous 5 years can be found beneath.

Tikr.com

Everbridge’s steadiness sheet portrays monetary well being. The corporate maintains a big money steadiness of $488 million, amounting to a 3rd of Everbridge’s market capitalization. Whereas long-term debt has elevated over the past couple of years, at $665 million, it mustn’t elevate an excessive amount of concern but, given the corporate’s income development and sizable money stockpile. Present and fast ratios of two.15 and a pair of.00 additionally point out that there needs to be no considerations relating to short-term liquidity.

Valuation

Given the shortage of profitability the corporate has exhibited to date, in addition to a considerably restricted monetary historical past, assigning a good worth threshold for the inventory is difficult and needs to be thought-about with warning. Wherever valuation metrics lead buyers now, there’s little doubt that Evebridge has traded considerably overvalued for a very long time. On a P/S foundation EVBG is buying and selling at a 3.15x TTM and a 2.81x FWD ratio, showing moderately valued contemplating the corporate’s top-line development historical past and prospects. Particularly if we think about the truth that EVBG had been buying and selling at P/S multiples of over 15x by way of the tip of 2021, the latest inventory downfall appears to be offering buyers with an honest entry alternative.

On a P/B foundation, Everbridge trades at a 2.58x a number of which additionally seems affordable. One factor to notice nonetheless, is that this explicit metric will not be very appropriate for software program corporations, as they’re notoriously asset-light and derive most of their worth from intangibles which might be tough to assign an correct worth on, in addition to mental property and community results.

Ultimate Ideas

When all issues are thought-about, I feel it’s honest to imagine that for Everbridge, the latest sell-off, though initially deserved, has gone too far, presenting buyers with a horny worth proposition. The largest problem over the subsequent few quarters will likely be on the profitability entrance as development is inevitably going to sluggish. For a inventory that turns into extra interesting within the midst of uncertainty and presents enticing service options, I imagine that the upside potential is clear.